TIA’s mark has slumped over the previous 24 hours, following Celestia’s 176 million token liberate on Wednesday.

This gargantuan influx of tokens has intensified downward stress, ensuing in a nearly 10% drop in TIA’s price. With bearish sentiment rising, the altcoin appears at risk of face additional declines. This analysis examines the elements in the support of this type.

Celestia’s Token Liberate Results in Spike in Promoting Stress

On Wednesday, Celestia unlocked 176 million TIA tokens, valued at $890 million at most modern market costs. This influx of most modern tokens has elevated TIA’s circulating offer and set main stress on its mark. TIA for the time being trades at $4.68, shedding 9% of its price over the previous 24 hours.

Token unlocks incessantly construct uncertainty and distress among traders, particularly if they explore a excessive risk of advertising and marketing stress from token holders. This has been the case for TIA, no matter clarifications that now not all of the unlocked tokens would be straight away accessible for sale.

In a put up on X, Taran Sabharwal, CEO of Stix buying and selling platform, outlined that Celestia’s 21-day unstaking length approach that any individual planning to sell their unlocked TIA tokens has likely already unstaked. Consequently, the expected total promoting stress from the token liberate stands at 92.3 million TIA, or roughly $460 million.

“This equates to a max promoting stress of ~$460M. What is also attention-grabbing here is that this accounts for <50% of the entire cliff unlocks, that approach that the sell stress is half of of what people possess been wanting forward to,” Sabharwal posted.

Promoting Assignment Underway, However There Is a Procure

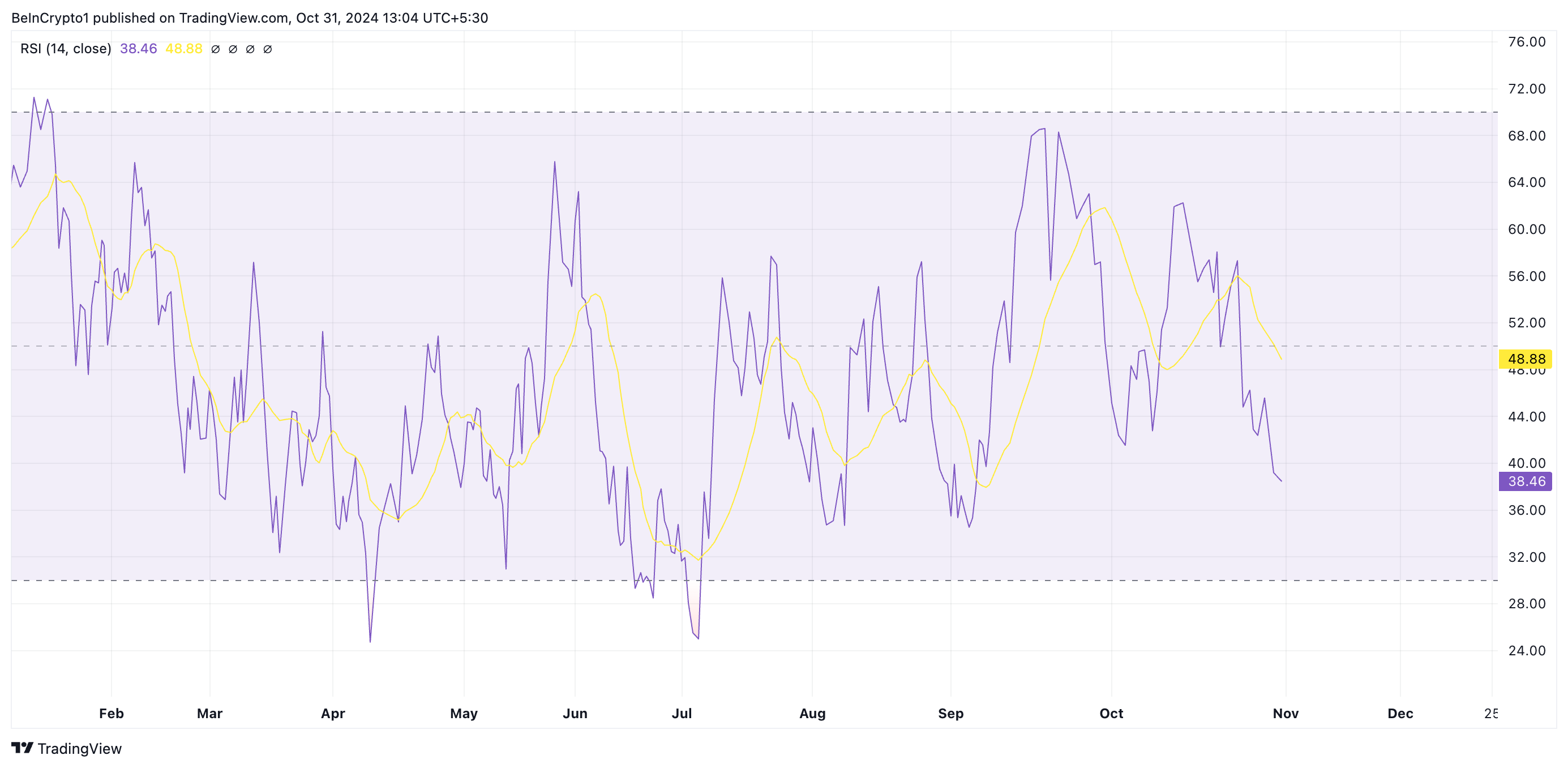

BeInCrypto’s evaluation of the TIA/USD one-day chart confirms the uptick in promoting stress following the Celestia 176 million token liberate. As of this writing, the coin’s Relative Energy Index (RSI), which measures oversold and overbought market stipulations, is in a downward type at 38.46. This RSI reading alerts that promoting stress outweighs procuring for assignment among market participants.

Read extra: High 9 Safest Crypto Exchanges in 2024

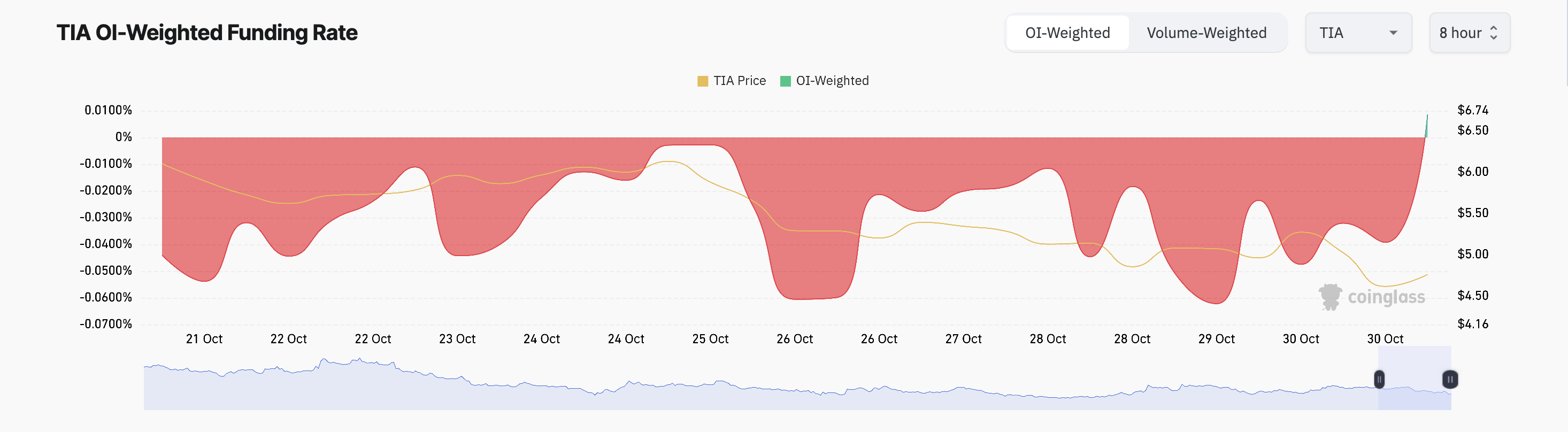

Curiously, TIA’s futures traders possess adopted a extra bullish outlook, as mirrored by its funding price. Coinglass recordsdata exhibits that the coin’s funding price has became particular for the first time since September 10.

The funding price is a periodic price paid between traders in a perpetual futures market to steadiness the price of the futures contract with the underlying space mark. When the funding price turns particular after being destructive for a extended length, it signifies a skill shift from bearish to bullish sentiment. It means that traders now take lengthy positions, wanting forward to costs to upward push.

TIA Brand Prediction: Coin Struggles With Toughen

TIA is for the time being buying and selling at $4.68, down 9% over the previous 24 hours. This decline has pushed it below the support stage of a horizontal channel established since July. In this range, the upper boundary at $6.83 serves as resistance, while $4.71 marks the support stage.

Read extra: 9 Absolute best Blockchain Protocols To Know in 2024

May maybe presumably well level-headed promoting stress continue, TIA’s price might well unbiased hurry additional, potentially reaching its multi-month low of $3.72. Conversely, a bullish reversal at the $4.71 relief might well suggested a restoration, with TIA aiming for a breakout above the $6.83 resistance. Clearing this threshold might well power TIA’s mark previous $7, a stage it hasn’t surpassed since June.