The TIA mark on the novel time is trading round $1.forty eight after erasing earlier beneficial properties from a minor soar reach the $1.66 resistance zone. Despite transient rallies, TIA stays locked in a solid macro downtrend and is struggling to set up any fixed upside momentum. A breakdown below the intense $1.forty five make stronger may perchance perchance well invite deeper selling pressure unless merchants step in snappily.

What’s Occurring With TIA’s Trace?

On the 4-hour chart, Celestia is nearing the bottom of a extreme set an declare to zone between $1.43 and $1.46. This dwelling has been tested a pair of instances since leisurely June, forming the final visible make stronger range sooner than a skill jog toward $1.38 or decrease. The 20/50/100/200 EMAs on the same timeframe are all trading above mark and dwell steeply stacked to the plot back which is a transparent reflection of sustained bearish dominance.

Trace action on the 1-day chart confirms the existing pattern. TIA has failed to interrupt the descending structure fashioned since February, with resistance rejections lining up completely at key horizontal supply zones equivalent to $1.66, $2.10, and $2.60. Most candles this month possess closed below their opens, additional confirming the dearth of purchaser conviction at most easy phases.

Why Is The TIA Trace Going Down This day?

The decline in TIA mark is being driven by a pair of confluences of technical and on-chain pressure. First, the Why TIA mark going down on the novel time ask of is answered by the rejection from the 4-hour mid-Bollinger Band, which aligns with the $1.55–$1.60 resistance pocket. After failing to shut above the Bollinger midline, the price became pushed decrease in a textbook squeeze-and-reject scenario.

On the 30-minute chart, RSI has dropped attend below 40, reflecting fading intraday strength. MACD has flipped bearish again after a shallow crossover attempt, and a marked bearish RSI divergence has emerged across the $1.66 swing high.

From a macro request, the weekly chart reveals TIA persevering with to respect a descending trendline from the $20 prime. A breakout attempt in early June failed to lift, and the asset is now printing fixed decrease highs and decrease lows. The long-time length structure furthermore reveals a fracture of market structure (BOS) round $1.50 — now a flipped resistance zone.

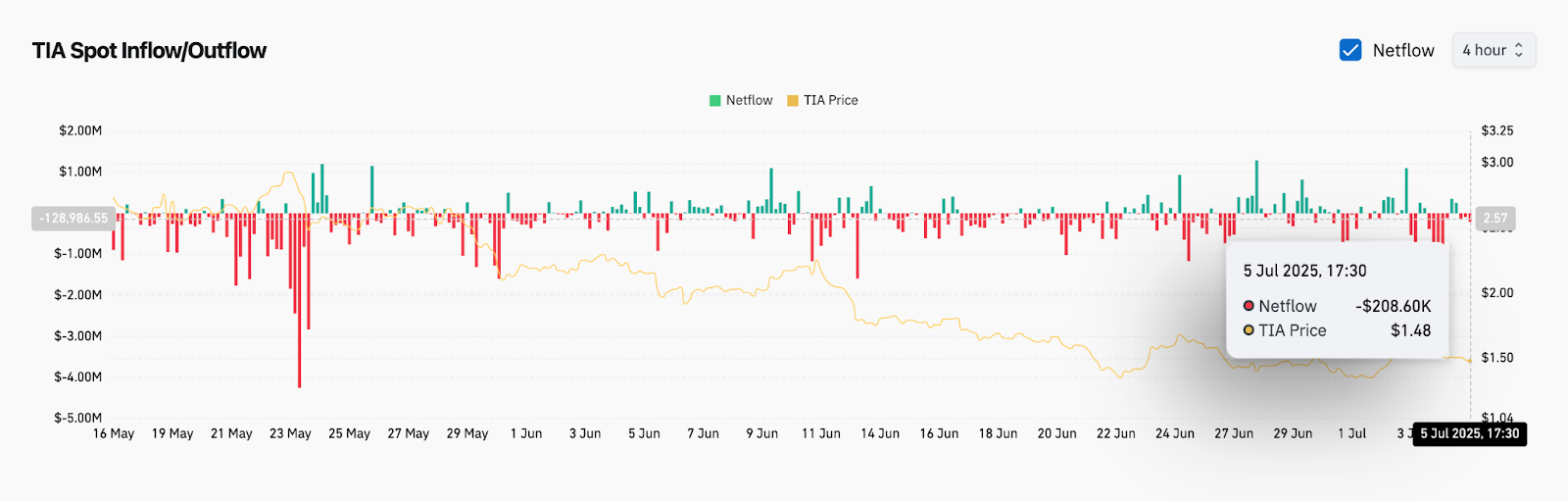

On-chain data from July 5 confirms that station netflows dwell negative, with -$208K in outflows recorded as TIA mark slipped attend toward $1.forty eight. Actual outflows counsel merchants are exiting positions, additional weakening set an declare to-facet make stronger.

Indicators Signal Worn Momentum Sooner than Key Support Retest

The 4-hour Bollinger Bands possess began to widen again following a transient contraction, implying that directional volatility may perchance perchance well furthermore magnify within the reach time length. With candles drawing near the decrease band and no bullish engulfing patterns confirmed, plot back pressure stays the extra seemingly final consequence.

EMAs offer no instantaneous make stronger. The 20 EMA sits at $1.51 and has flipped into dynamic resistance. The 50 EMA ($1.50) and 100 EMA ($1.56) furthermore dwell untouched by mark since July 3, underscoring the continued rejection of bullish makes an attempt.

The day-to-day chart suggests an expanding inefficiency gap the entire formulation down to $1.38 and $1.34 — both previous set an declare to zones. Unless volume picks up with a solid reversal signal reach $1.forty five, TIA may perchance perchance well proceed bleeding into deeper accumulation territory.

TIA Trace Prediction: Immediate-Term Outlook (24h)

The transient outlook for TIA mark action is bearish-neutral, with key make stronger maintaining for now at $1.forty five–$1.46. If this dwelling breaks, the following targets to the plot back are $1.38 and $1.34. If bulls role up to protect the most easy zone and push previous $1.52 with volume confirmation, TIA may perchance perchance well furthermore gape a relief rally toward $1.60–$1.66.

Then again, unless the asset reclaims the 50 EMA and invalidates the bearish RSI/MACD alignment, upside stays limited. A decisive breakdown below $1.43 would seemingly role off a poke toward the $1.30 psychological stage — a zone no longer visited since the April capitulation phase.

Celestia Trace Forecast Desk: July 6, 2025

| Indicator/Zone | Stage (USD) | Signal |

| Resistance 1 | $1.52 | Local resistance reach 20 EMA (4H) |

| Resistance 2 | $1.66 | Rejection zone and previous high |

| Support 1 | $1.forty five | Key intraday make stronger |

| Support 2 | $1.38 | Next structure make stronger |

| RSI (30-min) | ~39 | Bearish bias |

| MACD (30-min) | Bearish crossover | Fading momentum |

| EMA Cluster (20–100) (4H) | $1.50–$1.56 | Dynamic resistance |

| Bollinger Bands (4H) | Widening | Downside volatility enlargement |

| Netflow (On-chain) | -$208K | Bearish pressure, capital exiting |

Disclaimer: The data equipped on this article is for informational and academic functions easiest. The article doesn’t constitute monetary recommendation or recommendation of any form. Coin Version is rarely any longer liable for any losses incurred as a outcomes of the utilization of drawl material, merchandise, or products and companies talked about. Readers are suggested to converse warning sooner than taking any action linked to the firm.