Celestia’s (TIA) designate has declined progressively for the reason that starting of June to make a descending channel.

Exchanging fingers at $6.45 at press time, the altcoin currently trades at a designate stage last noticed in December 2023.

Celestia Witnesses Spike in Token Promote-Offs

Since its designate climbed to a 30-day excessive of $10.76 on Would possibly per chance well well also 29, Celestia’s (TIA) designate has plunged. It has since trended internal a descending channel, suggesting sustained promoting force.

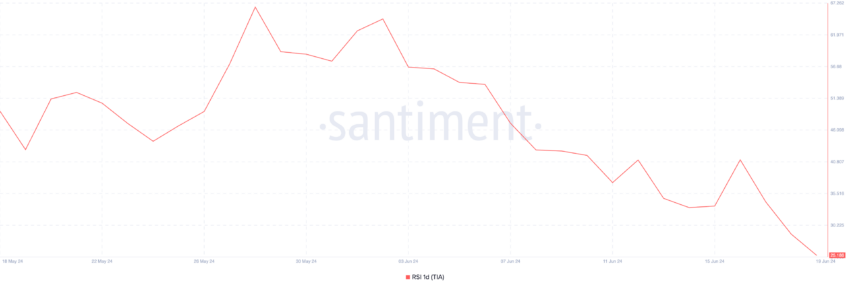

The token’s Relative Power Index (RSI) is currently 25.8, confirming the excessive TIA sell-offs amongst market individuals.

This indicator measures the asset’s overbought and oversold prerequisites by tracking designate modifications. The indicator ranges from 0 to 100. Readings above 70 show that an asset is overbought and most likely due for a correction, whereas readings below 30 suggest the asset is oversold and can presumably rebound rapidly.

At 25.8, TIA’s RSI confirmed market individuals’ desire for promoting. This signals that TIA merchants desire to sell their holdings as a replacement of aquire recent tokens.

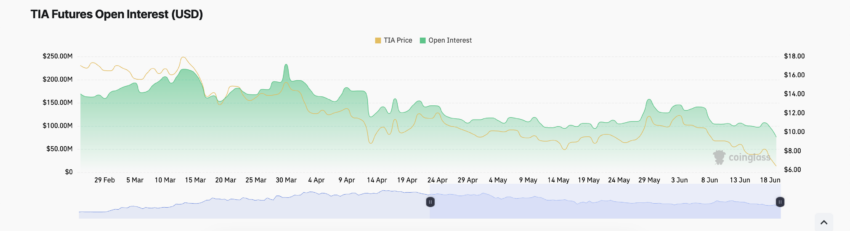

Additional, as TIA’s designate falls, its futures launch interest also craters. At $76.06 million at press time, it has dropped by 41% for the reason that starting of June.

Read Extra: Top 10 Aspiring Crypto Coins for 2024

For context, at its recent stage, TIA’s futures launch interest currently sits at a stage last seen in November 2023.

An asset’s futures launch interest tracks the general preference of prominent futures contracts or positions which admire yet to be closed or settled. When it falls, it signals that more merchants are closing their positions and exiting the market with out opening recent ones.

TIA Brand Prediction: Is the Next Stay At $6.02?

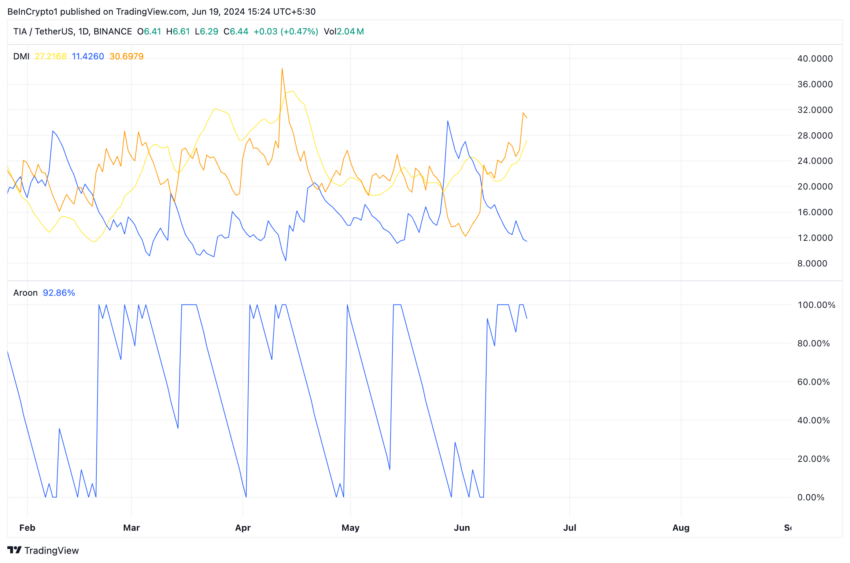

TIA’s Aroon indicator confirms the strength of the recent market downtrend. As of this writing, TIA’s Aroon Down Line used to be 92.66%,

This indicator identifies an asset’s constructing strength and attainable designate reversal facets. When the Down Line is shut to 100, it means that the market’s downtrend is stable and that the most up-to-date low used to be reached quite only in the near past.

Also, readings from TIA’s Directional Circulate Index (DMI) repeat a bearish bias towards it. At press time, the token’s sure index (blue) rests below the unfavorable index (orange).

This indicator assesses the strength and course of a market constructing. When pickle up this suggests, it signals that the market is in decline.

If this downtrend continues, TIA’s rate might per chance perchance perchance fall to $6.02.

Read Extra: Wonderful Upcoming Airdrops in 2024

Alternatively, if this projection is invalidated, the altcoin’s designate might per chance perchance perchance upward push to $7.09.