Bitcoin hovered between $87,477 to $90,317 on Dec. 17, 2025, as derivatives data reveals futures merchants retaining their nerve while choices markets quietly leaned defensive.

Bitcoin Derivatives Recordsdata Indicators Tactical Pullback Probability

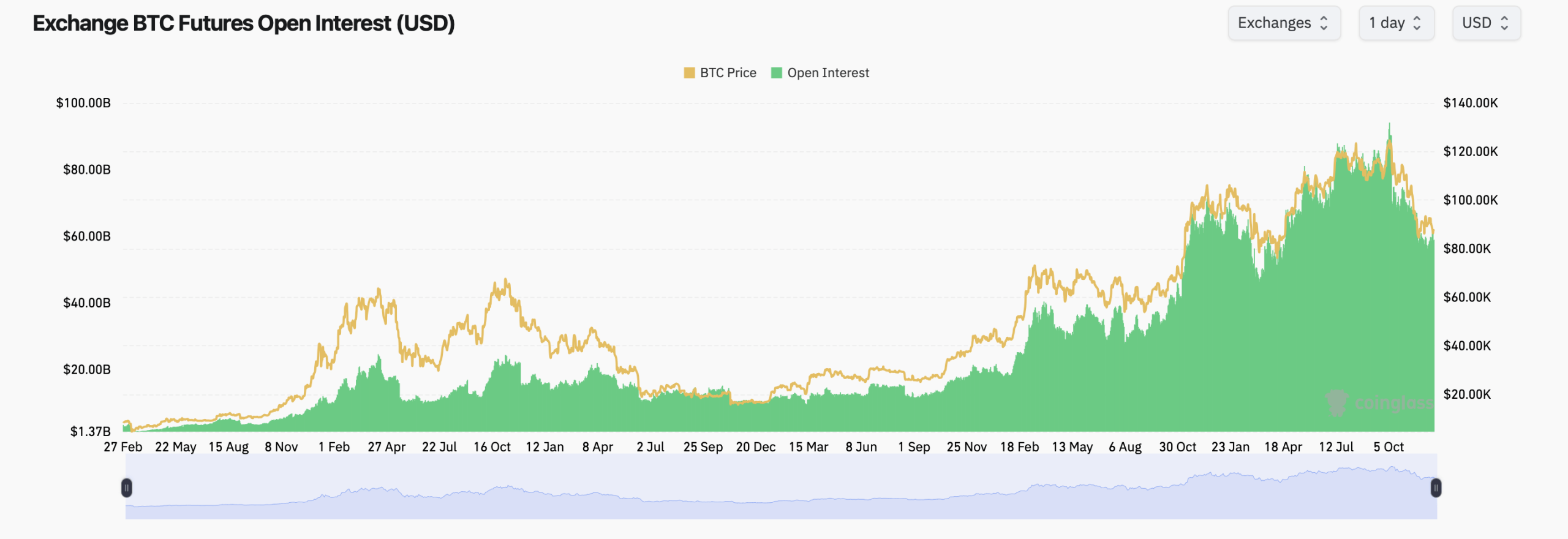

Per coinglass.com stats on Wednesday, bitcoin futures start hobby (OI) remains elevated, with total OI sitting end to $58.97 billion across exchanges, signaling that leverage has now no longer meaningfully exited the machine despite unique designate softness. In bitcoin phrases, start hobby stands at roughly 673,770 BTC, a level that continues to anchor derivatives job effectively above historical averages and suggests merchants are composed engaged—even if conviction has cooled at the margin.

A more in-depth explore at exchange-level positioning reveals a acquainted hierarchy at the high. CME leads futures OI with approximately 126,030 BTC, representing almost 19% of the realm total, pointing to the persevered dominance of institutional positioning. The crypto exchange enormous Binance follows closely with about 122,520 BTC, while Bybit, Gate, and MEXC spherical out a tightly clustered center tier.

OKX posted modest OI impart over the previous 24 hours, while smaller venues similar to Kucoin and BingX noticed sharper contractions, hinting at selective deleveraging in preference to a substantial unwind. Short changes in futures positioning deem a market that’s adjusting in preference to fleeing.

Aggregate start hobby rose a diminutive bit over the previous four hours but dipped marginally on a 24-hour basis, reinforcing the premise that merchants are composed trimming threat tactically as an change of hitting the exits. The futures OI-to-volume ratio remains elevated, a signal that positions are sticky and merchants are longing for a clearer directional cue.

Nansen Research Analyst Suspects ‘Many Customers Gather Not Sold Their Area Holdings and Dwell Bullish for 2026’

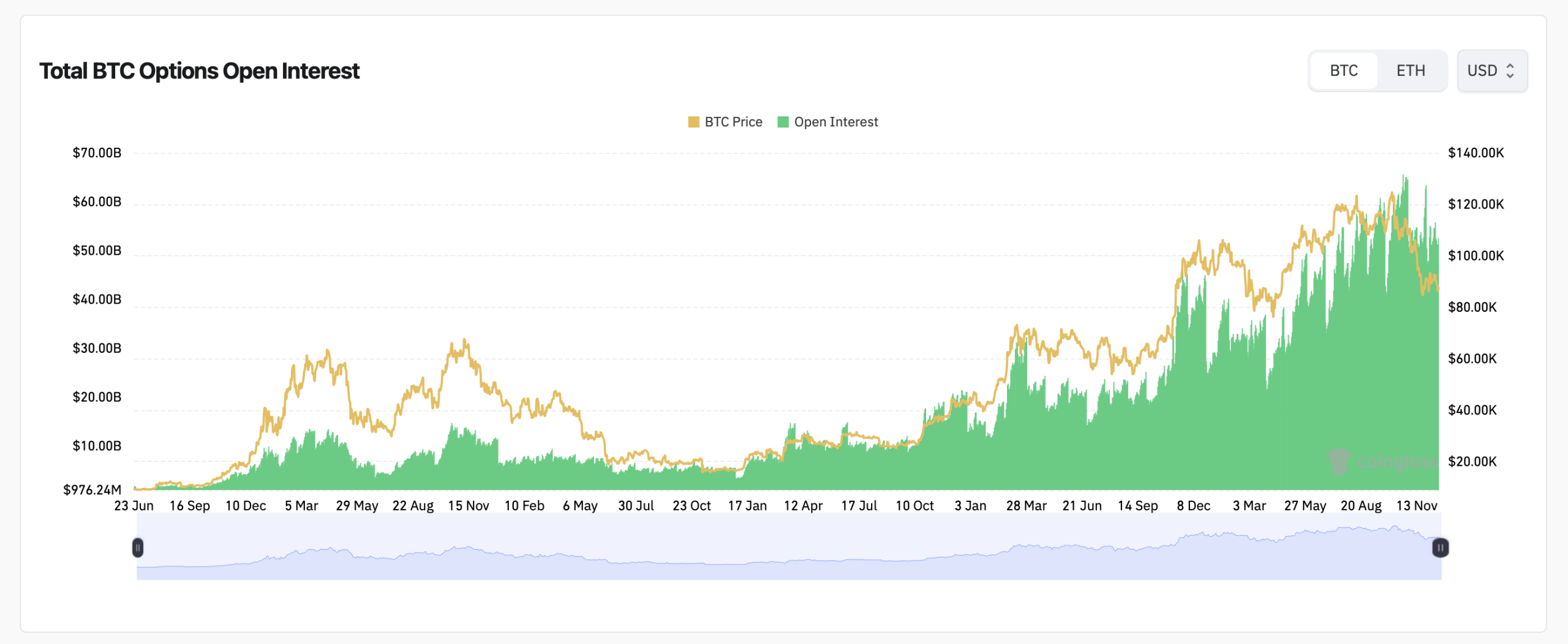

Strategies markets, nonetheless, utter a more cautious fable. Total bitcoin choices start hobby, logged by coinglass.com, continues to trace higher alongside designate over the longer time length, but end to-time length positioning skews defensive. Calls yarn for roughly 64% of total start hobby, yet unique volume has tilted a diminutive bit toward locations, reflecting hedging set a question to in preference to outright bearish bets.

The most heavily populated choices strikes sit down effectively above the plan designate. Huge call start hobby clusters are concentrated at $100,000, $106,000, and $112,000 for slack-December expiries, signaling that merchants composed gaze upside capacity—compatible now no longer at the moment. On the design back, fundamental set hobby has built around the $85,000 and $80,000 ranges, defining the market’s temporary agonize threshold.

Max agonize data provides one other layer to the narrative. On Deribit, the dominant bitcoin choices venue, max agonize ranges for slack-December contracts cluster end to the upper-$80,000 vary, suggesting designate gravity could presumably presumably continue to pull bitcoin sideways into expiration. Binance and OKX describe the same patterns, with max agonize ranges drifting higher into early 2026 but closing below essentially the most aggressive upside strikes.

Also learn: Is Crypto a Security? (Share IV: DeFi, Staking, Airdrops, NFTs)

That dynamic aligns with broader sentiment flagged by institutional analysts. In a prove sent to Bitcoin.com Recordsdata, Aurelie Barthere, foremost learn analyst at Nansen, mentioned positioning aspects to temporary caution despite longer-time length optimism.

“Having a peek at positioning, patrons appear cautious in the short time length. Possibility markets suggest less than a 34% probability of BTC regaining 91k by January,” Barthere mentioned. “Nonetheless, I believe many patrons have now no longer supplied their plan holdings and reside bullish for 2026, with option markets assigning more than a 50% probability of BTC buying and selling above 105k by March 2026.”

Barthere added that correlations start air crypto could presumably presumably power the next leg, declaring:

“Taken together, I will be able to gaze a scenario where prices circulate lower into Q1 2026, driven primarily by the persevered correlation with AI shares, sooner than bottoming in Q2 on the support of a fiscal increase and a more dovish Fed.”

Taken as a total, bitcoin’s derivatives market is signaling restraint, now no longer retreat. Futures merchants reside planted, choices merchants are hedging their bets, and max agonize ranges suggest a market suppose to lower in preference to flee. For now, leverage is composed in the room—but it completely’s observing its step.

FAQ ⚠️

- What does elevated bitcoin futures start hobby mean?

It suggests merchants are asserting leveraged publicity in preference to closing positions outright. - Why are bitcoin choices leaning defensive?

Rising set volume displays hedging against temporary design back in preference to outright bearishness. - The set are the foremost bitcoin max agonize ranges?

Across foremost exchanges, max agonize clusters sit down in the upper-$80,000 vary for slack-December expiries. - What’s the outlook for bitcoin in 2026?

Aurelie Barthere says choices markets suggest caution end to time length but increasing self belief in prices above $105,000 by March 2026.