Cathie Wood’s ARK Invest has laid out one of its clearest long-period of time views yet on Bitcoin and Nvidia, two belongings that outlined the 2024–2025 market cycle. The firm’s latest Expansive Concepts 2026 sage predicts that the Bitcoin market cap will make bigger by 700% over the next four years.

It also predicts that Nvidia’s dominance in AI hardware might well maybe moreover just face rising tension from opponents.

Bitcoin Notice to Hit $800,000?

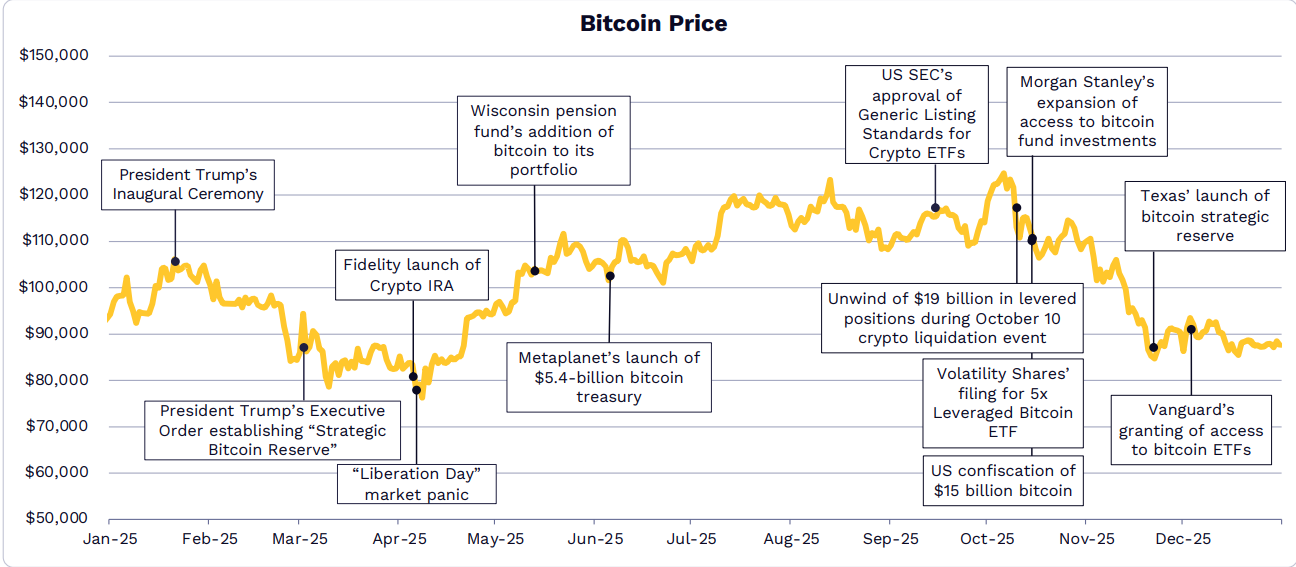

ARK argues that Bitcoin’s conduct changed meaningfully in 2025. Its drawdowns had been smaller, volatility declined, and probability-adjusted returns improved when put next to previous cycles.

Measured by the Sharpe Ratio, Bitcoin outperformed Ethereum, Solana, and the broader CoinDesk 10 Index throughout just a few time frames. That shift helps ARK’s watch that Bitcoin is extra and extra acting bask in a acquire-haven asset in desire to a purely speculative one.

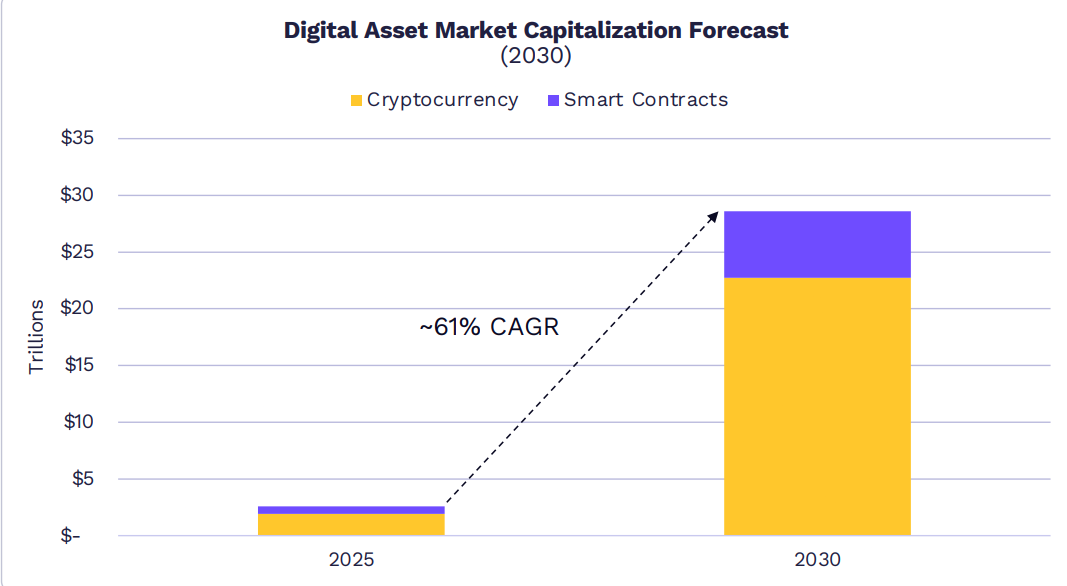

Consequently, ARK expects Bitcoin to dominate a all of a sudden increasing crypto market. The firm estimates total cryptocurrency market capitalization might well maybe moreover reach $28 trillion by 2030, rising at roughly 61% yearly.

Crucially, ARK believes Bitcoin might well maybe moreover memoir for 70% of that market, lifting its market capitalization to around $16 trillion by the tip of the decade.

In accordance to present provide projections, that implies a Bitcoin worth of roughly $800,000 per coin. That’s a near nine-fold make bigger from on the present time’s $90,000 ranges.

Nonetheless, ARK’s forecast is no longer purely bullish throughout all use cases. The firm reduced its expectations for Bitcoin adoption as an emerging-market acquire haven, citing the short rise of buck-backed stablecoins.

As an different, ARK elevated its “digital gold” assumption after gold’s market cap surged sharply in 2025.

Nvidia Direct Continues, However Competition Tightens

ARK’s outlook for Nvidia is extra cautious in tone, even as AI demand continues to surge.

The firm expects world AI infrastructure spending to exceed $1.4 trillion by 2030, pushed mainly by accelerated servers. That pattern helps long-period of time demand for AI chips, including Nvidia’s GPUs.

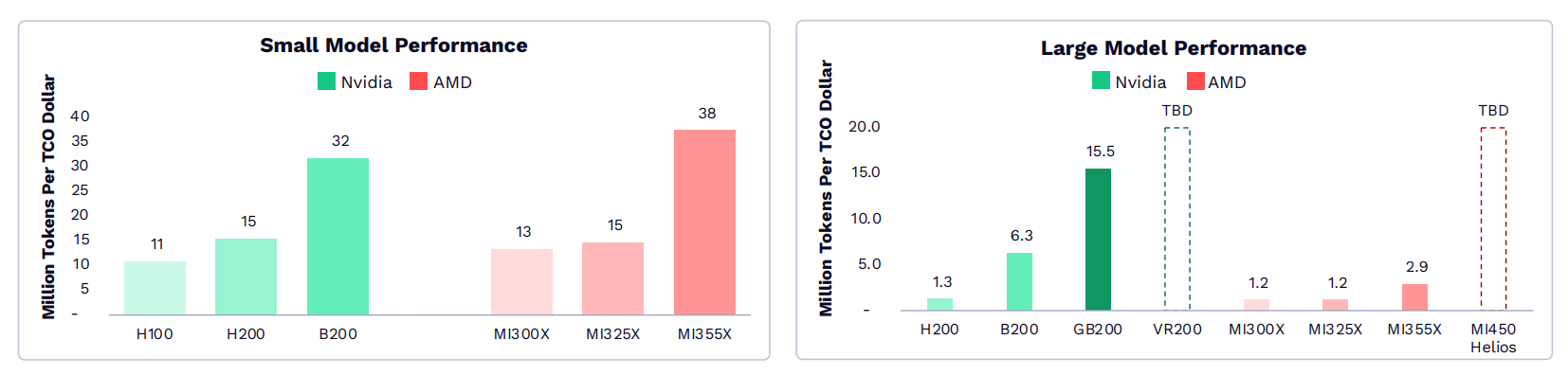

However ARK highlights a key shift. Hyperscalers and AI labs are extra and extra desirous about total worth of possession, no longer raw efficiency alone.

That opens the door for custom AI chips and application-explicit built-in circuits (ASICs).

Competitors comparable to AMD, Broadcom, Amazon’s Annapurna Labs, and Google’s TPU platforms are already transport or making ready subsequent-technology chips.

Nvidia Faces Intense Competition from AMD. Offer: ARK Invest

Many offer lower running charges per hour than Nvidia’s absolute top-slay systems, even if efficiency lags in some cases.

ARK’s knowledge exhibits Nvidia’s most up-to-date GPUs are among the many most extremely efficient, but in addition among the many most costly to scoot. That pricing tension might well maybe moreover restrict Nvidia’s capacity to spice up margins on the identical tempo seen in present years.

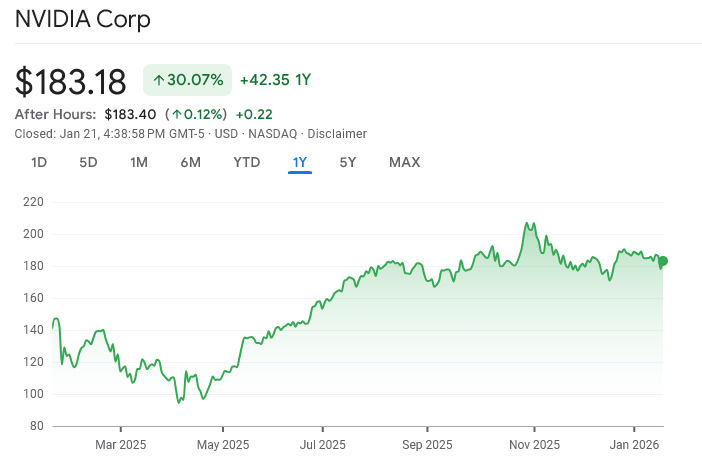

What This Procedure for Nvidia’s Stock

ARK does no longer predict a crumple in Nvidia’s commercial. As an different, it signals a shift from explosive dominance to extra aggressive affirm.

For Nvidia’s stock, this means a determined trajectory than Bitcoin’s. In desire to just a few expansion, future positive aspects might well maybe moreover just rely on earnings affirm, instrument income, and ecosystem lock-in.

In vivid terms, Nvidia’s share worth must always nonetheless rise over time, but likely with slower affirm, greater volatility, and sharper reactions to competition and margin tension. The easy piece of AI-pushed rerating will likely be over.