As Bitcoin (BTC) struggles to stabilize after the BTC halving, the wider cryptocurrency market composed feels the impact.

Although its mark hasn’t performed in particular correctly in most standard days, Cardano (ADA) is seeing a critical develop in whale task.

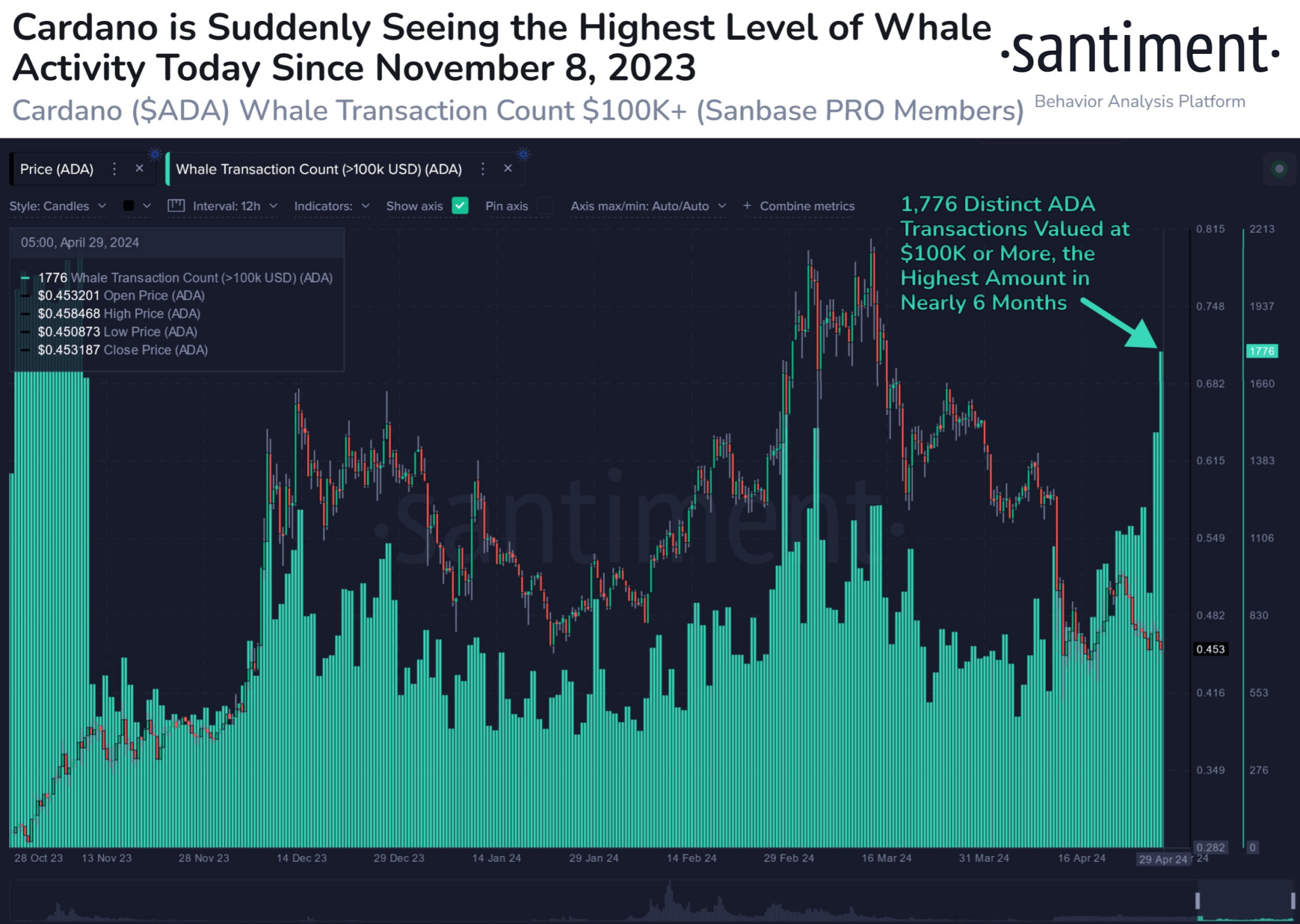

In step with cryptocurrency tracker Santiment, on April 29, ADA skilled a indispensable surge in whale transactions, surpassing $100,000.

Specifically, 1,776 transactions of that quantity or extra had been recorded as the ideal depend in almost six months.

This uptick in whale task is historically linked to doable mark reversals. It’s especially worthy provided that ADA’s market cap has plummeted by a staggering 43% since March 13.

Cardano technical prognosis

In the medium to long time duration, Cardano has breached the lower boundary of an ascending pattern channel, suggesting both a slower charge of ascent on the origin or the beginning of a extra horizontal pattern.

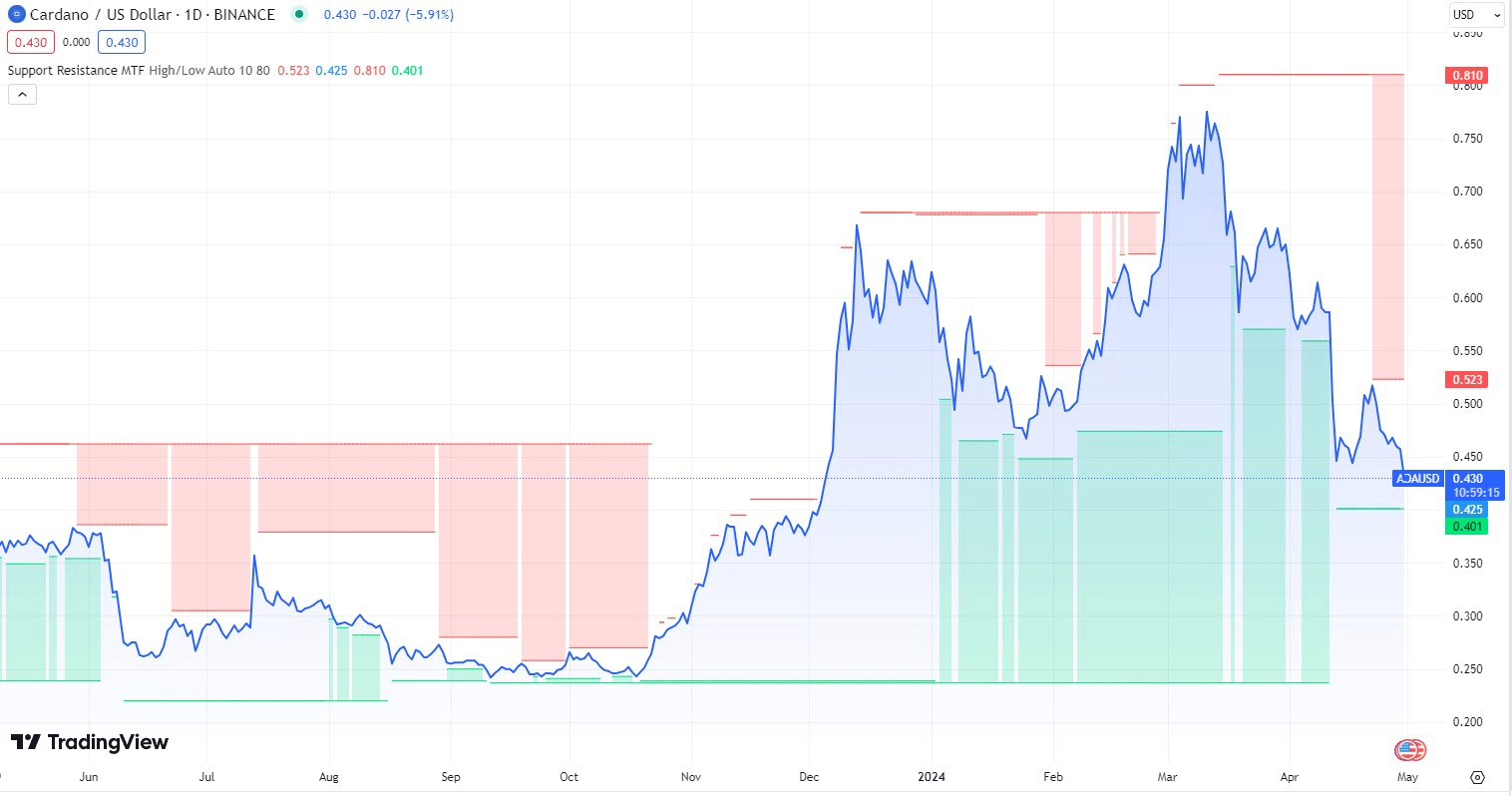

Currently, ADA is discovering out resistance on the $0.46 level. While this might maybe maybe maybe build off an negative response, a breakthrough above $0.46 might maybe maybe maybe well also designate a explicit pattern.

Furthermore, the detrimental volume balance implies that trading volume is increased when costs tumble, signaling diminishing investor optimism for your whole.

The currency’s short momentum is detrimental, with the Relative Energy Index (RSI) at almost about 30. Which capability that patrons consistently sell at lower costs, reflecting growing pessimism and sustained downward rigidity despite the sizable-scale whale transactions.

Cardano mark chart

ADA is at the moment trading at $0.430, marking a 5.Forty eight% loss in the closing 24 hours and lengthening a retracement of 16.06% over the past week.

The detrimental pattern has endured over the closing 30 days, with Cardano shedding 33.fifty three% of its cost.

Given the predominantly bearish technical indicators for ADA and its big pullback over the past month, it’s no longer easy to rely on a critical develop in ADA’s cost in the rapid time duration despite this sizable scale buying by a runt minority.

Disclaimer: The boom material on this region must always composed no longer be belief about investment advice. Investing is speculative. When investing, your capital is at distress.