- Cardano price recovers a cramped bit on Tuesday after falling almost 7% the day past.

- On-chain files indicators a restoration as ADA’s funding price turns obvious, with bullish bets at a month-to-month excessive.

- A on day by day basis candlestick shut below $0.57 would invalidate the bullish thesis.

Cardano (ADA) recovers a cramped bit by 4%, buying and selling spherical $0.70 on Tuesday after falling almost 7% the day past. On-chain metrics tag further restoration as ADA’s funding price turns obvious while its bullish bets attain the very ideal level over a month.

Cardano Ticket Forecast: ADA retest key increase level

Cardano’s price declined 36.36% final week and continued its pullback on Monday by almost 7%. At the time of writing on Tuesday, it recovers a cramped bit after retesting its key increase level at

$0.64.

The $0.64 level roughly coincides with a lot of phases as follows, making it a key reversal zone:

- The beforehand broken descending trendline.

- Its 61.8% Fibonacci retracement level at $0.67.

- The bullish convey block situation extends from $0.64 to $0.57. A bullish convey block situation is the effect market participants, comparable to institutional traders, beforehand placed aquire orders.

If the abovementioned level holds as increase, ADA might perhaps well also lengthen the restoration to retest its subsequent resistance level at $0.98.

Alternatively, the Relative Strength Index (RSI) reads 44, below its neutral level of fifty, indicating bearish momentum. The RSI need to slide above its neutral level of fifty to hold up bullish momentum. Such a trend would add a tailwind to a restoration rally.

ADA/USDT on day by day basis chart

On-chain metrics increase Cardano’s restoration

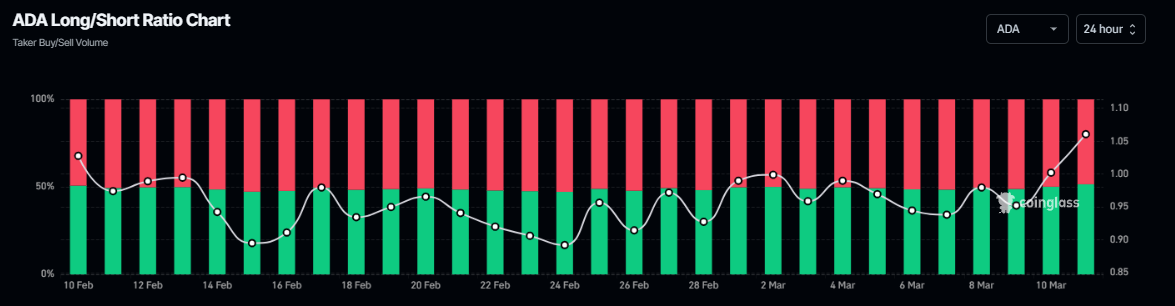

on-chain metrics supports further restoration. Coinglass files reveals ADA’s long-to-short ratio, which reads 1.06, is at its highest level in over a month. This ratio above one displays bullish sentiment in the markets as more traders are making a wager on the asset price to upward push.

ADA long-to-short ratio chart. Supply: Coinglass

In accordance to Coinglass’s OI-Weighted Funding Price files, the desire of traders making a wager that the fee of Cardano will scurry further is lower than that searching ahead to a price elevate.

This index is in step with the yields of futures contracts, that are weighted by their Birth Pastime (OI) charges. Generally, a obvious price (longs pay shorts) indicates bullish sentiment, while negative numbers (shorts pay longs) point to bearishness.

In the case of ADA, this metric reads 0.0007%, reflecting a obvious price and indicating that longs are paying shorts. This field usually signifies bullish sentiment available in the market, suggesting a doable restoration in Cardano’s price.

Cardano OI-Weighted Funding Price chart. Supply: Coinglass

Even even supposing on-chain metrics and technical evaluation increase the bullish outlook, a on day by day basis candlestick closes below $0.57 would invalidate the bullish thesis. This trend might perhaps well also trigger Cardano’s price to decline and retest its subsequent increase level at $0.50.