Cardano’s mark rebound stalled at $0.44 on July 18, after 40% beneficial properties in 14 days; on-chain knowledge prognosis explores the bullish and bearish catalysts that have impacted ADA mark stagnation within the final 72 hours.

Cardano’s DEX Volumes Flee Amid Blended Market Indicators

Since July 5, Cardano has been on an upward trajectory, mirroring the broader crypto market traits. But after nearly 2-weeks of power uptrends, mixed indicators have emerged inner the Cardano ecosystem as bulls and bears battle to dominate the subsequent market section.

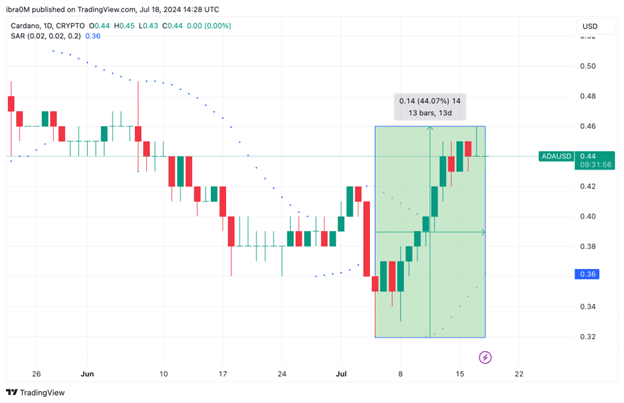

Within the final two weeks between July 5 and July 18, ADA costs have elevated very a lot. The chart above presentations how ADA costs had surged 44% from the month-to-month time physique low recorded on July 5.

Nonetheless, a more in-depth behold at the chart presentations that the Cardano mark rally has struggled to contrivance above the $0.Forty five resistance no matter the bullish sentiment surrounding the cryptocurrency sector this week. This uncommon market alignment means that conflicting bullish and bearish catalysts are for the time being in play inner the Cardano markets.

On the definite aspect, Cardano’s decentralized change (DEX) procuring and selling volumes have surged very a lot, highlighting the rising interest in its DeFi ecosystem. Per most contemporary knowledge, Cardano’s 24-hour procuring and selling volume surpassed $350 million, with DEX volumes crossing 50 million ADA this week.

This surge indicates increasing adoption of DeFi applications on the Cardano blockchain, which customarily correlates with greater community process and potentially definite impacts on the community’s health. No matter this uptick in DEX process, Cardano‘s mark has continued to present bearish traits. ADA has skilled a essential correction, procuring and selling at approximately $0.4493, a 3% decline over the final week.

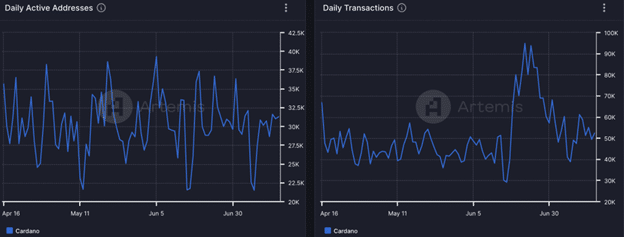

Extra prognosis finds a decrease in community process, with day after day active addresses losing from 39,300 to 31,000 and day after day transactions falling from 94,000 to 49,500. These metrics counsel some bearish stress on ADA, which is mirrored in essentially the most contemporary mark action.

No matter transient bearish indicators, the lengthy-length of time outlook stays optimistic. Cardano’s co-founder Charles Hoskinson and diversified proponents imagine in its possible to revolutionize monetary markets. Also, speculation a couple of possible Cardano put ETF approval would possibly maybe well attend as a valuable bullish catalyst.

Cardano Impress Forecast: Bulls Battling $0.Forty five Resistance

Cardano (ADA) has confirmed impressive performance in most contemporary days, with the cost climbing from $0.30 to $0.44, representing a 44.07% enlarge over the final 13 days. This bullish momentum has introduced ADA nearer to the serious resistance stage at $0.Forty five, which it desires to surpass to preserve its upward trajectory.

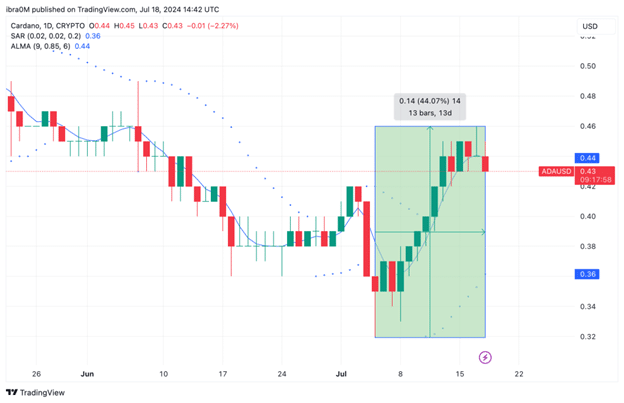

The chart illustrates a sturdy bullish pattern, supported by a series of greater highs and better lows. The Parabolic SAR dots below the cost point to a continued bullish sentiment, whereas the ALMA (Adaptive Transferring Realistic) line is for the time being at $0.44, performing as a dynamic give a enhance to stage. This means that any transient pullbacks would possibly maybe well bring together give a enhance to around this stage, potentially providing a procuring for different for merchants.

No matter essentially the most contemporary beneficial properties, ADA is coping with valuable resistance at $0.Forty five. Breaking this resistance decisively would possibly maybe well pave the manner for extra upside, concentrating on the subsequent essential resistance stage around $0.50. On the contrivance back, the essential give a enhance to stage is at $0.36, as indicated by the Parabolic SAR, which additionally aligns with a outdated consolidation zone. A tumble below this stage would possibly maybe well signal a shift in sentiment, potentially ensuing in a deeper correction.

The RSI (Relative Power Index) is at 55.93, which is still below the overbought territory, suggesting there is room for extra upward poke. This aligns with the general bullish outlook, though merchants would possibly maybe well also still gape for any indicators of RSI divergence that would possibly maybe well point to weakening momentum.

In summary, Cardano’s technical indicators are leaning bullish, with the aptitude for extra beneficial properties if the $0.Forty five resistance is breached.