Cardano (ADA) has remained comparatively stagnant, with its rate barely intriguing from the ranges considered seven days within the past. Regardless of this lack of rate action, trading quantity has surged nearly 28% within the final 24 hours, climbing to $1 billion.

This develop in exercise comes whereas ADA continues to consolidate, with technical indicators signaling indecision available within the market. As momentum builds, traders are looking out at intently for signs of a breakout from this tight range.

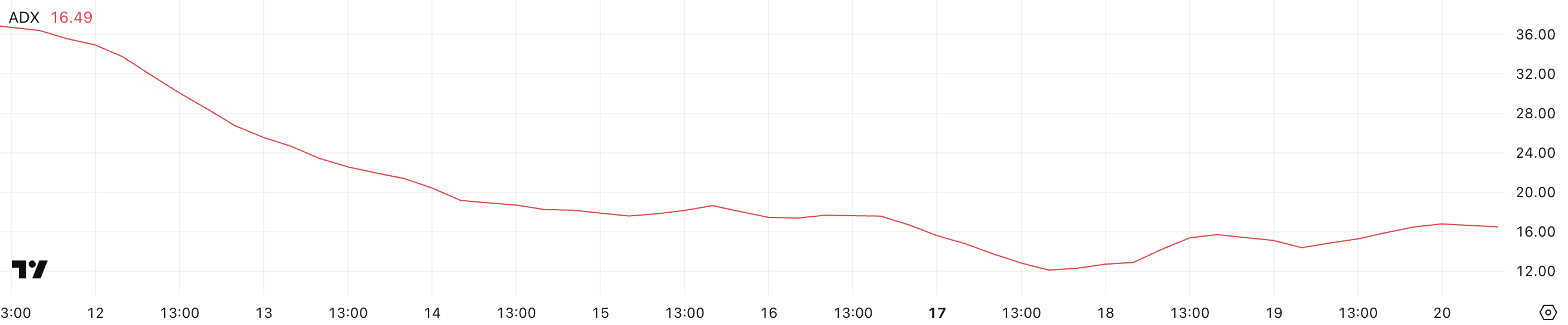

Cardano ADX Shows The Lack Of A Obvious Route

Cardano’s style strength has remained comparatively unchanged, with its ADX within the intervening time at 16.49 – roughly the identical level it has maintained since the old day.

This flat circulation within the ADX means that there hasn’t been a predominant shift in momentum, and the market lacks a clear directional style.

ADA’s rate is within the intervening time caught in a consolidation piece, with neither buyers nor sellers ready to place dominance, which is mirrored within the stagnant ADX reading.

The ADX (Reasonable Directional Index) is a technical indicator extinct to measure the strength of a style without indicating its direction.

An ADX below 20 on the final indicators a worn or non-existent style, whereas readings between 20 and 40 display conceal a increasing or life like style, and values above 40 demonstrate a solid style.

With ADA’s ADX protecting below the 20 rate, it means that primarily the most modern market environment remains indecisive, seemingly ensuing in endured sideways circulation.

For now, this consolidation piece could almost definitely persist till a stronger directional transfer emerges, both through renewed shopping for momentum or an develop in selling stress.

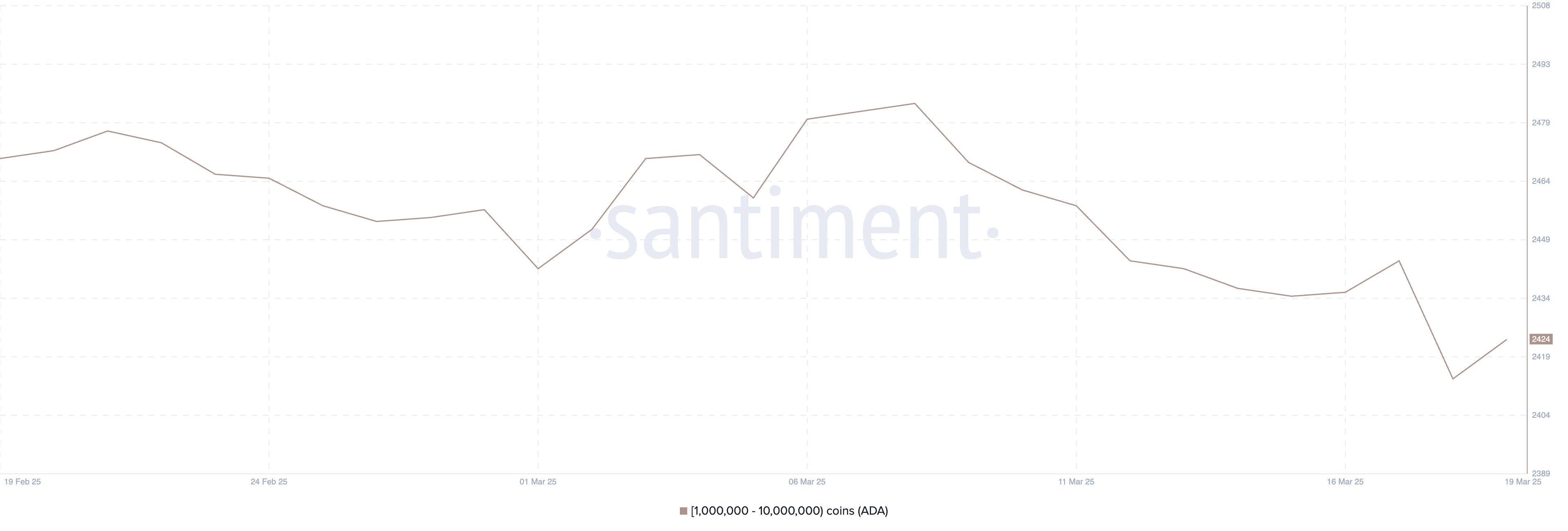

Cardano Whales Dip to July 2024 Lows

The number of Cardano whales skilled a pointy decline between March 8 and March 18. These are wallets protecting between 1 million and 10 million ADA.

In accordance with Santiment data, the number of ADA whales fell from 2,484 to fine 2,414, marking the bottom level since July 2024.

On March 19, there became as soon as a itsy-bitsy recovery, with the number of whales rising to 2,424.

Whereas this minor rebound shows some renewed accumulation, the total count remains effectively below the ranges considered in old weeks, highlighting reduced participation from bigger holders throughout this period.

Monitoring ADA whales is an extraordinarily phenomenal because of these enormous addresses in total play a predominant role in influencing rate action. Whales can construct liquidity shifts and in total act as a signal for institutional or excessive-procure-rate investor sentiment.

Basically the most modern lower whale count means that confidence amongst these key gamers could clean be cautious.

Even with the hot uptick, whale numbers remaining below their earlier highs could almost definitely display conceal subdued shopping for stress, potentially limiting ADA’s skill to atomize out of its most modern consolidation piece within the come time period.

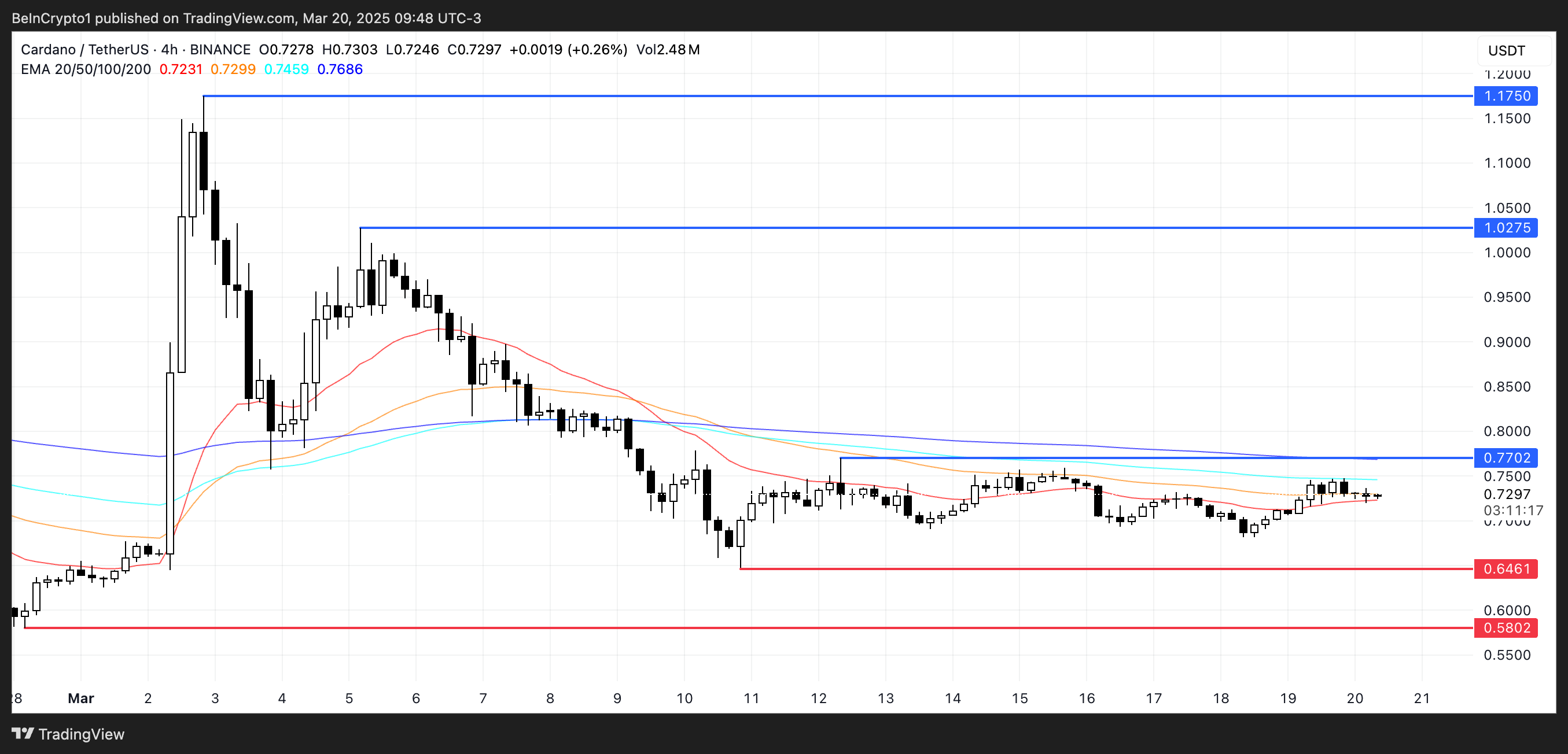

Cardano Is Procuring and selling Between a Necessary Range

Cardano EMA traces signal a consolidation piece. The non permanent intriguing averages remain below the long-time period ones however are within the intervening time very shut together, indicating an absence of solid momentum in both direction.

This setup suggests indecision available within the market, however it absolutely also leaves room for a attainable breakout. If Cardano rate manages to fabricate bullish momentum and place an uptrend, it could perhaps perhaps almost definitely first goal the $0.77 resistance.

A profitable breakout above this level could almost definitely pave the formulation for a rally toward $1.02, and if shopping for stress continues, ADA could even push as excessive as $1.17.

On the flip facet, if a downtrend develops, ADA could almost definitely tumble abet to study the foremost give a enhance to level at $0.64.

Shedding this give a enhance to would be a bearish signal and could almost definitely place off a deeper decline toward $0.58.

Basically the most modern positioning of the EMA traces shows that whereas there’s no determined style dominance, both bullish and bearish scenarios remain conceivable counting on how the rate reacts to those well-known ranges.