Cardano stamp isn’t escaping the broader market’s sell-off. The Cardano stamp has dropped 7.6% within the previous 24 hours, trimming grand of its recent beneficial properties. But, on a month-to-month scale, ADA is soundless up 28.6%, leaving merchants caught between optimism and peril.

In the motivate of the scenes, an even bigger struggle is taking half in out: super whales are selling, retail holders are staying bullish, and immediate sellers are piling in on derivatives markets. With all three forces pulling ADA in diversified instructions, one ingredient may perhaps finally mediate who comes out on high.

Astronomical Whales Orderly Holdings as Network Activity Declines

On-chain info reveals Cardano’s supreme wallets, conserving from 1 billion ADA up to infinity, occupy reduce their holdings from 5.43% in late June to 5.02% now, signaling a transparent bearish tilt from indispensable avid gamers. Even supposing the percentage dip doesn’t read grand, even a half of-a-percent drop is huge by methodology of whale holdings.

Adding to this tension, energetic addresses on the Cardano community are sliding, per the month-to-month chart. Addresses are down over 40% since peaking on 18th July, at 42,000.

This drop coincided with the ADA stamp dip, as the stop preceded the local high of $0.92. The drop in addresses may perhaps fair be undoubtedly one of many causes for the whale apathy.

For token TA and market updates: Need extra token insights savor this? Be a half of Editor Harsh Notariya’s Day-to-day Crypto E-newsletter here.

Retail Stays Bullish While Short Stress Builds

Despite whales trimming their stakes, retail merchants remain confident, with netflows from exchanges staying destructive for months, that methodology extra ADA is being withdrawn than deposited. Usually, this is bullish; it reveals holders are accumulating, no longer selling.

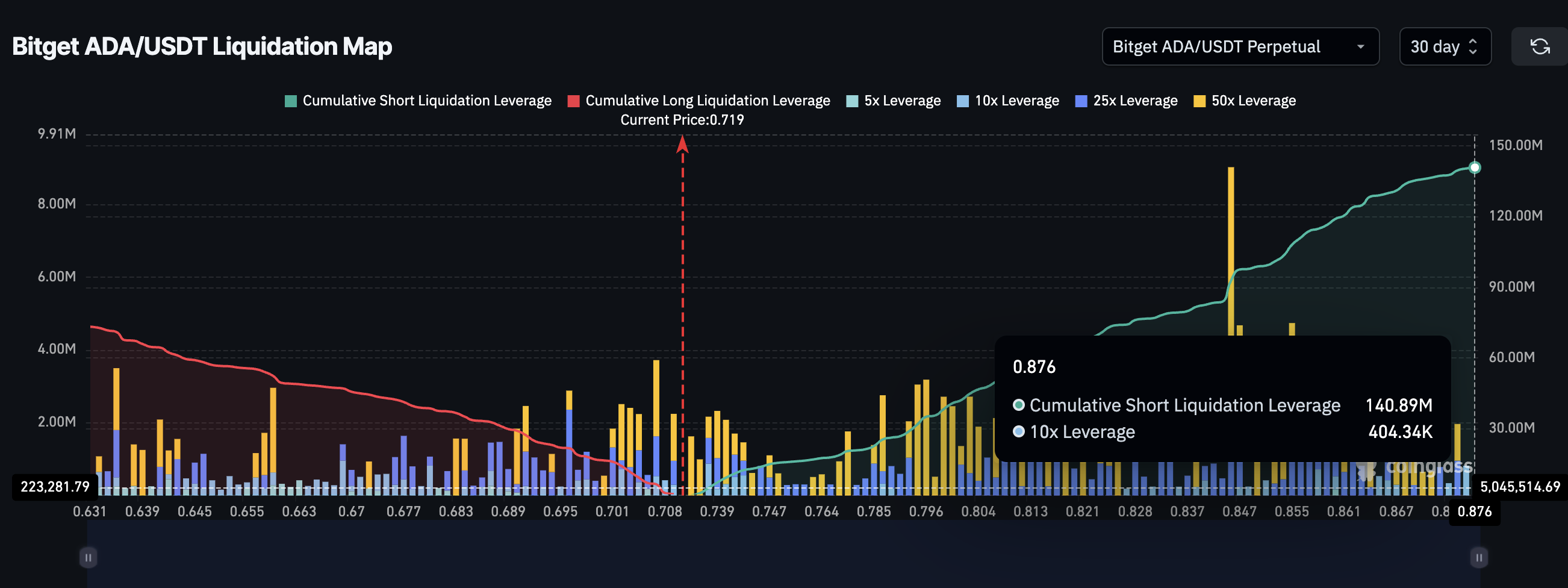

But derivatives merchants are siding with the whales. Bitget’s 30-day liquidation design reveals $141.7 million briefly positions versus excellent $74 million in longs, a transparent bet that ADA’s stamp has extra room to fall. And these merchants are clearly turning bearish. This explains the three-methodology struggle: featuring whales, retail, and leverage merchants.

If whale dumping continues, shorts may perhaps take hold of support watch over, riding ADA lower and forcing extra liquidations. But a unexpected immediate squeeze, led by retail sentiment, may perhaps flip the script, letting optimism fetch.

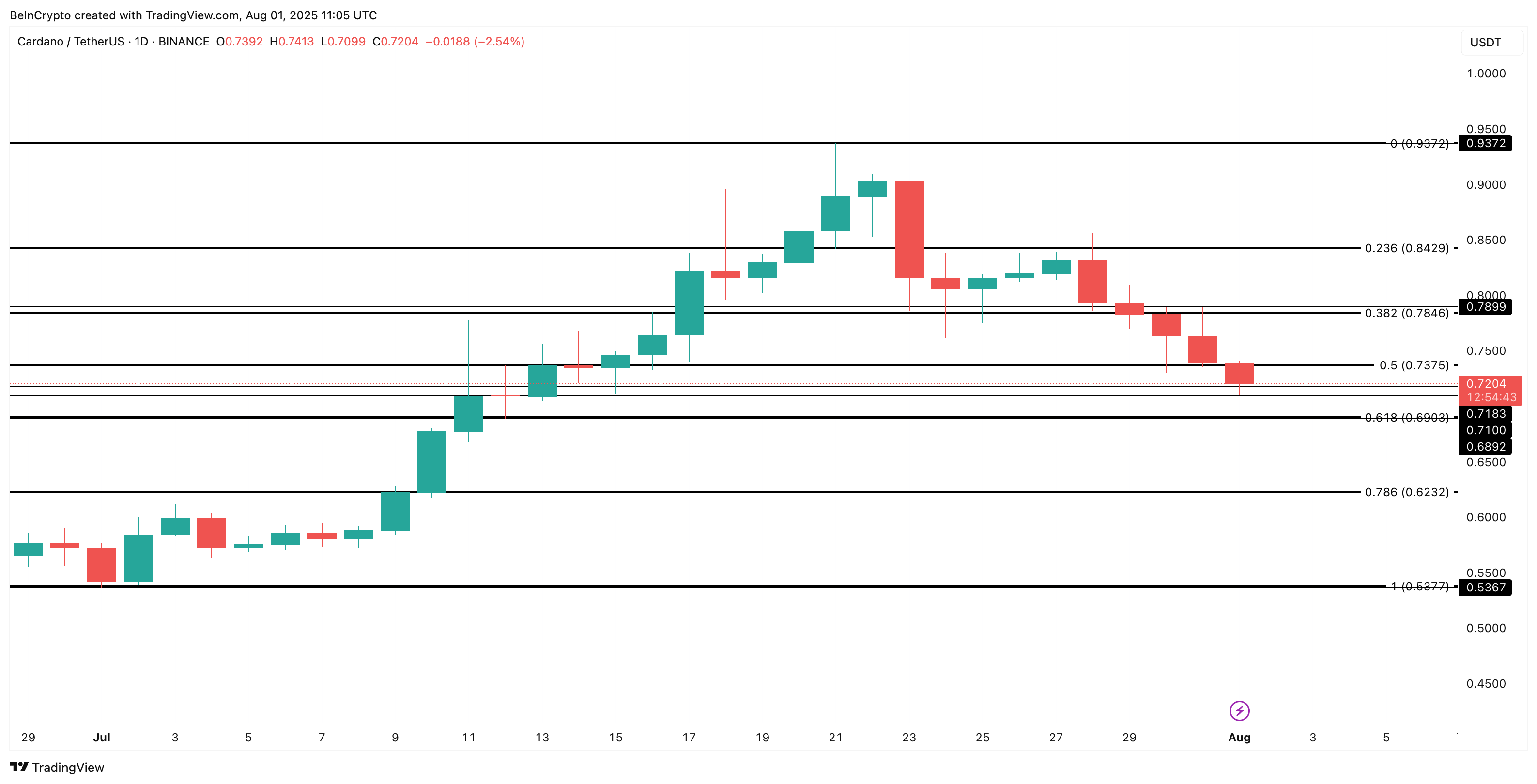

Key Cardano Tag Stages in Focal level

ADA is hovering draw a actually unprecedented toughen phases at $0.71 and $0.68. A breakdown may perhaps trudge prices to $0.62, matching the bearish whale and immediate positioning. In line with the liquidation design, a drop to $0.62 will liquidate whatever long positions remain.

But when bulls reclaim $0.73 and $0.78, momentum may perhaps flip motivate to the upside, invalidating the bearish hypothesis. That may perhaps then location a push toward $0.84 and $0.93, in desire of retail. Additionally, that will liquidate the immediate positions.

For now, the market stays in a standoff, with whales trimming, retail holders clinging on, and derivatives merchants looking forward to a breakdown to earnings. One ingredient, whether the immediate-heavy positioning triggers a squeeze or provides tension, may perhaps soon mediate who wins this struggle for Cardano’s next immense shuffle.