Analysts and investors are questioning the sustainability of the hot surge. Despite the initial rally, Cardano’s designate did now not shut above a key resistance level, signaling capability weak point in the uptrend.

On-chain records from Santiment unearths a decline in query for ADA, in conjunction with to investor caution. Reduced network bid and shopping stress elevate doubts referring to the sustainability of the hot rally.

As the market awaits additional traits, investors are intently staring at for indicators of a reversal or continuation of the uptrend, working out that ADA’s subsequent switch would possibly per chance presumably residence the tone for its performance in the weeks forward.

Cardano Indicator Shows Relating Data

Cardano faces a main possibility of a 30% plunge to its yearly low of round $0.27, as on-chain records from Santiment unearths rising selling stress and diminishing query.

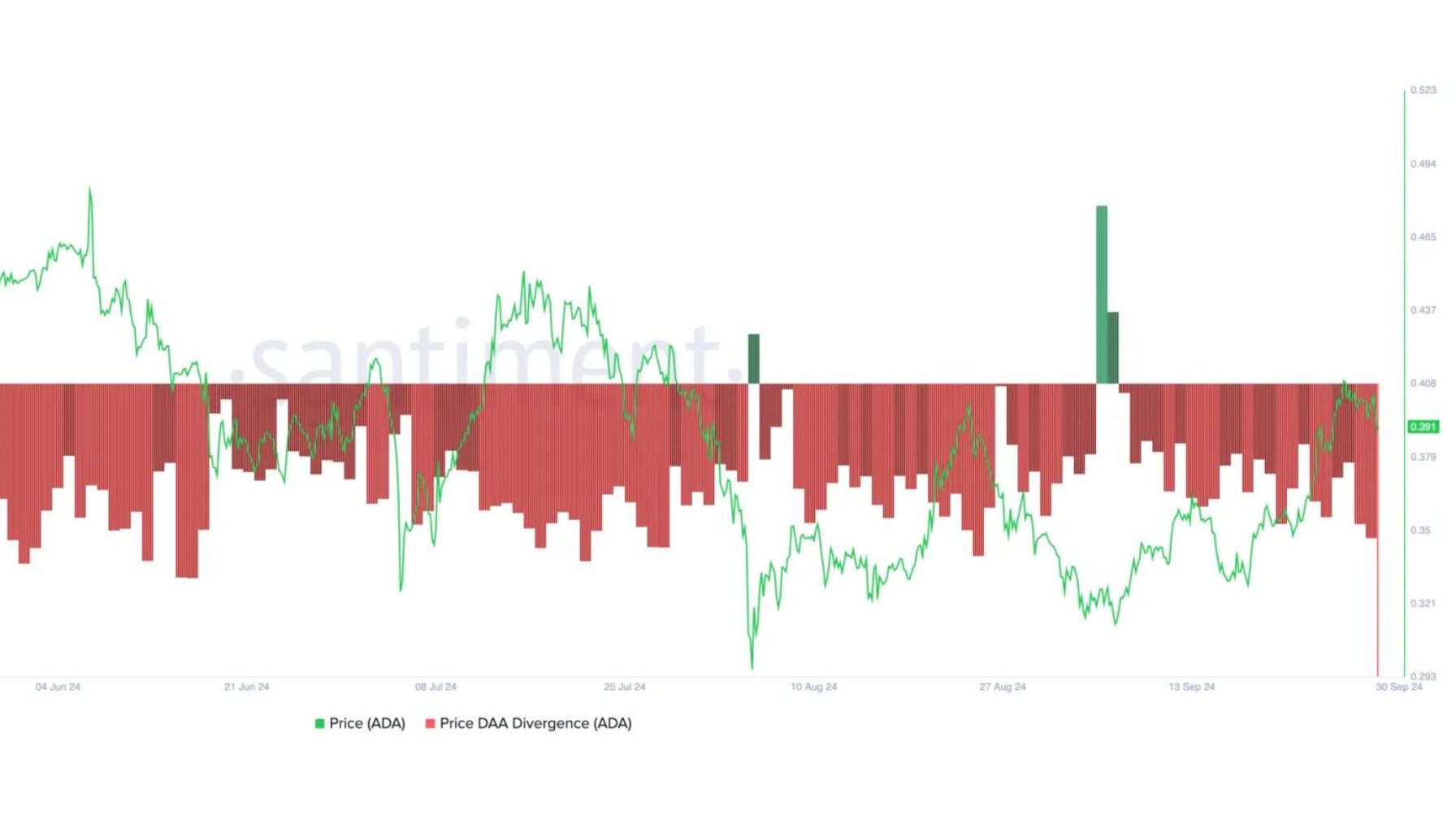

The warning indicators for ADA’s designate dangle modified into clearer, with its day to day inviting-address (DAA) divergence exhibiting a detrimental discovering out of -43.3% at the time of writing. This metric, which tracks the correlation between an asset’s designate movements and changes in its day to day inviting addresses, has remained detrimental since September 7, indicating a troubling trend for Cardano.

The detrimental DAA divergence means that indispensable of ADA’s rally this month, following the Federal Reserve’s ardour price cuts, has been fueled extra by broader market sentiment than by any specific query for ADA itself. This lack of natural query will improve the probability of a steep correction quickly.

With out sustained shopping stress, Cardano’s designate would possibly per chance presumably plunge sharply as merchants begin to lock in earnings, additional using prices downward.

If ADA fails to interrupt above its recent resistance level of round $0.41, analysts request a deeper correction, potentially pushing the cost lend a hand to the annually low of $0.27. With weakening query and increasing selling stress, Cardano’s shut to-term outlook looks to be like unsure, and merchants are bracing for added procedure back possibility.

ADA Build Action: Testing A Notable Provide Stage

ADA trades at $0.38, following a 10% dip from its day to day 200 exponential transferring sensible (EMA) at $0.41. This level has modified into a essential resistance dwelling, as the cost formed a original local high round this zone.

ADA must reclaim the $0.41 level and push above the subsequent key resistance at $0.Forty five to verify a bullish trend for the approaching weeks. Efficiently breaking previous these ranges would signal renewed energy, giving the bulls control and potentially ensuing in elevated prices.

However, if ADA fails to push above these important ranges, the altcoin would possibly per chance presumably face additional procedure back stress. A failure to reclaim $0.41 and surpass $0.Forty five would seemingly consequence in elevated selling, triggering a doable 30% plunge. In this kind of relate, ADA would be susceptible to revisiting its yearly low of round $0.27.

Given the hot market uncertainty and declining query, merchants are carefully staring at ADA’s designate movements, as the subsequent few days will be pivotal for determining whether or no longer a bullish breakout or a deeper correction is on the horizon.

Featured image from Dall-E, chart from TradingView