Cardano (ADA) is up 10% during the final seven days, with its market cap reaching $23 billion and each single day trading volume forthcoming $700 million. This surge in momentum has introduced renewed consideration to ADA, as key indicators originate up to align in decide of a most likely breakout.

The ADX has crossed the needed threshold signaling model power, and whale job is showing early signs of restoration after hitting a yearly low. With a golden heinous formation also on the horizon, ADA could possibly well possibly moreover be gearing up for its next valuable switch.

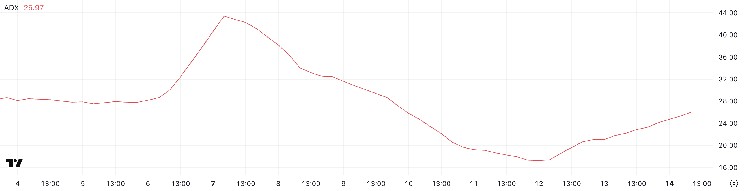

Cardano ADX Reveals The Uptrend Might possibly possibly Salvage Stronger

Cardano’s ADX (Common Directional Index) has climbed to 25.97, rising sharply from 17.41 correct two days ago. This considerable uptick suggests that ADA’s tag streak is gaining power, with early signs pointing toward a constructing uptrend.

The amplify in ADX displays increasing momentum on the support of the most modern strikes. That potentially signals that the asset is transitioning out of a low-volatility consolidation segment into a more directional model.

The ADX is a technical indicator dilapidated to measure the capability—no longer route—of a model, in total on a scale from 0 to 100.

Readings below 20 show cover a veteran or non-existent model, whereas values above 25 indicate a strengthening model. With ADA’s ADX now at 25.97, the indicator has crossed the most critical threshold that separates uneven, indecisive tag streak from a more structured directional switch.

This shift could possibly well possibly moreover indicate that Cardano is in the early phases of a sustained uptrend, particularly if supported by rising volume and other bullish signals in the approaching sessions.

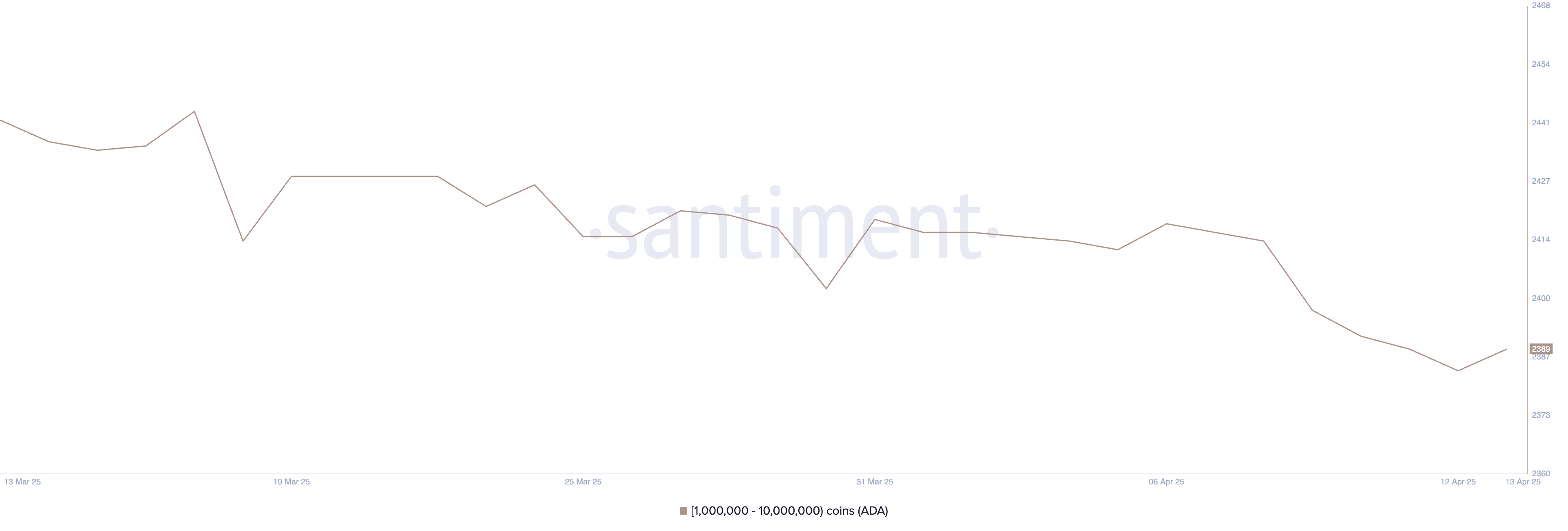

ADA Whales Are Shopping for All over again

The preference of Cardano whale addresses—these holding between 1 million and 10 million ADA—fell gradually from April 6 to April 12, shedding from 2,418 to 2,384. That market its lowest degree since February 2023.

On the assorted hand, a minute rebound came about the day gone by, with the count rising modestly to 2,389.

While this uptick could possibly well possibly moreover mark at renewed accumulation, the total amount remains significantly decrease when put next with most modern weeks, suggesting that valuable holders are gathered showing caution.

Tracking whale job is required because these broad holders can exert mighty impact over tag movements as a result of sheer size of their positions.

A actual decline in whale wallets in total indicates diminished self assurance or profit-taking. On the assorted hand, an amplify can signal accumulation and most likely upward tension on tag. Even supposing the most modern rebound in ADA whale numbers is a certain signal, the total remains reasonably subdued.

This could possibly well possibly moreover indicate that, despite ADA’s makes an try to obtain an uptrend, broad gamers are no longer but fully convinced of its sustainability. This would limit the capability of any rapid breakout unless more whale accumulation follows.

Cardano Might possibly possibly Kind A Golden Unpleasant Rapidly

Cardano’s EMA traces are gradually aligning in a device that implies a most likely golden heinous could possibly well possibly moreover obtain soon.

If this crossover is confirmed, it can possibly well possibly moreover give Cardano tag the momentum wished to study resistance round $0.709.

A successful breakout at that degree could possibly well possibly moreover push the cost better toward the next purpose at $0.77.

On the assorted hand, Cardano remains in a aloof utter, at this time trading correct above two nearby reinforce phases at $0.629 and $0.61. If both of these phases is tested and misplaced, it can possibly well possibly moreover invalidate the bullish setup and trigger renewed promoting tension.

A breakdown below both helps would most likely reverse the sizzling momentum, with ADA potentially sliding toward $0.51.