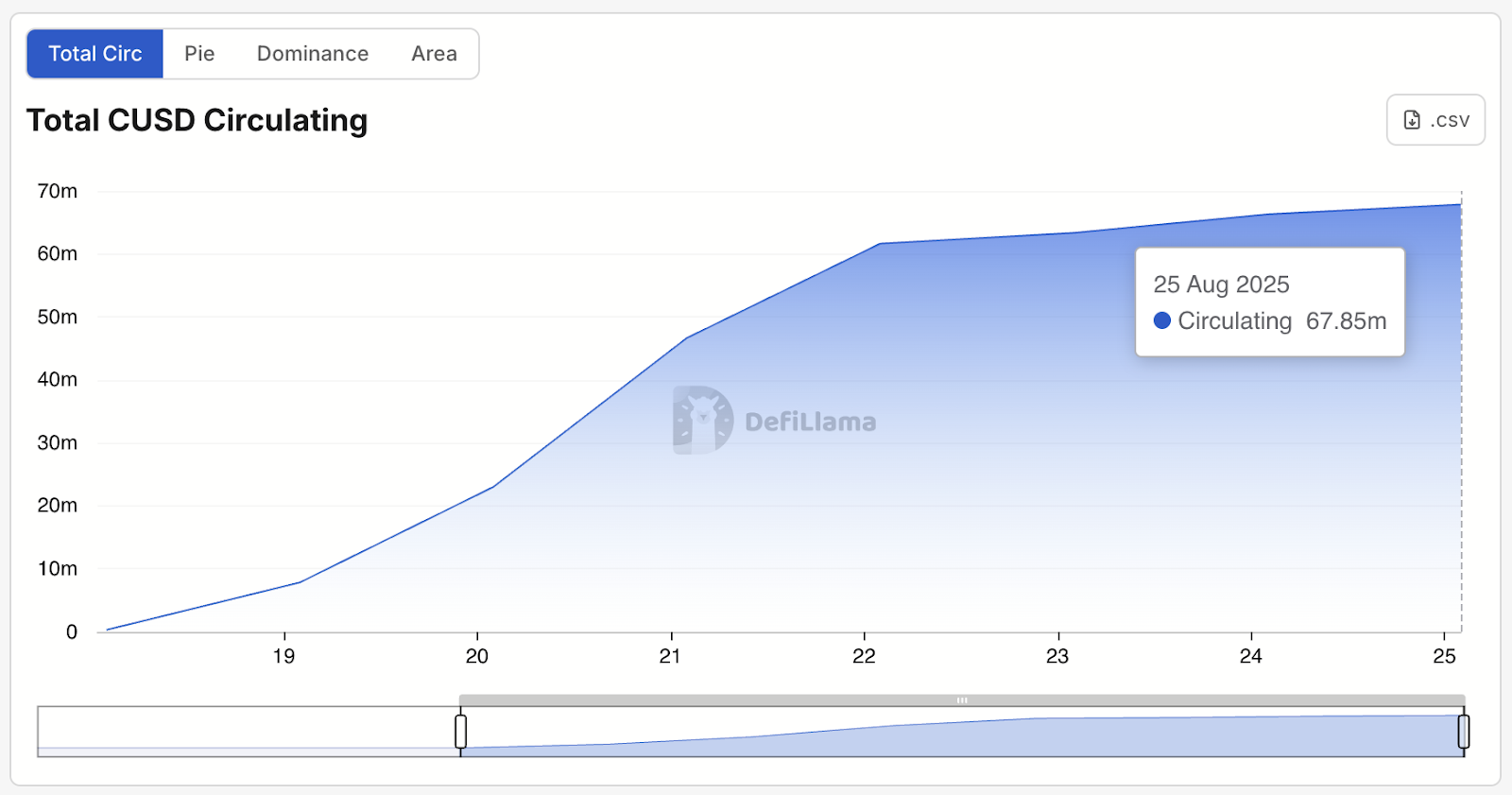

Cap Labs’ fresh stablecoin cUSD has seen rapidly adoption since open, ice climbing to $67.85 million in circulation over the past week, consistent with DefiLlama.

Etherscan reveals 2,735 holders of the token to this level. The leap indicators solid request for Cap’s yield-layered digital greenback model, which combines regulated reserve assets with EigenLayer-powered credit underwriting.

Built atop the newly launched Cap Stablecoin Community (CSN), cUSD is designed as a 1:1 redeemable stablecoin backed by assets treasure PayPal’s PYUSD, BlackRock-managed BUIDL, and Franklin Templeton’s BENJI. The yield-bearing model stcUSD — minted by staking cUSD — is enabled by a 3-come by collectively draw of lenders, operators, and restakers.

Cap’s core innovation lies in its construction: operators borrow stablecoins to deploy yield solutions, restakers underwrite the operator’s credit possibility, and lenders (stcUSD holders) effect a floating yield, currently around 12%, counting on market request and operator efficiency. While restaker collateral provides safety in opposition to operator default, stcUSD holders are unruffled uncovered to fluctuating yield dynamics.

In contrast to many past stablecoin launches, Cap’s model is thoroughly tuned to follow the GENIUS Act, the sweeping US stablecoin legislation that prohibits hobby-bearing payment tokens. Talking on the Stablecoin Summit in Cannes in June, Cap Labs founder Benjamin Lens used to be blunt:

“They stated no yield, and it’s splendid certain — there’s no device around it. They dwell no longer prefer stablecoins giving yield to retail merchants,” Lens stated.

Thus, stcUSD is a separate ERC-4626 vault token, which users can mint by staking cUSD. The yield is generated thru a marketplace of borrowing and restaking, no longer straight from Cap Labs.

“Genius Act covers companies which would be generating yield on behalf of users and giving them to the users,” Lens stated in Cannes, whereas Cap is “an immutable initiate protocol treasure Ethereum, treasure Bitcoin.”

Mixed with the real fact that the percentage of anyone stablecoin backing cUSD is proscribed to 40%, Lens thinks they catch got a compliant mechanism. “Here’s the usual that we’ve agreed to with Templeton and BlackRock for our integration with them,” Lens told Blockworks, noting it’s the same blueprint that UStB (from Ethena) made in partnership with BlackRock.

Restaking evolution

Cap’s form aligns with a pattern rising on EigenLayer: the financialization of Actively Validated Services (AVSs). Traditionally, AVSs on EigenLayer supplied infrastructure services and products — treasure oracles or bridges — with possibility restricted to uptime or correctness. Nonetheless a fresh wave of AVSs is the usage of EigenLayer to underwrite financial ensures.

Cap is one example highlighted by EigenLayer founder Sreeram Kannan. “A staker can stake and promise that an operator [like Susquehanna] goes to make a 10% APR,” Kannan told Blockworks. “You doubtlessly can underwrite financial possibility the usage of EigenLayer, which is a the truth is fresh extra or much less possibility, which requires powerful, powerful extra fascinating curation and monitoring,” he stated.

What makes this conceivable is EigenLayer’s current rollout of a fresh feature, complementary to slashing, which went dwell in April.

While slashing permits restakers to be penalized for backing underperforming operators, redistribution, launched in leisurely July, enables slashed funds to be redirected help to the impacted AVS — akin to Cap’s lending vault — in its set of burned.

That alternate turns EigenLayer into a programmable possibility distribution layer, capable of imposing structured finance contracts fully onchain.

“With financial AVSs, slashing is the core common sense,” Kannan stated. “A liquidation is an example — if the hurdle rate is no longer met — reduce and pass the money out.” That’s more uncomplicated than slashing some infrastructure AVSs treasure a ZK or TEE coprocessor, the set it’s extra difficult to adequately divulge the slashing common sense onchain, he added.

In accordance with a be taught sign from Serenity Compare and Catalysis printed Sunday, Cap’s model resembles a CDS-treasure construction: Restakers log off-chain right agreements to quilt operator defaults, put up collateral onchain, and are liquidated if their guarantee fails. Cap currently lists market makers treasure Fasanara, GSR, and Amber as operators, with Gauntlet and Symbiotic restakers offering credit safety.