Key Takeaways:

- Tron: Wide in Asian markets no matter regulatory scrutiny, powered by Tether.

- Ethereum: Favored in Western markets for its compliance and innovation, powered by USDC.

- Ethereum has a elevated market capitalization, while Tron sees higher each day particular person reveal, suggesting varied ranges of market engagement.

- The aptitude outcomes for Ethereum and Tron vary from one dominating the market, both coexisting, or both being overtaken by a brand unique blockchain.

Earlier than the introduction of radar and satellite navigation, sailors in total relied on the flight of birds to resolve the presence of nearby land loads. In the same vogue, in the blockchain markets, the “flight patterns” of stablecoins can in total uncover you rather fairly about the fortunes of a blockchain mission.

As of this writing, Tron is main Ethereum in USDT present, with $57 billion on Tron versus $50 billion on Ethereum. What could perchance this mean for blockchain investors? Can Tron overtake its older, extra standard rival because the premier Layer-1 dapper contract blockchain?

In short, which token is the upper aquire in some unspecified time in the future – ETH or TRX?

On this handbook, we analyze the basics, historic past, and regional dynamics of both Tron and Ethereum to take into tale if we are able to hunt out a winner.

The Fundamentals

In the aid of bitcoin, Ethereum is the 2nd largest crypto on this planet, with a market cap of $386 billion. At correct $10.6 billion, Tron is a miles off thirteenth on the table total (and ninth for folk that completely peep at L1 blockchains). Bitcoin towers above all of them, with a market cap of $1.24 trillion.

Token Label and Offer

On the time of writing, ETH used to be price $3,169, an elevate of 178% one year over one year and 1557% from its label in Q4 2020. Naturally, this label mosey has made ETH a conventional chance among investors for long-term holding.

TRX items a inquire in distinction in many programs. Since its commence in 2017, the token has never ventured above a top of $0.23 in label. First and major of Q2 2024, 1 TRX is price $0.120, a 6000% elevate since 2017 and 173% one year-on-one year.

Both ETH and TRX live no longer own any limits on the quantity of tokens that is also issued over time. In both blockchains, a location quantity of tokens are frequently burnt off to arrange the accessible present and retain an upward label tension.

Every single day Energetic Users

On Every single day Energetic Users, our favourite metric, Tron is with ease earlier than its rivals. The community has around 1.9 million each day users. After crossing the 1,000,000 milestone in 2022, the numbers own remained fairly genuine, with noticeable spikes in 2023 and early 2024.

On Ethereum, the quantity of each day active users is totally around 465,000. The graph seems to be fairly flat over time, barring a few minor spikes here and there. Even if there is a late upward pattern, it is miles dazzling clear that holders of ETH on the whole use the community less in total than TRX house owners.

Network Fees

High gasoline prices had been a perennial relate for the Ethereum community. This has spawned the style of Layer-2 networks (L2s) and sidechains prioritizing decrease transaction prices. L2s cherish Arbitrum and Optimism and sidechains cherish Polygon offer decrease gasoline prices than the Ethereum mainnet.

Even in 2024, area to community congestion and demand, gasoline prices on ETH mainnet can vary from less than a greenback to $70 or extra. In distinction, transactions on the Tron community in total label between $1 – $3, area to community reveal.

Additional, Tron additionally offers free transactions. Users willing to stake TRX on the community can skills transactions with out gasoline prices. The boundaries can fluctuate depending on the quantity of TRX staked.

In 2024, Ethereum’s annualized prices had been around $2.75 billion, with a monthly price of $226 million. In the period in-between, Tron reported annualized prices of $1.52 billion and monthly prices of $125 million.

Reputation and Regional Dynamics

Any dialogue of the Tron community would be futile with out a peep at its controversial founder, Justin Solar. A fugitive from the Chinese language executive, Solar has been accused of every thing from insider shopping and selling to market making, tax evasion, varied forms of commercial fraud, money laundering, and extra.

Even sections of the Tron white paper had been allegedly plagiarized from white papers written by Protocol Labs, one other blockchain group. Solar, who owns the Tron Foundation, used to be charged by the SEC in 2023 for fraud and violations of US securities laws linked to the sale of TRX tokens.

Undoubtedly, investor concept of Tron has been heavily influenced by the unfavorable press generated by Justin Solar over time. However, no matter its early wobbles, Tron has obtained traction in key markets outside the US and the EU.

Two key trends had been guilty for this:

- The addition of USDT to the Tron blockchain as a TRC20 token

- Partnership with Binance to increase the Tron community on the liked alternate

Tron enjoyed the early mover aid in offering an with out complications accessible digital cost machine essentially essentially based around a stablecoin, with very low prices and instantaneous transactions. This proved highly stunning in areas that suffered from the following eventualities:

- Lack of contemporary banking systems and high terrifying-border transaction prices (Asia, Africa)

- High ranges of inflation that rendered the nationwide currency unusable (Latin The USA)

- Western sanctions blocking off worldwide monetary institution funds (Russia, Iran)

In these areas and China, the users own acute accurate-world cost wants that Tron successfully meets. Most live no longer care about Justin Solar’s recognition; many users could perchance perchance not even know his existence.

US regulators own many times centered USDT and Tron for non-compliance with monetary rules. However, they are both entrenched in the worldwide market attributable to the early mover aid—rival alternate recommendations cherish USDC and Arbitrum arrived noteworthy later.

How Ethereum (and USDC) Compares

Regarding recognition, Ethereum’s linked to Justin Solar – co-founder Vitalik Buterin – has had no main scandals or controversies linked to him. He’s generally known as an innovator and pioneer of blockchain applied sciences.

Ethereum additionally has a fairly natty recognition, which has aided its adoption as a platform for crypto innovation and investment in Western markets. In tandem, Circle’s USDC stablecoin has emerged as a conventional change to USDT attributable to its focal level on compliance with US monetary rules.

The major thing to explain is that while ETH is intensely standard in the West, it is miles never widely venerable for accurate-world solutions cherish funds. Crypto is essentially considered as a instrument for investment and wealth technology by holding or shopping and selling.

In distinction, Tron and USDT own obtained popularity in Asia, Latin The USA, Africa, and Russia as they give viable picks where venerable banking and cost systems own failed.

Software program Ecosystems

A snappily peep at Dappradar.com finds a clear mismatch between the 2 networks. Ethereum has successfully over 4,000 apps, with over a dozen exhibiting thousands of extraordinary active wallets (UAWs). Here is a fast peep at the head 5 dapps on Ethereum:

- Xterio: A gaming app with over 67k UAWs and transaction volumes of $716k in 24 hours

- Uniswap V3: A regular shopping and selling and AMM protocol with 32k UAWs and $2.7b transactions

- 1inch Network: A liquidity and DeFi aggregator with 9.4k UAWs and $225m transactions

- EigenLayer: A radical unique restaking protocol with 8.8k UAWs and $392k transactions

- Uniswap V2: The predecessor to V3, with 7.87k UAWs and $137m transactions

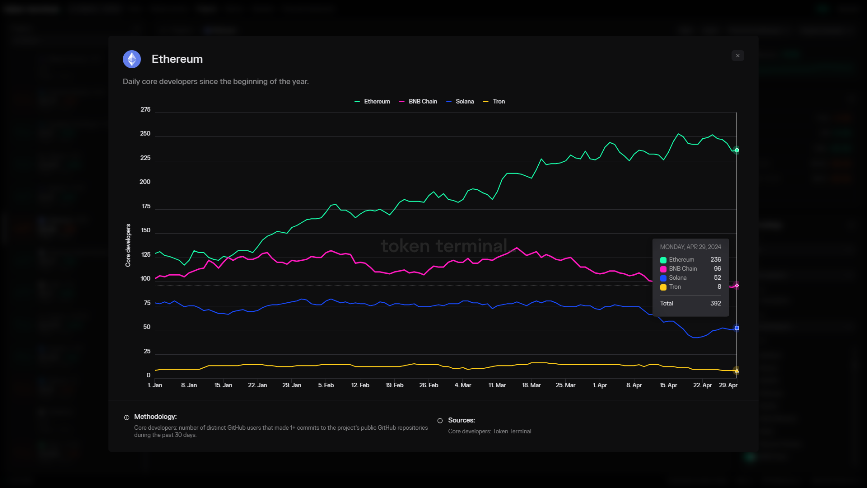

Additional, Ethereum has over 236 core builders who revamped 1.69k code commits in 30 days. According to DeveloperReport.com, the blockchain attracts the utmost quantity of active builders, with 2,392 as of December 2023.

Tron has extra modest stats in comparability. Except for 8 core builders, the blockchain reportedly has completely 16 self reliant builders. The ecosystem is a lot from thriving, and developer reveal looks unimaginative essentially, even when the platform has around 1380 apps and protocols.

- PayNet Staking: A high-chance staking app with 743 UAWs

- Level Crypto Staking: One other decentralized staking app with over 500 UAWs

- Tron NRG: A protocol that permits TRX stakers to rent their vitality, with 171 UAWs

- Bitget Swap: A shopping and selling wallet with 157 UAWs and $32.6k transactions in 24 hours

- JustLend DAO: A decentralized lending app with 119 UAWs and $277k transactions

These numbers point out that Ethereum is manner earlier than Tron in phrases of ecosystem evolution and developer reveal. The overwhelming majority of Tron users are enthusiastic completely in its USDT funds feature, which is never any longer imperfect. It has a pickle use case that has obtained traction particularly elements of the globe.

However, Ethereum is miles ahead in phrases of testing and extending unique programs to use blockchain technology. If you might perchance very successfully be shopping for modern companies and products and apps that can make mainstream acceptance in some unspecified time in the future, you might perchance very successfully be extra seemingly to hunt out those on Ethereum’s ecosystem.

Scalability and Totally different Technical Aspects

Ethereum and Tron are highly scalable blockchains, in dissimilarity to bitcoin, which relies on an vitality-intensive proof-of-work consensus mannequin. While Ethereum makes use of a total proof-of-stake mannequin, Tron relies on a designated proof-of-stake consensus mechanism.

Ethereum, particularly, has a huge lead when working on scaling solutions. Dutzende of L2 chains and facet chains are for the time being below style. Tron at explain has one main L2 below style linked to Bitcoin.

Transaction Speeds

Because of the the delegated PoS, Tron can job transactions noteworthy sooner than Ethereum, main to a claimed practical bustle of around 2000 transactions per 2nd (TPS). The Ethereum 2.0 mainnet can completely take care of between 15 and 30 TPS.

This will seemingly alternate with the addition of newer elements cherish sharding to Ethereum by future updates. Besides, the blockchain already offers sooner transaction speeds by sidechains and L2s cherish Arbitrum (4000 TPS), Polygon (65,000 TPS) and Unsuitable (2000 TPS).

Programming Languages

Ethereum is extra pleasant against builders because it supports a huge vary of programming languages, including Python, Ruby, Rust, Plod, Delphi, Mosey, Java, and Javascript. In distinction, Tron has adopted a narrower strategy, supporting completely Python and Solidity.

Future Prospects: Coexistence or Competition?

Given the highly chaotic and comparatively unregulated nature of cryptocurrency markets, making assured predictions about anything is advanced. On the vogue forward for the continuing competition between Ethereum and Tron, we are able to explore no longer less than three programs by which it will play out:

Yell 1: Winner Grab All

Ethereum’s extra seemingly final end result here’s a receive. It has wider investor acceptance, and its significant weakness is late and dear transactions. These points can realistically be solved by future updates and L2s.

A Tron receive is less seemingly for a huge quantity of reasons. Except for the prices against Justin Solar, Tron is additionally below investigation for the use of its platform to evade sanctions in Russia and for unhealthy activities cherish terrorism financing in the Heart East.

Yell 2: Coexistence

Both Ethereum and Tron gravitate against opposing extremes in the crypto world. Ethereum flourishes in highly regulated and developed markets because it will entice and protect extra institutional investors. The SEC licensed ETH futures in 2023. Space ETFs could perchance perchance put collectively suit, presumably after one other apt battle in the US courts.

In the period in-between, Tron reputedly flourishes extra in grey, unregulated monetary markets and areas where monetary inclusion faces major challenges. As regulators in the West exert higher tension on the blockchain commercial, Tron and USDT could perchance perchance focal level extra on markets in Asia, Latin The USA, and Russia.

Yell 3: One other Blockchain Wins

On this arrangement back, both an existing or trace-unique L1 could perchance perchance upward thrust and disrupt your whole ecosystem, vanquishing Ethereum and Tron. We already own one such contender, Solana (SOL).

Solana already has sooner and more cost effective transactions and scalability. It’s a ways additionally the fifth most functional crypto at the time of writing, with a market cap of $61 billion. It’s a ways arguably the head L1 contender that has an more cost effective chance to overtake Ethereum in the following decade.

Investor Takeaway

Both ETH and TRX explain exciting opportunities for crypto investors.

ETH is the sector’s 2nd most standard crypto with thrilling long-term holding potentialities, respectable staking APY, and demanding institutional backing.

TRX offers the chance to construct high APY by staking and the advantages of advance-zero transaction prices. However, it is miles vastly extra inclined to regulatory motion.

These two cryptos own varied evolutionary trajectories, audiences, and seemingly use instances.

Grand relies on your chance speed for food and jurisdiction. For US/EU investors who care about compliance and transparency, ETH and USDC are seemingly safer picks to TRX and USDT. But a savvy investor could perchance perchance continuously aquire both.