With the 2025 bull speed around the corner, the Render Network stamp can upward thrust dramatically. The surge in seek info from for 3D graphics in leisure raises the inquire: Might well RENDER chase to $25 by 2025? Let’s detect the elements at play.

Table of Contents

What is Render?

The Render Network is a decentralized platform for GPU rendering that permits artists to use extremely effective GPU nodes worldwide for their projects on seek info from. Node providers make a contribution their unused GPU energy to a blockchain-based entirely marketplace, which permits faster and more inexpensive rendering than archaic centralized services. In this methodology, the Render token serves because the medium of alternate between customers and providers of GPU energy.

Moreover, Render Network is fraction of the OTOY technology stack, which makes use of OctaneRender application. The mix extends to widely ancient gains equivalent to Blender, Adobe After Results, Houdini, Autodesk Maya, Unreal Engine, and extra.

Market seemingly

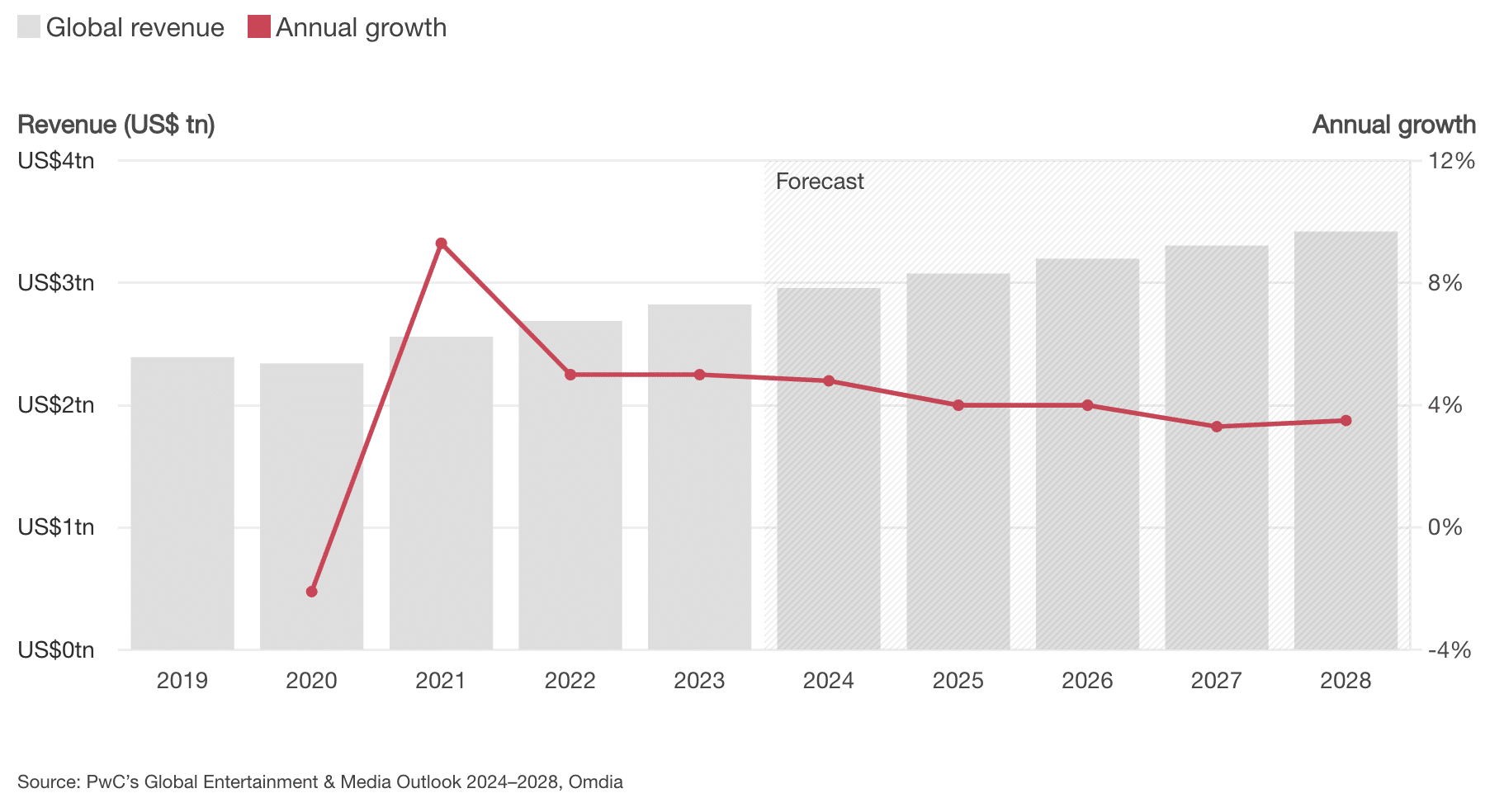

The leisure alternate, in particular gaming and cinema, is the essential marketplace for 3D graphics rendering. The seek info from for computer-generated imagery (CGI) and animation ideally suited continues to grow. As an instance, in step with PwC World, the leisure sector can potentially exceed $3 trillion in cost.

The rising seek info from for 3D graphics will favor platforms equivalent to Render that supply scalable rendering services. Moreover, the Render Network’s availability on extra than one blockchain networks – Ethereum, Polygon, and Solana – affords further flexibility and reach. Among these, Solana stands out as in particular capable of going thru increased rendering workloads due to its excessive scalability and low-cost transaction charges.

Moreover, Render has already collaborated with considerable productions, including the VR skills for “Batman: The Consuming Assortment” and the opening titles for “Westworld.”

Market region

As of July 25, Render Network is number 2 in dispensed computing, 2nd ideally suited to Web Computer, and ranks Thirty 2nd within the broader crypto market with a market cap of around $2.6 billion.

Whereas any other folks could perchance perchance well additionally very well be popping hopium capsules and dreaming of tokens skyrocketing to $100 or even $1,000, the associated payment diagnosis could perchance perchance well additionally merely soundless be realistic. Render’s already excessive-ranking region limits its growth seemingly. It’s no longer with out a doubt about crushing desires but about taking a detect at the market with obvious eyes in its place of rose-tinted glasses.

Inflation and present

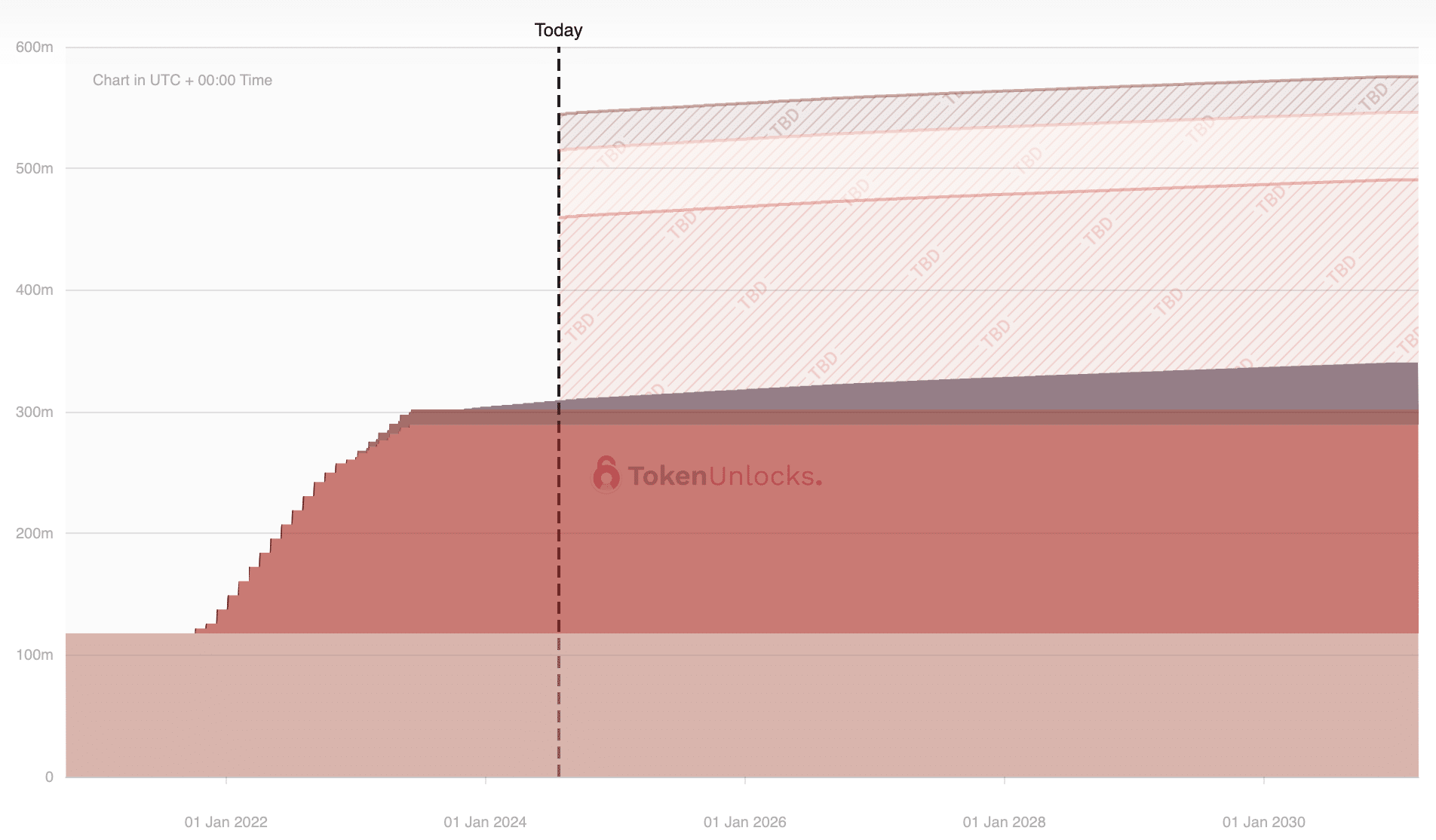

Render Network doesn’t face most considerable concerns over token unlocks, as most tokens take into accout already been unlocked. The becoming fresh tokens coming into circulation are due to the inflation payment, location at 760,567 RENDER monthly to incentivize customers. Then but any other time, the particular circulating present has inflated in a different plan. From January 2024 to July 2024, the provision increased by 18,950,928 RENDER, resulting in a 5.1% inflation payment over six months.

The Burn Mint Equilibrium deflationary mechanism has no longer kept a long way from this stage of inflation. If the pattern continues, the annual inflation payment will reach 10.2%. This metric is a truly necessary for forecasting the provision by mid-2025 to precisely assess the token’s valuation. Starting with a present of 390,859,381 tokens, the projected present would be approximately 430,727,038 RENDER.

Correlation with Bitcoin stamp movements

Diagnosis of the Pearson correlation coefficient between RENDER and BTC from 2020 to July 2024 displays a correlation of 0.727. The signifies a sturdy linear relationship, with RENDER’s stamp movements closely following BTC’s.

The diagnosis also checked out the annual traditional deviations for RENDER and BTC, that were 1.725 and zero.616, respectively. Moreover, RENDER had annual returns of 235.69%, whereas BTC had 62.98%. These numbers helped fabricate a model to predict RENDER’s stamp adjustments in step with BTC’s movements.

| RENDER | BTC | |

|---|---|---|

| Annual Return | 235.69% | 62.98% |

| Annual St. Deviation | 1.725 | 0.616 |

| Pearson Correlation Coefficient | 0.727 | 0.727 |

Render’s 2025 bull speed stamp diagnosis

We developed a model with three scenarios: undergo case, injurious case, and bull case. These scenarios correspond to BTC costs in 2025 of $100,000, $150,000, and $200,000, respectively. By standardizing the adjustments in BTC and RENDER, we calculated the anticipated stamp for RENDER in every discipline. The calculations think a BTC stamp of $65,000 and a RENDER stamp of $6.80 because the starting points:

| Endure Case | Execrable Case | Bull Case | |

|---|---|---|---|

| BTC | $100,000 | $150,000 | $200,000 |

| RENDER | $14.26 | $24.91 | $35.57 |

The injurious case discipline appears to be the most realistic. Given the calculated present, it projects RENDER reaching a market cap of roughly $10.73 billion and a stamp of $24.91. This market cap looks achievable, pondering RENDER is now not any longer going to be the particular token to upward thrust within the middle of a bull speed.

Disclosure: This text doesn’t bid investment advice. The enlighten material and affords featured on this net page are for educational purposes ideally suited.