Within the early 2010s, banking customers dissatisfied with the funds, complexity and downhearted service of frail banks obtained some fresh alternatives.

Neobanks, most steadily is named digital or challenger banks, emerged as fintech startups geared in direction of offering banking products and providers primarily by cell apps and web platforms, with out the want for bodily branches.

Fintechs fancy Straightforward within the US, N26 in Germany, and Monzo and Revolut within the UK centered on offering an intuitive particular person expertise, most steadily incorporating aspects corresponding to accurate-time spending notifications, budgeting instruments and easy money transfers.

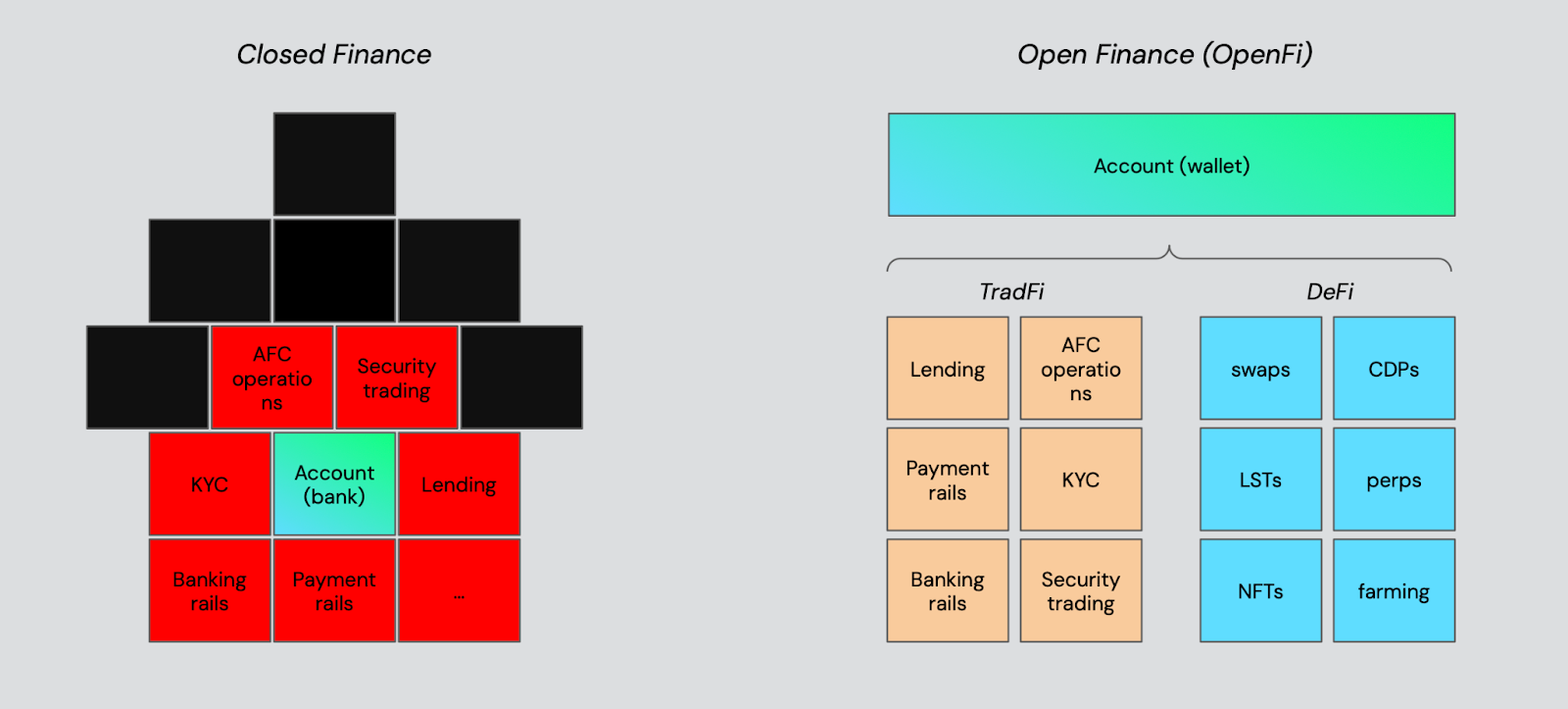

But fancy their brick and mortar counterparts, there remains an myth on the guts of a closed loop of products and providers.

Be taught more from our thought fragment: Fintech has hit a wall. Blockchain will spoil by it.

A fresh crypto consortium is pitching “Open Finance,” or OpenFi, as a substitute to each and each neobanks and strictly crypto DeFi.

The foremost conception lies in starting from a particular person-controlled myth. Reasonably than having banks because the KYC-enforcing gatekeeper, banking products and providers could even be plugged in — and swapped out — fancy the “money Lego” metaphor we’re so acquainted with in Web3.

Briefly, OpenFi is a framework for integrating noncustodial blockchain solutions into the frail monetary system.

The imaginative and prescient of OpenFi

Pitched on the sidelines of EthCC in Brussels, the community envisions a future the build banking accounts are replaced by attention-grabbing wallets, enabling users to administer their funds self sustaining of any one centralized entity.

As an different, fancy an a la carte menu, genuinely expert suppliers rob on the job of banking products and providers, an design that eliminates single aspects of failure and puts users up to the mark.

A key component of the OpenFi design is the pattern of infrastructure to pork up apps. As Jasper De Maere, analysis lead at Outlier Ventures successfully-known, “apps inspire infrastructure [and] infrastructure permits fresh apps.” Briefly, it’s time fintechs migrate to a fresh tech stack, he stated.

Unlike embedded wallets equipped by centralized gamers — most steadily typically known as CeDeFi, OpenFi advocates name for utilizing attention-grabbing wallets — Safe and Zeal, which is constructed on Safe, are two of the community’s initial individuals.

Dapper accounts provide divulge win admission to to DeFi capabilities, allowing users to search out out their security setup, whereas outsourcing payment and banking rails to suppliers corresponding to Monerium and Gnosis Pay.

Be taught more: Gnosis uRamp joins suite of on-chain banking products

For OpenFi to appreciate its fat most likely, there desires to be a concerted effort to believe more particular person-pleasant capabilities that could rival these equipped by frail fintech firms, however additionally extra growth on identity and security solutions.

On the identity front, Julian Leitloff of idOS pointed to the must streamline onboarding and aid away from redundant KYC processes. On the present time, most users must gradually study their identity when gaining access to assorted monetary products and providers. OpenFi, which Leitloff known as “the killer exhaust case for crypto,” proposes a unified identity solution that simplifies this process.

The idOS system makes exhaust of an Arbitrum Orbit chain however is chain-agnostic, and offers particular person-encrypted recordsdata to dapps by utilizing an SDK.

Institutions quiet mandatory

Despite the promise of OpenFi, frail monetary establishments will proceed to play a an vital role, per Julian Grigo from Safe. Merchants and service suppliers need to now not yet prepared to score divulge crypto funds, which is why hybrid solutions fancy Stripe, Gnosis Pay and Kulipa are mandatory to bridge this gap whereas asserting regulatory compliance.

However by unbundling accounts from banking products and providers, the OpenFi community hopes to fulfill the promise of an birth, particular person-centric monetary ecosystem, with better different and more alternatives for producing yield onchain — something the neobanks have didn’t lift.