Chainlink (LINK) price efficiently validated a bearish consequence self-discipline in the direction of mid-March nonetheless is now taking a behold to reclaim losses.

The altcoin is anticipated to receive strengthen from merchants who incurred substantial losses at some stage in the final two days, potentially contributing to its recovery.

Chainlink Investors Act Bullish

Following the big drawdown that resulted in nearly a 30% decline in Chainlink’s price, LINK holders are looking to take abet acknowledged losses. Their plan is considered of their most modern actions, which primarily target retaining off selling.

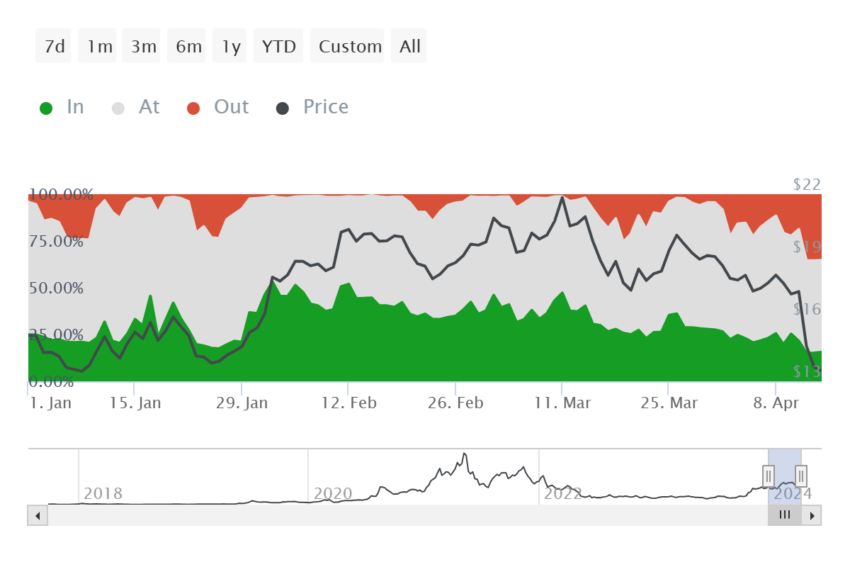

This will doubtless also be verified by distributing the merchants conducting transactions on the network in keeping with their profitability. The lively addresses that are in revenue only comprise 15% of all individuals. The rest, 85%, are these that are either bearish losses or are breaking even.

The latter two styles of merchants will refrain from selling since they are looking for to fabricate abet the cash they misplaced.

Read More: Strategies to Aquire Chainlink (LINK) With a Credit Card: A Step-By-Step Handbook

Substantiating right here is that in the final four days, shut to 100,000 addresses, or nearly 14% of all merchants retaining LINK, enjoy misplaced their earnings. Greater than 50% of the LINK holders are in losses on the time of writing.

Thus, these merchants will continue to push price recovery to gain their earnings, which might lead to Chainlink’s price getting greater to key resistance levels as soon as extra.

LINK Designate Prediction: Focusing on the Bearish Sample

Chainlink’s price hitting the lows of $11.98 at some stage in the intra-day trading hours is proof that the descending triangle used to be validated. Alternatively, its lower pattern line at $17 stays a essential barrier.

LINK would want to first breach through this to continue rising and at final breaking out of the descending triangle. Buying and selling at $14.54 on the time of writing, the altcoin only needs to breach through two resistances at $14.62 and $15.69.

Flipping them into strengthen would enable a upward push to $17, marking a 17% develop for LINK.

Read More: How To Aquire Chainlink (LINK) and All the things You Need To Know

Alternatively, if this breach fails, a drawdown is additionally imaginable, limiting Chainlink’s price upward push to $16. If, then again, bearishness intensifies and the $14 or $13.55 is misplaced, the bullish thesis will be invalidated.