The Avalanche (AVAX) network is in the spotlight as contemporary on-chain records finds an uptick in Total Price Locked (TVL).

The hot rise in TVL has prompted market analysts to speculate whether AVAX can reclaim the $50 rate level.

Avalanche Total Price Locked Continues to Climb

A more in-depth behold at the each day rate chart for AVAX indicates that the token has skilled a pullback. Nonetheless, it level-headed exceeds distinguished give a boost to stages, exhibiting resilience in a turbulent market.

The one-day chart evaluation reveals AVAX shopping and selling beneath the 50-day (yellow line) engaging sensible, which generally requires caution among merchants. A engaging sensible is a technical indicator that merchants and merchants employ to safe out the style route of an asset’s rate.

Nonetheless, the Relative Energy Index (RSI) means that AVAX is neither oversold nor overbought, giving neutral signals. At contemporary, the RSI sits at Forty eight. RSI is a momentum indicator that measures the magnitude of contemporary rate modifications to analyze overbought or oversold prerequisites

Learn More: How To Purchase Avalanche (AVAX) and The full lot You Want To Know

This steadiness in the RSI, coupled with AVAX’s location above excessive give a boost to, suggests the token could well moreover be consolidating before a capacity uptick.

The TVL all over the Avalanche ecosystem has considered a important develop, in step with records from DeFiLlama. This metric is wanted as it indicates the stage of user have faith and the volume of capital committed to the network’s DeFi protocols.

An rising TVL generally precedes bullish sentiment, as it shows a vivid and extending ecosystem, doubtlessly main to bigger build a question to for AVAX. At expose, the TVL sits at $1.164 billion. Right here’s the top most likely it has been since November 10, 2023.

AVAX Mark Prediction: Is $50 Subsequent?

Furthermore, the Global In/Out of the Cash (GIOM) for AVAX affords an optimistic describe, with a majority of the holders ‘In the Cash’ at the contemporary rate. This situation components to a precise likelihood that nearly all merchants are sitting on profits, which could attend as a psychological boost, cutting back the likelihood of fear promoting and providing a putrid for future rate development.

Most ‘out of the money’ holders bought their AVAX at $54. The contemporary block of shedding holders equates to 653,000 addresses conserving 28 million AVAX. Nonetheless. A Push in opposition to $50 would behold roughly a third of these holders tumble assist ‘into the money’ as that resistance zone begins at $Forty eight.33.

Learn More: Avalanche (AVAX) Mark Prediction 2024/2025/2030

Given these components, the search recordsdata from isn’t lawful whether AVAX can reach the $50 rate again, nonetheless pretty when. With a sturdy TVL and most merchants winning at contemporary stages, Avalanche reveals sure signs of underlying energy. The network’s sustained development and increased price locked in its DeFi protocols add to the conviction that AVAX is environment the stage for its subsequent distinguished rate toddle.

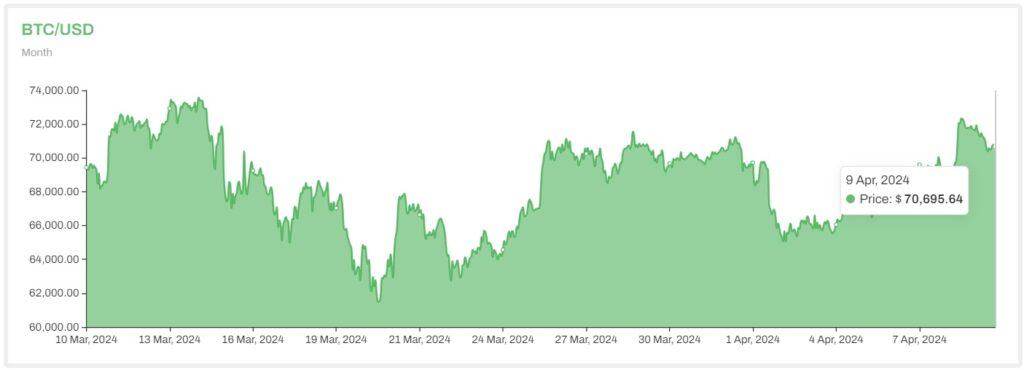

Nonetheless, AVAX could well behold a 15% decrease to its subsequent excessive give a boost to zone of $39 if the turbulent market continues with uncertainty surrounding the upcoming BTC halving. Invalidating its bullish thesis.