Bybit recovered its Bitcoin (BTC) market depth to ranges since earlier than this February’s hack. The attack largely affected Ethereum (ETH), however it led to an outflow of merchants and liquidity.

The Bybit alternate recovered its Bitcoin (BTC) market liquidity, step by step bettering market depth since February’s hack.

Files gentle by Kaito Analysis finds the market’s resilience and the unusual verbalize of reserves. The market operator grew to turn into a case survey for crypto resilience in rebuilding the market depth to manipulate slippage, while regaining the belief of merchants.

Bybit is peaceable offering its special liquidity depth for retail orders, creating a deeper pool of matchable costs for tiny-scale merchants. The characteristic could well additionally merely further rebuild the belief of retail merchants.

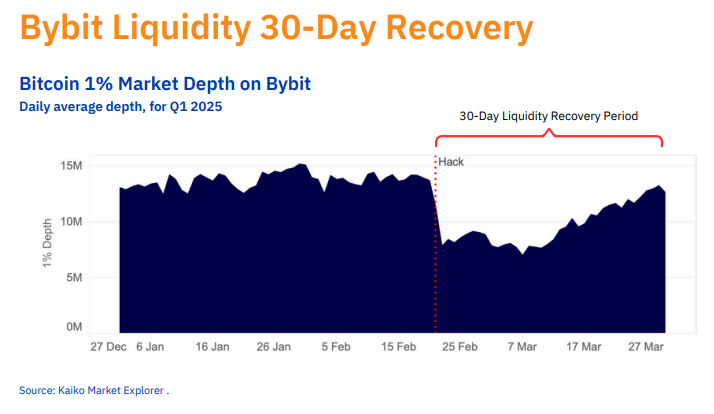

Bybit recovered most of its liquidity in 30 days

Kaito eminent that the first 30 days after the hack were severe for rebuilding liquidity and market depth.

The BTC market additionally crashed, while Bybit negotiated loan terms to make certain all withdrawal claims were fulfilled. Kaito Analysis identified that the alternate handled over 350K withdrawal requests.

As of Can also merely 7, Bybit carried $2.8B in day to day trading volumes, with BTC peaceable the dominant asset making up over 39% of trading exercise. The BTC market has $2.8M market depth for 2% slippage in accordance to Coingecko records.

Per Kaito’s document, the day to day average market depth is as high as $13M. No topic this, Bybit is regarded as one amongst the more liquid centralized markets.

The alternate lost a pair of of its market share following the exploit, and is at observe attempting to entice customers with new trading merchandise. The alternate then had to face the total market hasten linked to US tariffs negotiations and threats of a alternate battle.

The hack took region at a time of in most cases worsening market sentiment. In the case of all necessary exchanges lost a pair of of their liquidity. Bybit’s organized device to discovering sources of liquidity led to the quickest restoration amongst assorted exchanges. Some exchanges, much like HTX, Bithumb, and MEXC, saw double-digit wander in liquidity within the month following the Bybit hack.

Kaito identified that necessary events disrupt alternate liquidity. Even Binance lost up to 80% of its liquidity at some point soon of the 2023 possess market, following the June 2023 SEC lawsuit. One of the considerable most lost liquidity is yet to be recovered. This makes Bybit’s feat even more well-known, following the largest alternate hack within the historic past of crypto.

Altcoins enhance liquidity at a slower tempo

Bybit is additionally a key marketplace for altcoins and niche sources. Following the hack, liquidity regenerated more slowly. About a month after the hack, the alternate had recovered 80% of the identical old market depth.

Bybit targeted on the tip 30 altcoins, which are yet to reach assist to pre-hack market depths. The altcoin market is additionally affected by bearish sentiment.

The altcoin market restoration benefited from Authentic Trump (TRUMP), which change into amongst primarily the most liquid new tokens on the alternate. Established coins and tokens love UNI, ONDO, and LTC elevated their liquidity by 50% soon after the exploit.