Bybit seen the 2d-very top shopping and selling volumes among crypto exchanges last yr, making a “gradual nevertheless valid comeback” after suffering a $1.5 billion hack in February 2025, says CoinGecko.

Bybit‘s shopping and selling volume reached $1.5 trillion in total in the future of 2025, and its share of the market reached 8.1% for the yr, CoinGecko analysis analyst Shaun Paul Lee stated in a pronounce on Thursday.

“Despite the well-known hack Bybit suffered in February, it has clawed its plot encourage to the smash,” and has “slowly obtained encourage its dominance in the future of 2025,” he added.

The attack on Bybit is the excellent crypto hack ever, and was done by North Korean attackers exploiting a vulnerability in the alternate’s cool wallet infrastructure to safe off with $1.5 billion price of Ether (ETH).

Immunefi CEO Mitchell Amador instantaneous Cointelegraph earlier this month that just about about 80% of projects that endure from a hack below no circumstances fully safe better because of the the breakdown in operations and belief in the future of the response.

Bybit opted for measures love keeping withdrawals originate and honoring all user transactions. Its CEO, Ben Zhou, furthermore appeared on digicam to deal with concerns, assuring customers that the alternate had satisfactory funds to quilt all funds and deliberate to valid immediate liquidity through external toughen.

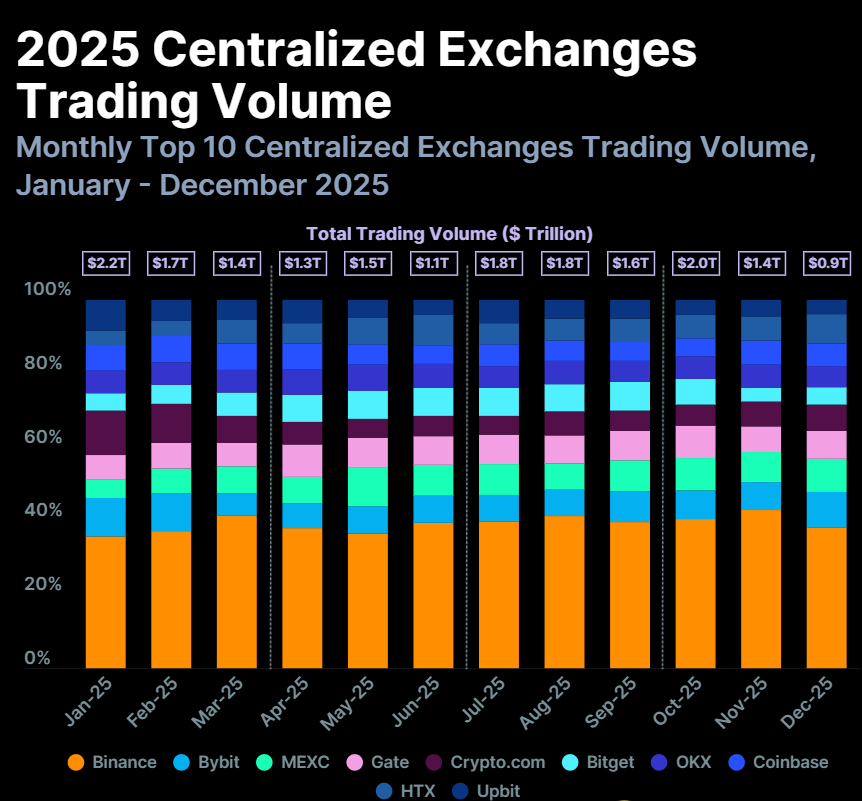

Most exchanges seen volume climb in 2025

CoinGecko’s pronounce stated six out of the smash 10 exchanges by market share seen their shopping and selling volumes climb in 2025, with shopping and selling volumes increasing by 7.6% on practical over the yr for $1.3 trillion in extra trades.

Four out of 10 exchanges seen double-digit percentage will increase in volumes, with MEXC leading because the fastest-rising alternate for the yr, with its shopping and selling volumes leaping 91% to $1.5 trillion in shopping and selling volume, up from $766.7 billion in 2024.

“MEXC persisted its aggressive zero-price policy all the plot in which through all jam shopping and selling pairs, attracting excessive-frequency merchants and retail customers, and boosting shopping and selling volume,” Lee stated.

Despite a gradual cease to the yr, 2025 was a bumper yr for crypto costs, with Bitcoin (BTC) and other coins recording a pair of all-time highs.

Binance holds onto high jam

Binance was mute the market chief among crypto exchanges, with CoinGecko estimating it seen $7.3 trillion in shopping and selling volume.

However, it didn’t register an safe greater in annual shopping and selling volume when compared with 2024, with its volume falling by 0.5% yr-on-yr.

“The trudge in shopping and selling volume would possibly well also goal even be attributed to the final bearish sentiment in the crypto market after the historical liquidation tournament on Oct. 10,” Shaun Paul Lee stated.

In a December originate letter last yr, the exchanges’ co-CEOs, Richard Teng and Yi He, announced the Binance user contaminated had climbed to over 300 million, and the total shopping and selling volumes all the plot in which through all products for the yr was $34 trillion.