The cryptocurrency market stays in a disclose of flux, with the world market cap hovering spherical $2.47 trillion, reflecting a modest 0.8% swap within the past 24 hours. Trading quantity has surged to $Forty eight.8 billion, indicating high investor job and interest.

Critically, Bitcoin (BTC) and Ethereum (ETH) dominate the market, with 51.3% and 17.3% shares, respectively. Regardless of this bustling job, the overall market’s Relative Strength Index (RSI) sits at 34.76, signaling that many resources are potentially oversold.

This gifts a possibility for savvy merchants to identify undervalued cryptocurrencies with the aptitude for a momentary rebound (within this week).

From an optimistic standpoint, Finbold identified two cryptocurrencies which are significantly oversold on a momentary foundation, as evidenced by their RSI readings, primarily based on knowledge from CoinGlass.

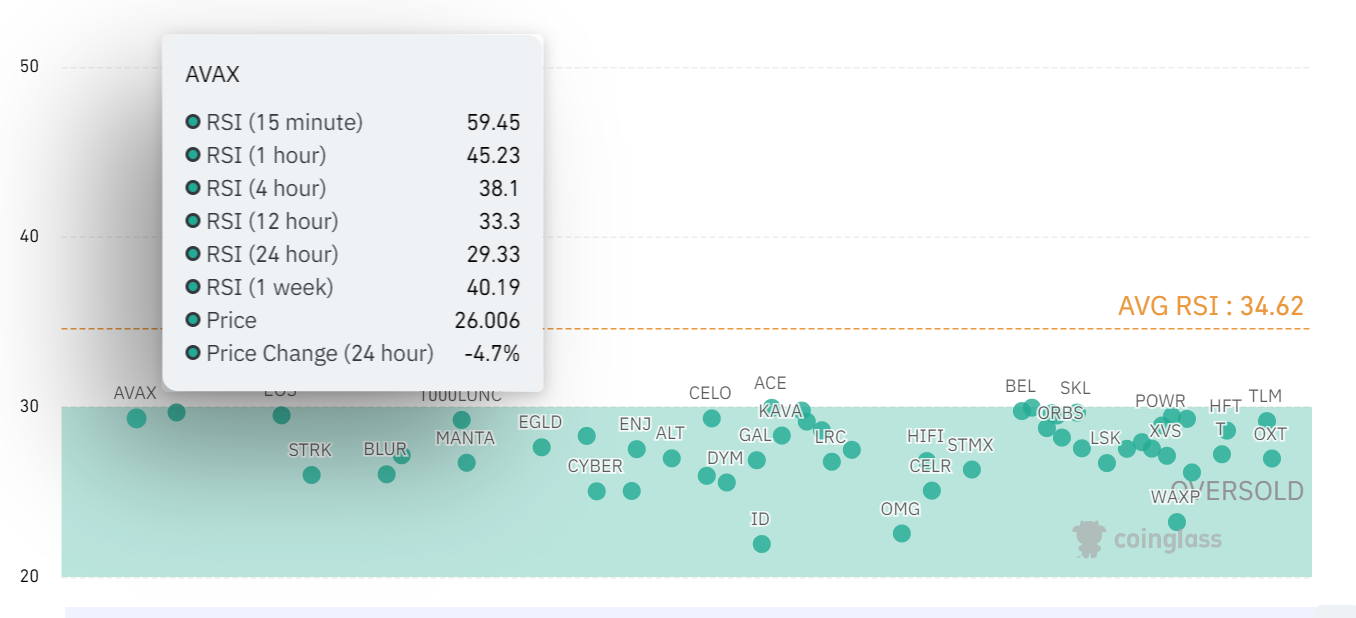

Avalanche (AVAX) – Why it’s miles an real aquire

Avalanche (AVAX) reveals several components that might possibly maybe develop it a swish aquire. The 24-hour RSI for AVAX is 29.33, placing it in oversold territory. Historically, resources with such low RSI tend to ride heed corrections. On the replace hand, oversold conditions don’t guarantee a rebound, and the market might possibly maybe also simply defend oversold for extended intervals.

Additionally, AVAX has experienced a 4.7% decrease in heed over the final 24 hours, suggesting a fresh sell-off that might possibly maybe also simply be an overreaction by the market.

This dip gifts a attainable entry point for merchants taking a look to capitalize on the following heed restoration.

Supporting the aquire signal, AVAX’s momentum indicator is currently exhibiting a aquire signal, reflecting distinct momentum despite the oversold situation. The Williams Percent Vary, but every other momentum indicator, also helps a aquire, indicating that AVAX is currently oversold.

Whatever the unprecedented sell alerts from fascinating averages, which replicate the fresh downward pattern, the oversold RSI and distinct momentum indicators highlight the aptitude for a bullish reversal.

The sensible market RSI of 34.76 extra emphasizes that AVAX is more oversold compared with the broader market, improving the aptitude for a rebound.

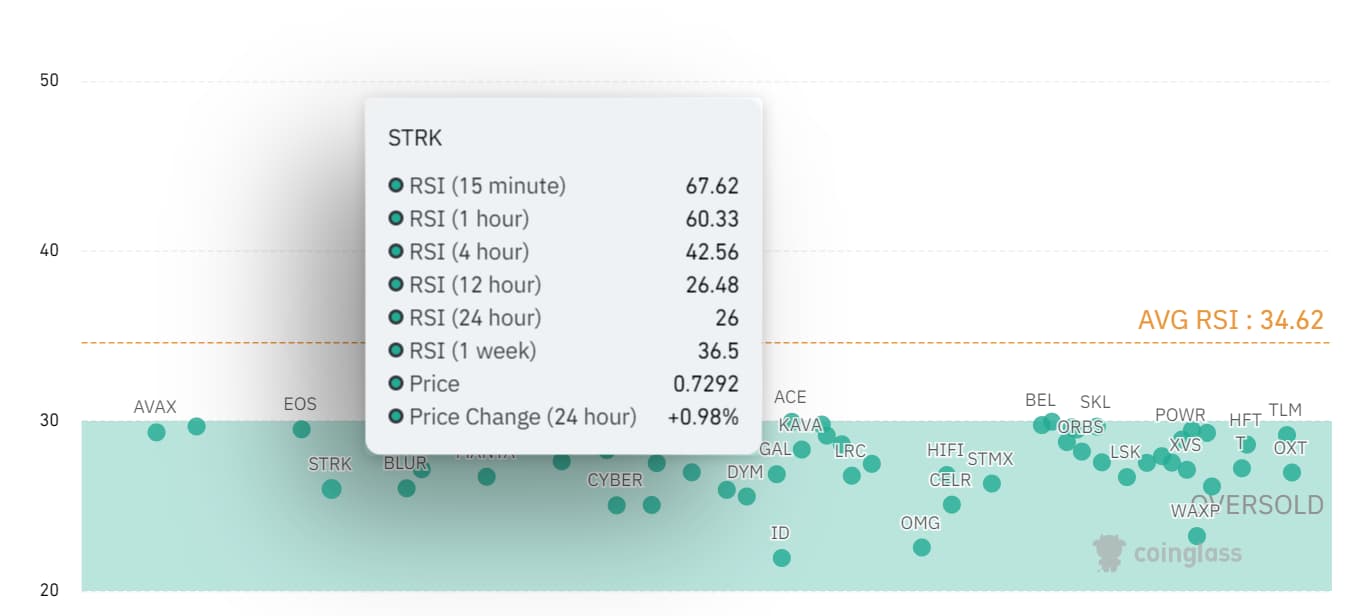

Starknet (STRK) – Why it’s miles an real aquire

Starknet (STRK) gifts several aquire alerts primarily based on its RSI and extra technical indicators. Both the 24-hour and 12-hour RSI values for STRK are properly under 30, standing at 26 and 26.Forty eight, respectively, indicating unprecedented oversold conditions. This makes STRK a chief candidate for a attainable heed rebound.

In disagreement to AVAX, STRK has experienced a distinct heed swap of 0.98% over the final 24 hours. This distinct momentum, despite the oversold RSI, means that the market is beginning to acknowledge its undervaluation, which might possibly lead to extra heed increases.

Further supporting the aquire signal for STRK are the Williams Percent Vary indicators. The Williams Percent Vary, with a heed of -88.235, reveals that STRK is closely oversold, reinforcing the aptitude for a heed magnify.

Whatever the sell alerts from varied fascinating averages, these oversold indicators counsel a high attainable for an upward correction. The sensible market RSI of 34.76 highlights that STRK is significantly more oversold compared with the broader market, improving the possibility of a rebound.

For merchants and merchants taking a scrutinize aquire alternatives this week, AVAX and STRK present attention-grabbing cases primarily based on their present RSI values and fresh heed movements.

On the replace hand, it’s obligatory to take into yarn the high volatility of cryptocurrencies, the put market conditions can quickly swap

Disclaimer: The speak on this plan ought to no longer be regarded as investment advice. Investing is speculative. When investing, your capital is at threat.