A quant has defined what a doable leading Bitcoin indicator would possibly presumably affirm about what’s subsequent for the cryptocurrency’s label.

Bitcoin Coinbase Top fee Would possibly per chance presumably per chance merely Retain The Acknowledge To Where BTC Goes Next

In a CryptoQuant Quicktake post, an analyst has talked about the model currently taking space in the Bitcoin Coinbase Top fee. “We are able to relate the model of Coinbase Top fee as a leading indicator of the long term course of BTC label,” notes the quant.

The “Coinbase Top fee” is a metric that retains track of the adaptation between the Bitcoin label listed on the cryptocurrency exchanges Coinbase (USD pair) and Binance (USDT pair).

When the worth of this indicator is certain, it capacity that the worth listed on Coinbase is increased than on Binance lawful now. This kind of model suggests the procuring for stress is increased (or the selling stress is decrease) on the everyday platform than on the latter.

Alternatively, the unfavorable premium implies Coinbase will seemingly be observing a increased amount of selling than Binance, as the asset is currently shopping and selling at a decrease label there.

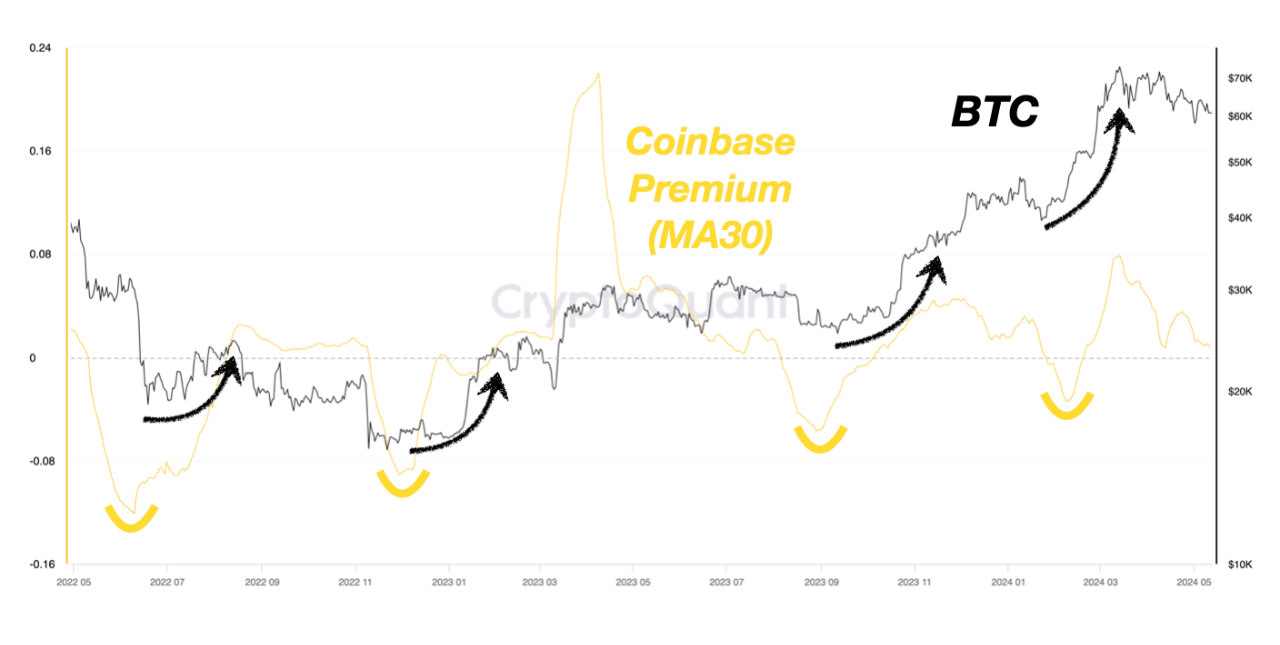

Now, right here is a chart that exhibits the model in the 30-day moving average (MA) of the Bitcoin Coinbase Top fee over the closing couple of years:

The 30-day MA worth of the metric appears to be like to have been happening in most current weeks | Supply: CryptoQuant

As displayed in the above graph, the 30-day MA Bitcoin Coinbase Top fee has been certain just recently, suggesting that Coinbase customers have supported the asset throughout the rally.

Coinbase is popularly is called potentially the most licensed platform of the US-basically basically based institutional entities, whereas Binance has a extra world shopper inappropriate. As such, the premium’s worth can provide hints about how the behavior of the American whales differs from that of the relaxation of the sector.

From the chart, it’s seen that the procuring for stress from these institutional traders peaked alongside the worth top but has since been declining. The metric continues to make certain overall, even supposing it’s now reasonably conclude to the neutral zero imprint.

In the graph, the quant has highlighted an spell binding sample that the cryptocurrency has adopted concerning the Coinbase Top fee for the duration of the closing two years. It could presumably well seem that at any time when the indicator has hit bottom in unfavorable territory and reversed encourage to an uptrend, the coin’s label has observed a rebound.

An example of this model moreover played out lawful earlier in the twelve months, when a reversal in the indicator ended in Bitcoin observing a rally in which the asset would eventually break its all-time excessive.

The Coinbase Top fee is currently riding a downtrend, but it and not using a doubt’s but to dip into unfavorable territory. The analyst explains that BTC is in a “wait and look” portion, the set a rebound will seemingly be reasonably longer out. The metric has to first decline extra and reach a reversal point, no longer lower than if the historical sample has to repeat.

Bitcoin had slipped below $61,000 earlier, however the asset has found a runt rebound in the day past, returning above $62,700.