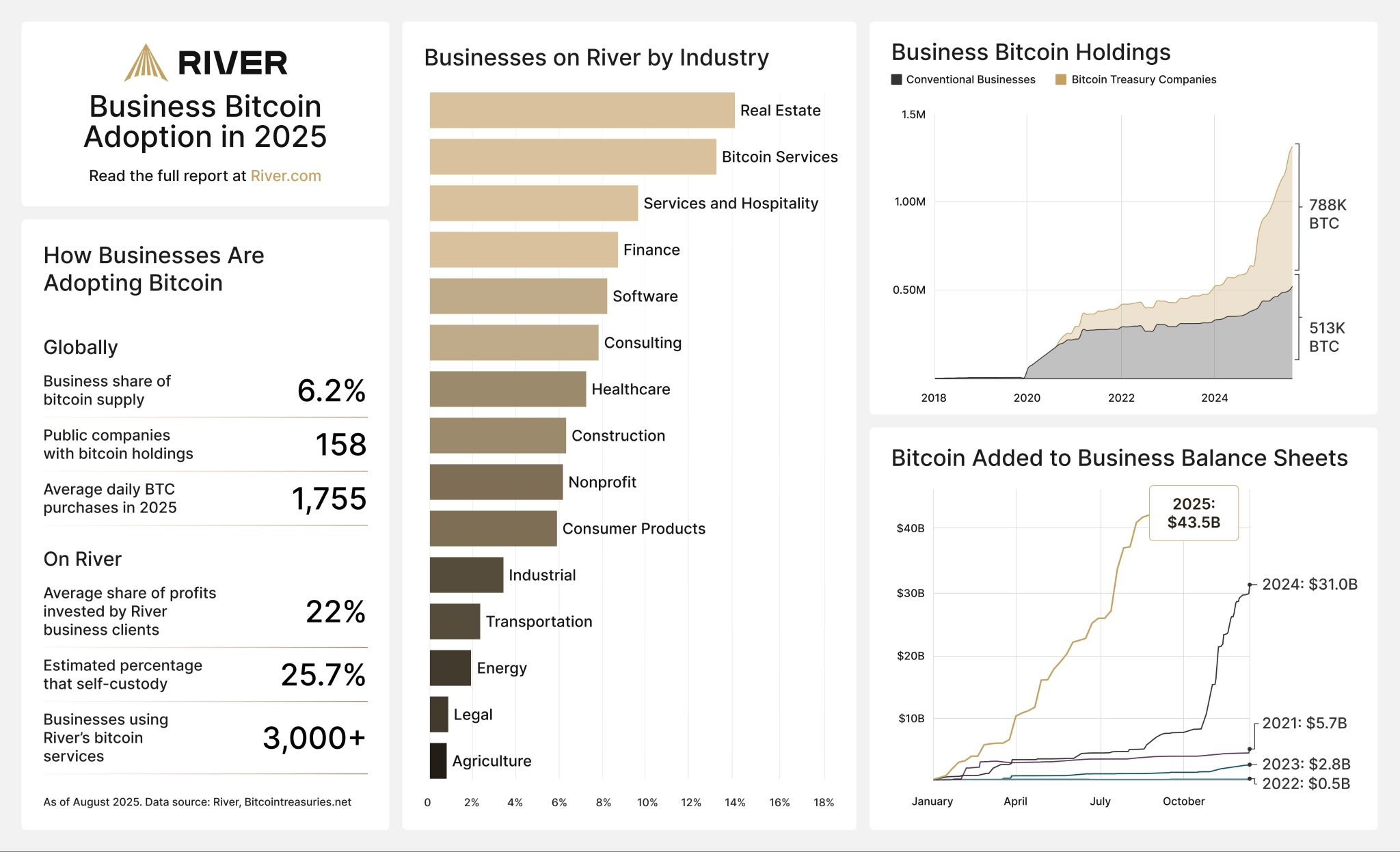

Bitcoin monetary products and services firm River said its commerce purchasers are reinvesting 22% of earnings into Bitcoin on sensible, signaling rising grassroots adoption.

Of River’s shopper substandard, actual estate companies were the finest adopters with with reference to 15% reinvesting earnings into Bitcoin (BTC), while hospitality, finance and tool sectors are allocating between 8% and 10%, River’s research analyst Sam Baker said in a yarn on Wednesday.

Even effectively being studios, painting and roofing companies, and non secular nonprofits are amongst the adopters.

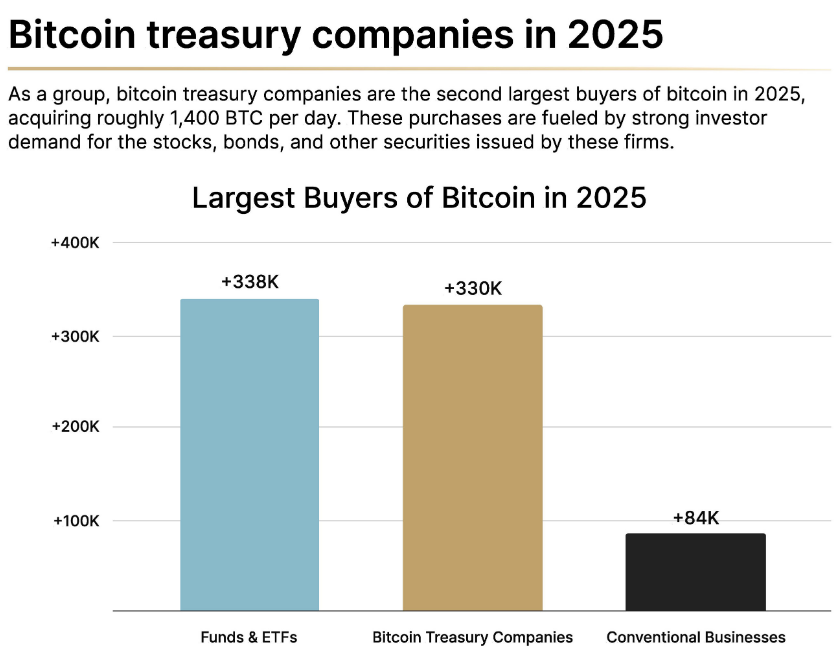

Baker said businesses love these hold quietly bought 84,000 Bitcoin in 2025 — a large stash representing just a few quarter of the holdings of institutional fund managers and company Bitcoin treasuries hold accrued.

“While Bitcoin treasury companies hold captured quite a bit of the media highlight, what’s on the total overpassed is adoption by feeble businesses that use Bitcoin to complement their existing commerce fashions,” he added.

Baker said enhancements in Bitcoin’s accounting requirements, regulatory readability, rising institutional acceptance, and a tough bull market hold created the “ideal prerequisites for the frequent adoption we are witnessing this day.”

Alternate and institutional Bitcoin adoption has been one in every of the finest catalysts within the aid of Bitcoin’s bull plug to $124,450 this cycle.

There were sessions the effect space Bitcoin alternate-traded fund issuers hold scooped up 10 occasions extra Bitcoin than what miners were in a arrangement to kind, pushing up Bitcoin’s mark.

It contrasts vastly with the 2020-2021 bull cycle, the effect businesses largely sat on the sidelines as Bitcoin topped $69,000 largely on retail hype.

Smaller businesses hold a much less difficult path to Bitcoin adoption

Baker worthy that 75% of the businesses it serves hold 50 workers or fewer, arguing that the small companies can hold a much less difficult time adopting Bitcoin as fewer hurdles are concerned.

On the opposite hand, larger companies with committee-basically based decision-making are extra inclined to apply norms and steer sure of controversy, Baker said, explaining why so few S&P 500 companies lend a hand Bitcoin.

“Even though a CEO or CFO is individually glad of Bitcoin’s lengthy-timeframe mark, they’re no longer going to advocate for adoption unless model companies hold already carried out so.”

Many are handiest investing modest amounts into Bitcoin

Nonetheless, River chanced on that over 40% of the businesses allocate between 1% to 10% into Bitcoin, while handiest 10% invest larger than half of their rep profits into the cryptocurrency.

Associated: Tether USDT stablecoin viewed on Bolivian retailer mark tags

For smaller companies, Bitcoin buys may perchance well well additionally be reasonably small — lower than $10,000. Final week, Rhode Island-basically based Western Predominant Self Storage added appropriate 0.088 Bitcoin, price $9,830, in a single purchase, bringing its total holdings to 0.43 Bitcoin.

Despite the increased adoption, Baker said most businesses aren’t even pondering Bitcoin consequently of “frequent misunderstandings and restricted awareness.”

He pointed to a Cornell College watch the effect handiest 6% of People were conscious that Bitcoin’s provide is capped at 21 million, while one other watch chanced on 60% of People admitted they “don’t know much” about the cryptocurrency.

“In other phrases, Bitcoin is on the total disregarded no longer because it has been evaluated and rejected, but because most decision-makers haven’t got the concept to deem it within the first characteristic.”

Magazine: The one factor these 6 global crypto hubs all hold in frequent…