SUI stamp is on the verge of making ancient past, with the aptitude to prevail in a brand unusual all-time excessive because it trades exquisite 2% below its old peak. If bullish momentum continues, SUI also can smash the $4.92 resistance and hit $5 for the first time by the cease of December 2024.

Whereas the uptrend stays intact, indicators just like the DMI and BBTrend suggest the trend’s energy will be weakening. Merchants are carefully staring at key phases, as a reversal also can survey SUI testing supports at $4.49 and even $3.65.

SUI Uptrend Is Aloof Solid, Nevertheless Going Down

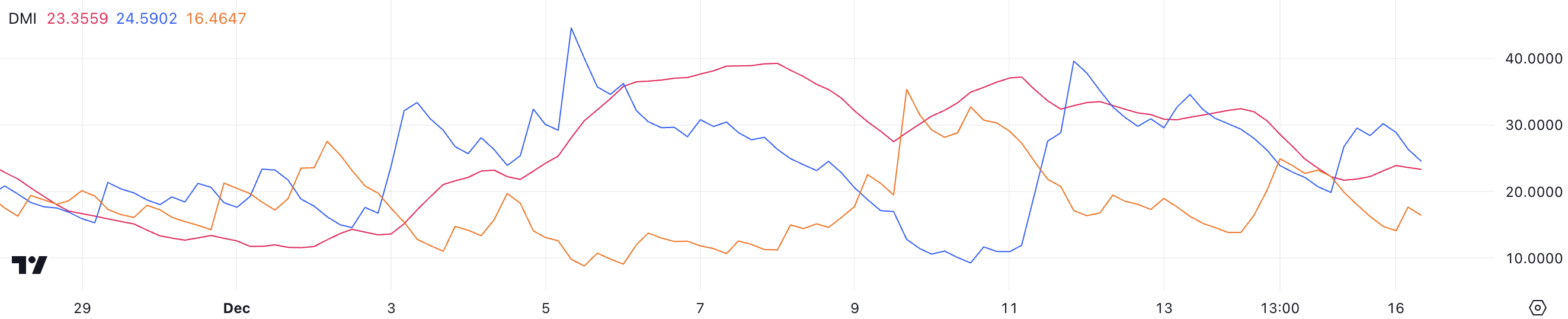

SUI Directional Breeze Index (DMI) chart finds that its Realistic Directional Index (ADX) is within the meanwhile at 23.3, down from 32 exquisite two days within the past. The ADX measures the energy of a trend, with values above 25 on the whole indicating a stable trend and values below 20 reflecting a veteran or directionless market.

Even though SUI ADX has dipped, it stays conclude to the threshold for a stable trend, signaling that the uptrend is silent intact but showing indicators of weakening.

The DMI chart additionally reveals the +DI (Directional Indicator) at 24.4, larger than the -DI at 16.3, confirming that the trend stays upward. Alternatively, the declining ADX means that the energy of this uptrend is reducing.

Whereas SUI is silent in an even draw, traders ought to silent show screen the ADX carefully. Extra declines also can signal a shortage of momentum and a doable shift toward a extra neutral or bearish phase.

SUI BBTrend Might perhaps Be Shedding Its Steam

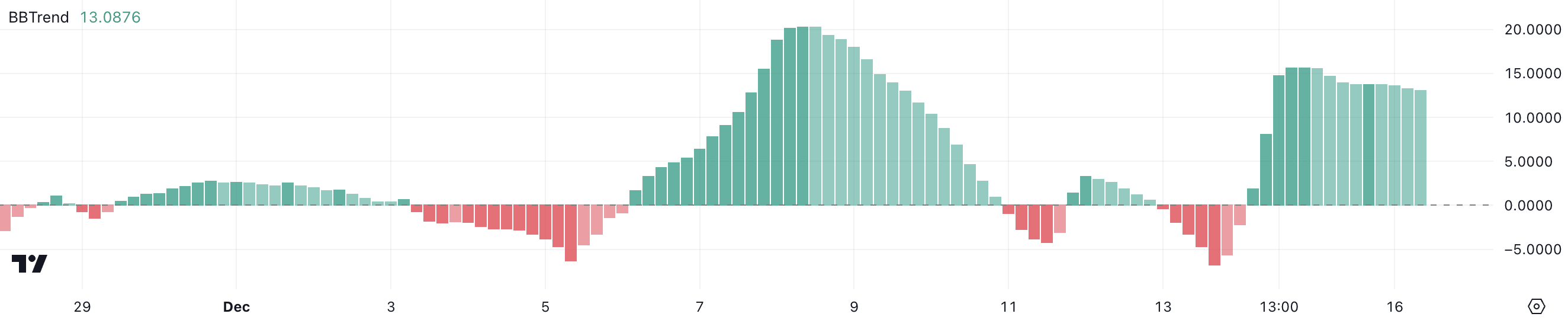

SUI’s BBTrend indicator within the meanwhile stands at 13, inserting forward obvious territory since December 14, after hitting a detrimental low of -6.74 on December 13.

BBTrend is a technical indicator derived from Bollinger Bands, designed to measure stamp momentum and trend direction. Certain values indicate bullish momentum, whereas detrimental values suggest bearish stress.

Even though SUI’s BBTrend stays obvious, it has declined from 15.69 exquisite two days within the past, signaling a runt lack of momentum.

This dip means that whereas SUI is silent in an uptrend with favorable momentum, the energy of the bullish trend will be waning.

SUI Label Prediction: Will Its Label Attain $5 In December?

SUI’s EMA lines indicate it stays in an uptrend, even though, as highlighted by the DMI, the energy of this trend is now not as stable as earlier than.

If the uptrend persists and SUI stamp breaks the $4.92 resistance, it’s miles going to also soon test the $5 mark, setting a brand unusual all-time excessive. With SUI within the meanwhile exquisite 2% below its old all-time excessive, bullish momentum also can push it into uncharted territory.

Alternatively, if the uptrend weakens and a downtrend emerges, SUI stamp also can first test toughen at $4.49. Ought to silent this stage fail to withhold, the stamp also can decline extra to $3.65, marking a considerable reversal.