With bitcoin priced at $89,907, boasting a market cap of $1.79 trillion and a brisk 24-hour shopping and selling quantity of $45.09 billion, it’s sure the crypto king isn’t sleeping. Nonetheless despite an intraday vary between $88,532 and $90,788, the charts paint an image less of a breakout bonanza and extra of a waiting game with angle.

Bitcoin Chart Outlook

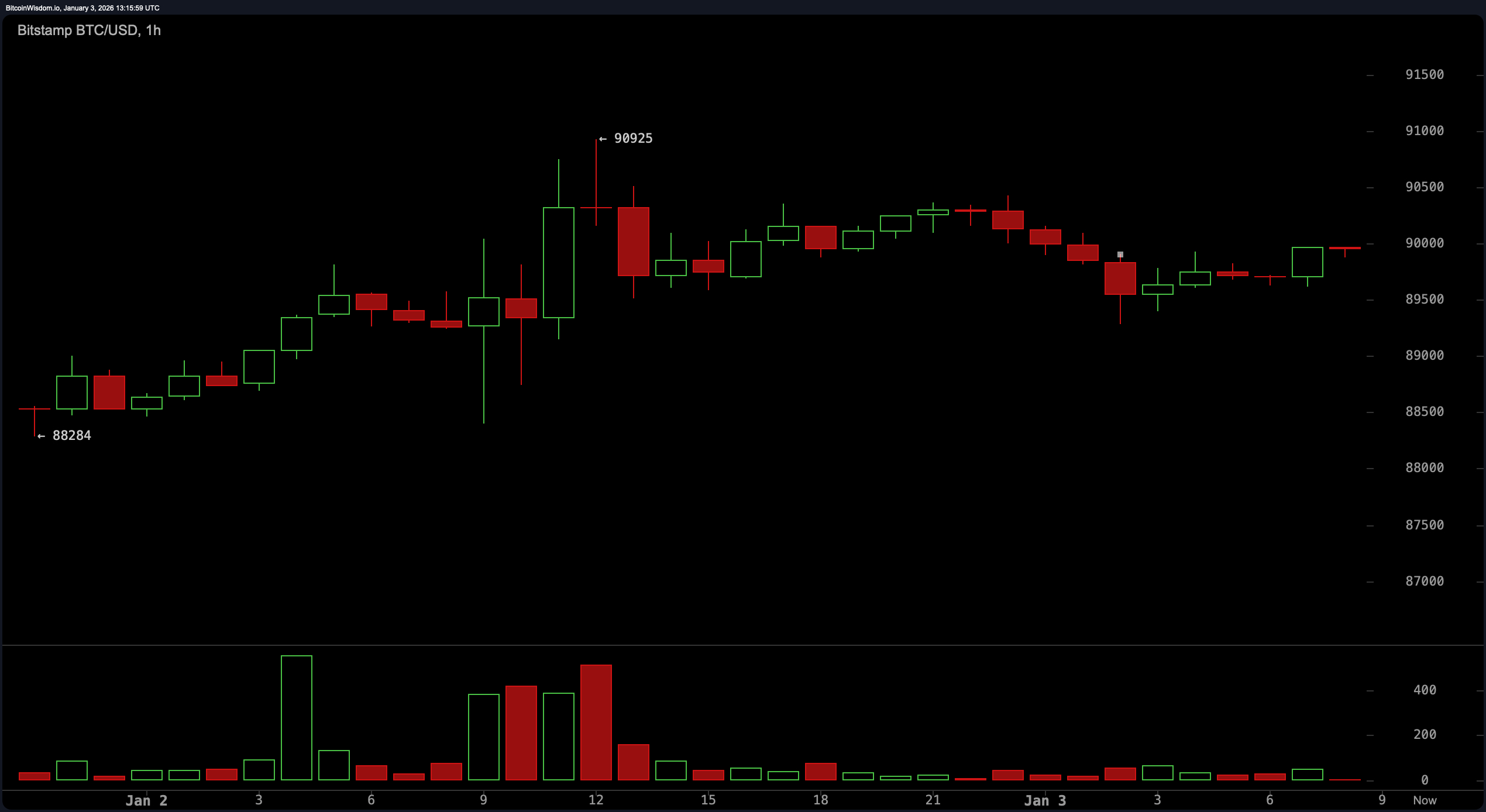

On the 1-hour chart, bitcoin’s ticket high-tail resembles a jittery tango between the $88,500 enhance ground and the $91,000 resistance ceiling. Short bursts of quantity seem when ticket touches the high of the vary, handiest to be met with rejection—admire a dance partner stepping on toes.

The intraday rhythm favors tactical entries shut to $88,800 to $89,200, as prolonged as construction doesn’t give design below $88,300. Exits are greater timed shut to the $90,300 to $90,800 ticket, unless investors without warning be taught to waltz past resistance with conviction.

Zooming out to the 4-hour chart, the portray turns into one in all cautious optimism. Since January 1, bitcoin has etched out greater highs and better lows, which is gorgeous, if no longer entirely convincing. Dips are being defended, nonetheless with all of the keenness of a sleepy guard dogs. Makes an attempt to breach the $90,900 to $91,000 level retain getting rebuffed, suggesting investors would possibly per chance presumably well very wisely be saving their vitality—or their funds—for but any other day. A drop below $87,500 would dent this fragile ascent, so traders should retain that line in their rearview mirror.

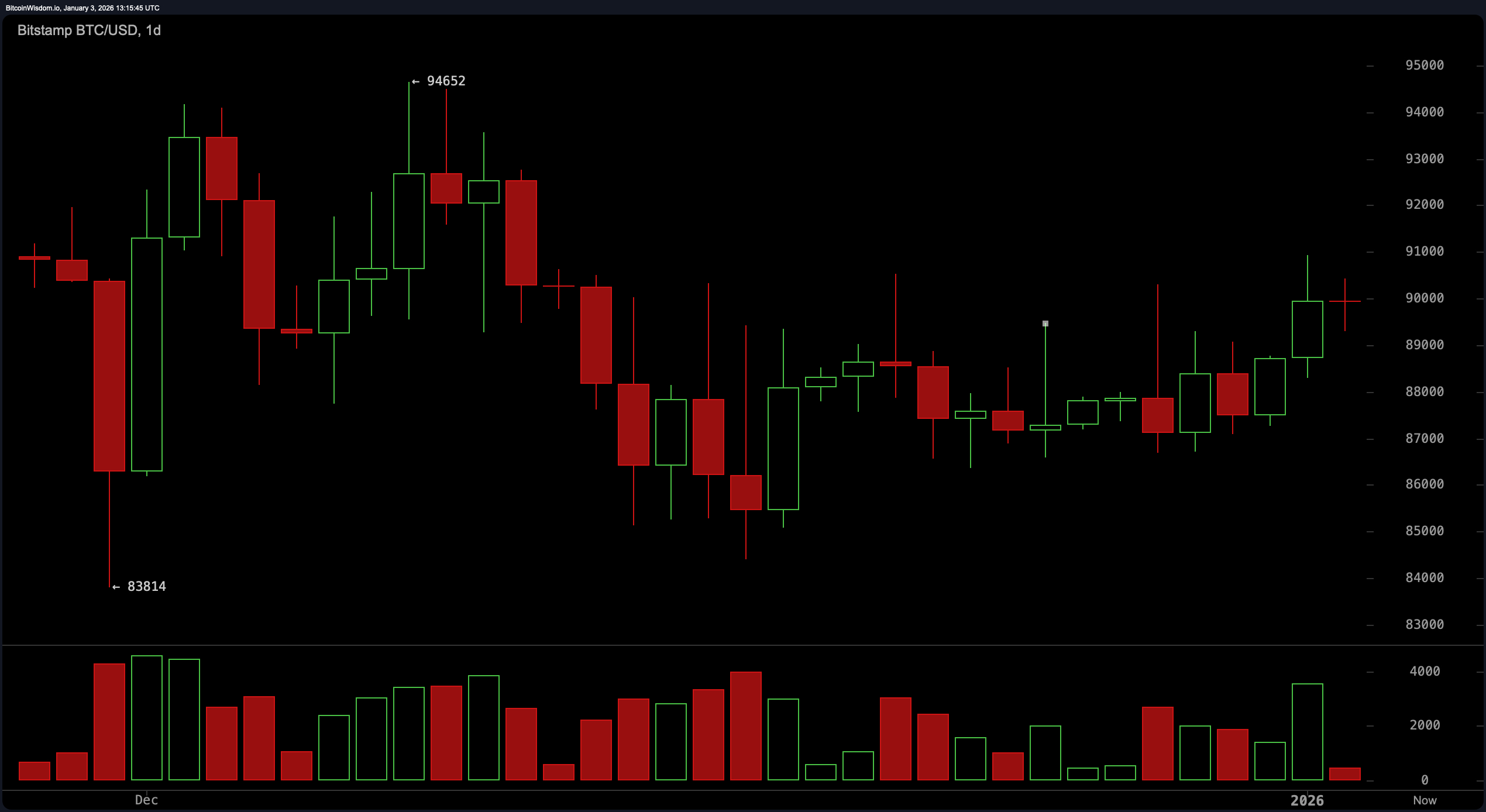

The day-to-day chart unearths bitcoin is, frankly, in no dash. Label would possibly per chance per chance be very easily lounging in the greater half of of a $84,000 to $95,000 vary, perched above December’s bottom at $83,800 nonetheless nowhere shut to reclaiming the $94,500 to $95,000 summit. With out a convincing day-to-day shut outdoors the $86,000 to $92,000 zone, this vary market looks subject to continue. Quantity isn’t precisely speeding to the party either, which helps the premise of consolidation over a breakout crescendo.

The oscillators are equally indecisive. The relative strength index ( RSI) reads a neutral 54, while the Stochastic oscillator sits at 74—neither too sizzling nor too frigid. The commodity channel index (CCI) at 209 and the momentum indicator at 2,272 both lean bearish, nonetheless they’re no longer dragging the the rest of the symptoms with them. The piquant common convergence divergence ( MACD) is accessible in with a worth of -410, making a serene case for some upside recovery, while the Superior oscillator provides to the neutrality refrain with a subdued -370.

Transferring averages (MAs) are caught in their bear tug-of-conflict. Shorter-time length exponential piquant averages (EMAs) and straightforward piquant averages (SMAs)—collectively with the ten, 20, and 30-length variants—all enhance the recent ticket high-tail, giving it a modest nod. Nonetheless, the 50-length EMA has turned into its inspire, and the 100 and 200-length piquant averages are straight-up pessimistic, flagging values a long way above the recent ticket. It’s a fracture up jury, nonetheless one element’s sure: the burden of proof lies with bitcoin’s bulls.

In immediate, bitcoin isn’t gifting away any secrets and tactics honest correct but. It’s a vary-sure beast for now, and unless ticket decisively breaks above $92,000 or crumbles below $87,000 with muscle, the supreme trades shall be the ones that retain their luggage light and their exits nimble.

Bull Verdict:

If bitcoin can reclaim territory above $92,000 with a quantity enhance that doesn’t vanish admire mist at fracture of day, the path in opposition to the $94,500–$95,000 zone reopens. Supportive immediate-time length piquant averages and better lows across multiple timeframes counsel the bulls haven’t misplaced the script—honest correct the highlight.

Possess Verdict:

Ought to aloof bitcoin falter below $87,000 with conviction, the vary construction unravels, and eyes flip fleet in opposition to the $84,000 level. With prolonged-time length piquant averages firmly above the recent ticket and a total lot of oscillators flashing warning, bears would possibly per chance presumably well honest no longer be charging but—nonetheless they’re for sure circling.

FAQ ❓

- What is bitcoin’s recent ticket? Bitcoin is shopping and selling at $89,907 as of January 3, 2026.

- Is bitcoin in a bullish or bearish vogue? Bitcoin is consolidating in a neutral vary between $88,532 and $90,788.

- What are key enhance and resistance ranges for bitcoin?Toughen sits shut to $88,300–$89,000, with resistance at $90,800–$91,000.

- Are technical indicators bullish on bitcoin correct now?Most oscillators and piquant averages repeat mixed indicators, favoring vary-sure high-tail.