Extremely capitalized traders win been accumulating Bitcoin (BTC) for the reason that Three hundred and sixty five days started, using the asset’s designate to an all-time excessive. These funding actions are observable through Bitcoin pockets addresses retaining dapper quantities of the coin, also is named whales.

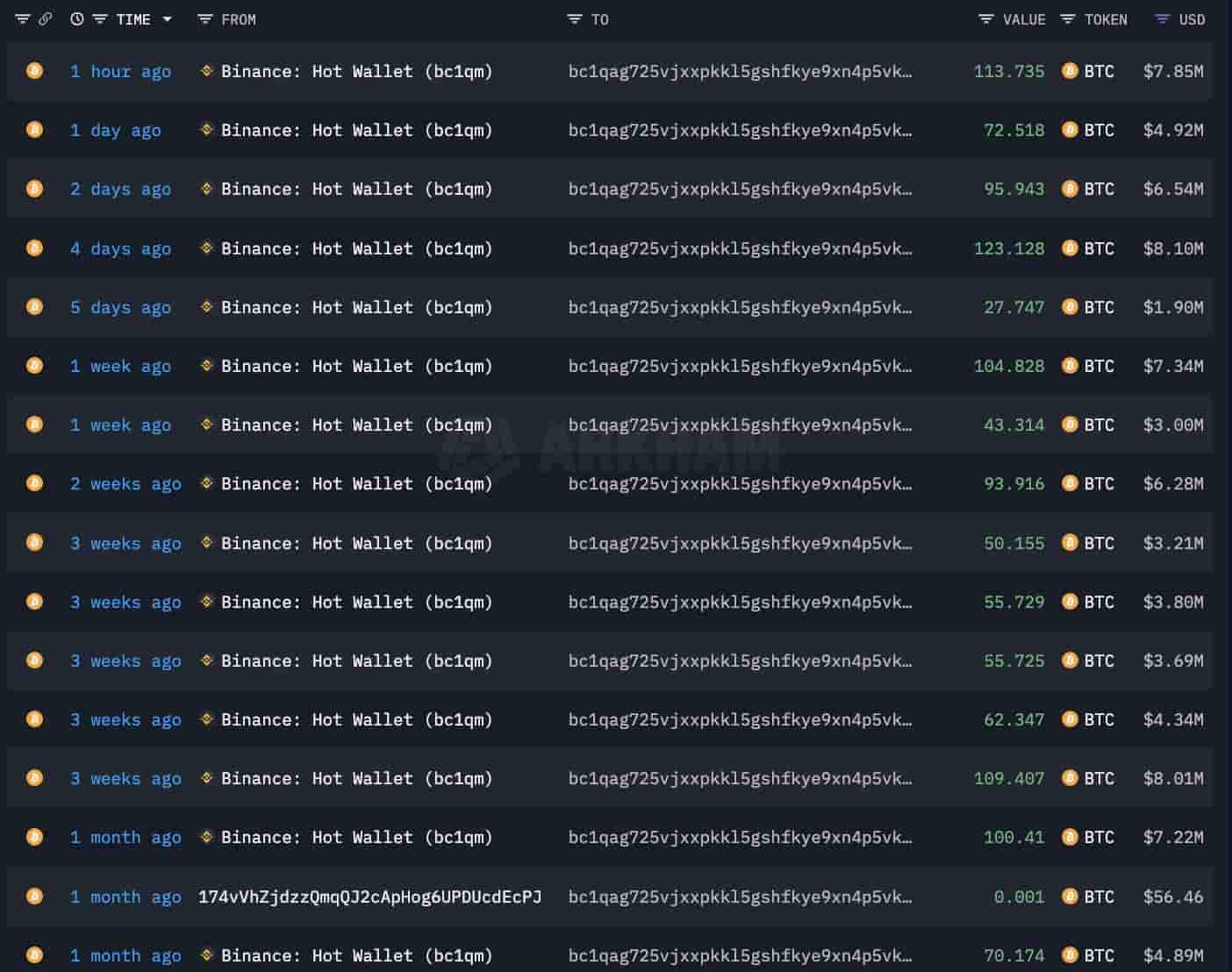

Particularly, a Bitcoin whale has stacked 1,308 BTC, value almost about $90 million since March 6. The address ‘bc1qag725vjxxpkkl5gshfkye9xn4p5vklrlhgkw5w’ currently holds this quantity at a buck-cost average of $68,617 per coin, in step with Lookonchain’s post.

Particularly, its closing contain was as soon as on April 7, for a 113.735 BTC Binance withdrawal, value over $7.85 million. This was as soon as the Bitcoin whale’s 2d-finest transaction at some level of this month of accumulation. The finest single contain was as soon as 123.128 BTC, with a value superior to $8 million on April 3.

BTC designate prognosis

As of writing, the main cryptocurrency is trading at $70,117, abet interior a designate fluctuate lost on April 2. In actuality, the fluctuate’s highs and lows are now key resistance and give a boost to ranges, of $71,500 and $68,500, respectively.

From a technical prognosis perspective, Bitcoin shows a brief-time length uptrend focused on $71,500 and further deciding from there. Moreover, the Relative Strength Index (RSI) in the 4-hour time frame suggests exact momentum and a bullish sign for Bitcoin whales to put money into.

More bullish alerts for Bitcoin whales and traders

In the intervening time, Finbold has been reporting multiple bullish alerts for Bitcoin whales and traders at some level of the week. For instance, a market cycle prognosis that calls for the “most aggressive bull cycle” in BTC historic past, with new highs.

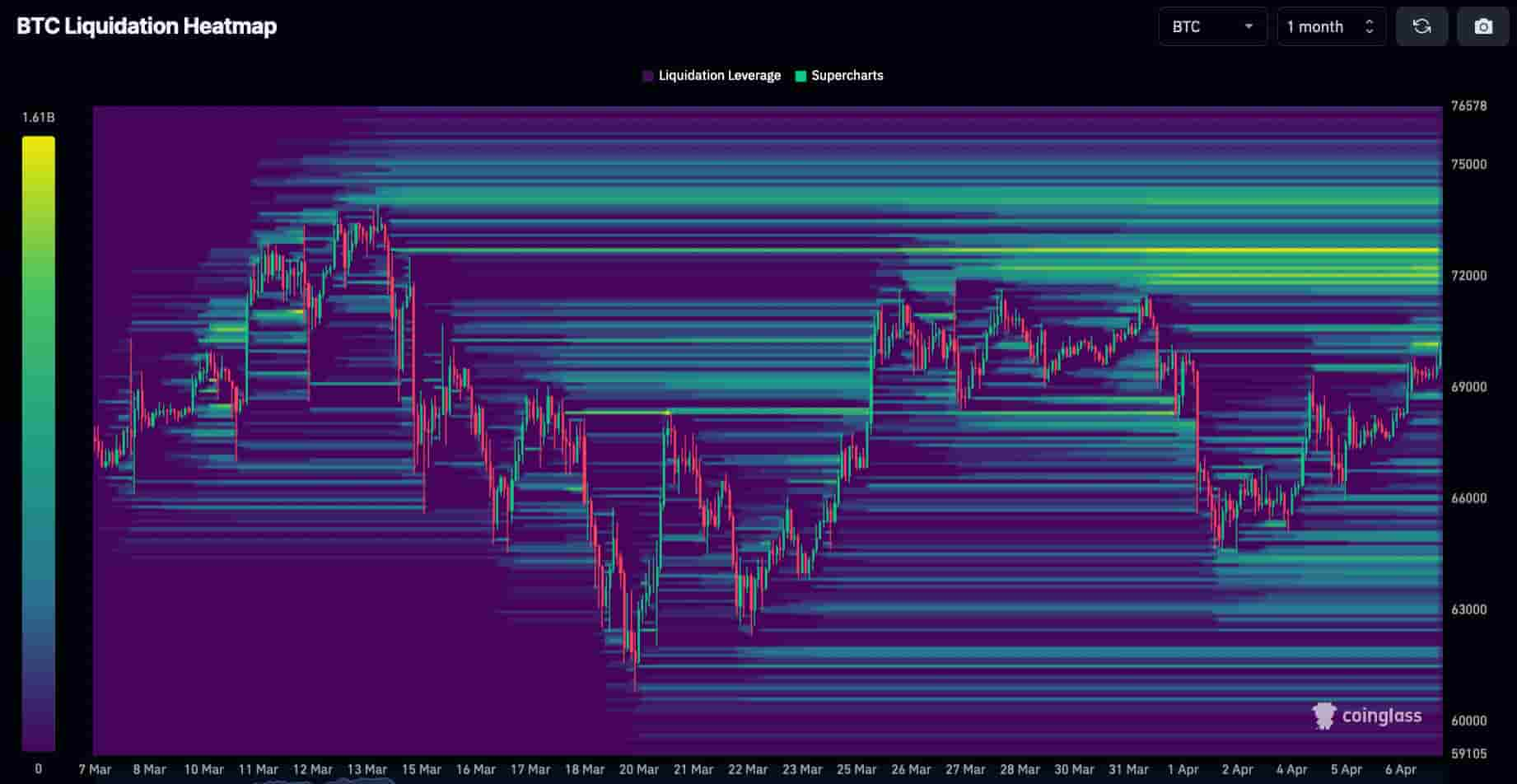

Curiously, records retrieved from CoinGlass by press time hints at a seemingly BTC brief squeeze above $72,000. Here’s on account of the dapper quantity of leveraged liquidations gathered in this zone, which Bitcoin whales could maybe well build a design for elevated earnings in a that that you just must maybe mediate of resistance-breaking surge.

Nonetheless, the Bitcoin neighborhood faces traditional uncertainties with out reference to the entire certain whale activity and technical bullish alerts. Here’s on account of the initiate of Roger Ver’s new e book ‘Hijacking Bitcoin: The Hidden History of BTC.’ The e book was as soon as launched on April 5 and turned a finest-vendor on Amazon interior gorgeous two days, shaking historic beliefs.

Yet, the upcoming Bitcoin halving anticipated to April 20 could maybe well force the investor’s consideration to bullish financial fundamentals.

All issues regarded as, Bitcoin’s future designate action stays unsafe, whereas largely favoring a bullish bias. Investors must carry out their due diligence and perceive the underlying dangers and alternatives of investing in BTC.

Disclaimer: The drawl material on this assign ought to no longer be regarded as funding advice. Investing is speculative. When investing, your capital is at chance.