Within the dynamic world of cryptocurrency investments, leveraging developed applied sciences like synthetic intelligence (AI) can vastly toughen decision-making capabilities.

Recognizing the functionality of AI in crafting strategic investment plans, Finbold sought the expertise of three leading AI objects—OpenAI’s ChatGPT-4 Turbo, Anthropic’s Claude 3 Opus, and xAI’s Grok—to devise the optimum crypto portfolio for a $10,000 initial investment aimed toward maximizing possibility-reward outcomes for Would possibly perchance perchance well also 2024.

Despite every AI’s uncommon strategy, there were significant similarities in their concepts, in particular with the inclusion and crucial allocation to foundational cryptocurrencies like Bitcoin (BTC), Ethereum (ETH). Each are regarded as crucial holdings that provide a steady foundation and high growth doable, respectively.

Their consistent selection across numerous AI objects shows a general consensus on their importance and enduring value.

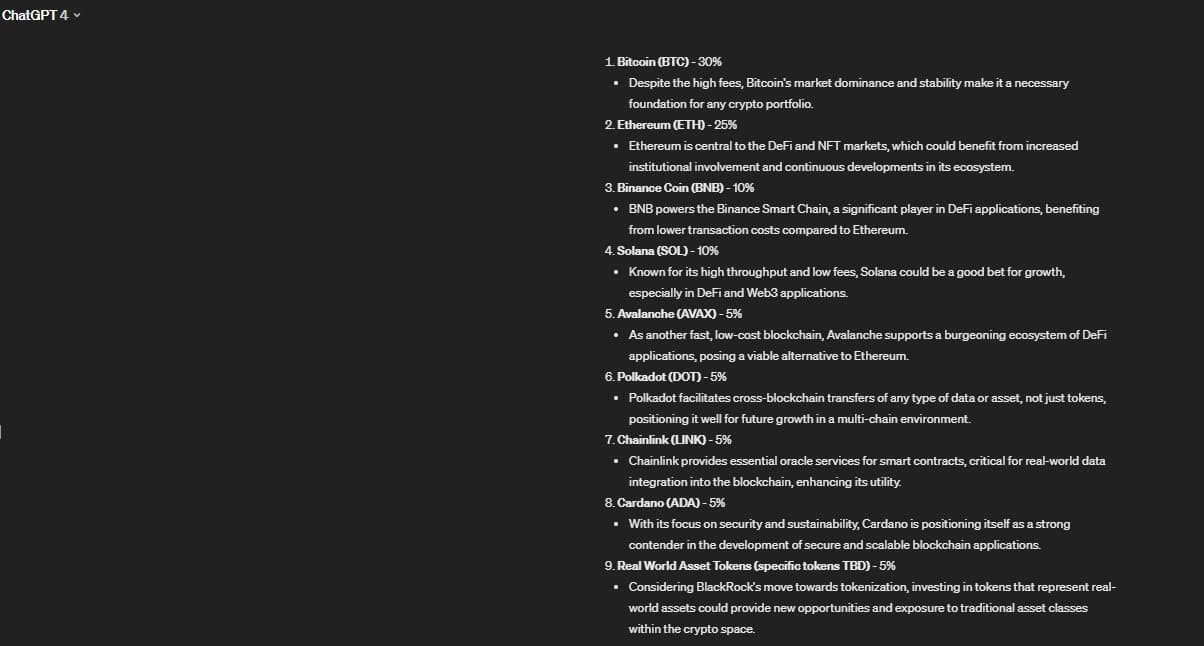

ChatGPT-4 very excellent $10,000 crypto portfolio

ChatGPT-4 Turbo advocated for a varied strategy. The portfolio instructed including 30% Bitcoin and 25% Ethereum, highlighting their elementary roles in any crypto strategy.

It moreover instructed smaller, but strategic investments in other high-doable cryptocurrencies equivalent to Binance Coin (BNB) and Solana (SOL) at 10% every, with 5% allocations in Avalanche (AVAX), Polkadot (DOT), Chainlink (LINK), Cardano (ADA), and Valid-World Asset Tokens (RWA). This numerous mix goals to leverage both steadiness and growth across varied segments of the cryptocurrency market.

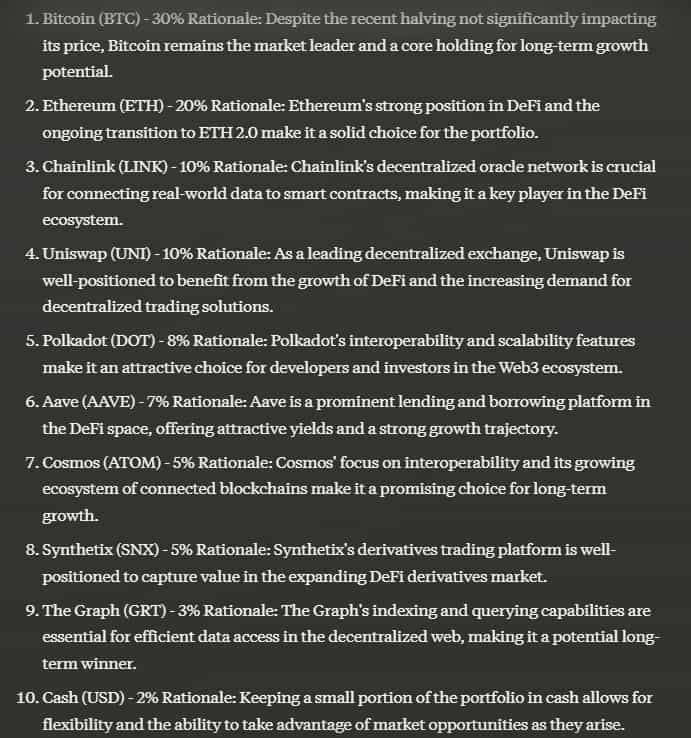

Claude 3 Opus’s completely crypto portfolio

Claude 3 Opus’s portfolio strategy was once somewhat more concentrated but moreover incorporated an improbable fluctuate of cryptocurrencies, placing a steady emphasis on Bitcoin and Ethereum with allocations of 30% and 20%, respectively.

It uniquely incorporated tokens like Uniswap (UNI) and The Graph (GRT), dedicating 10% and 3% of the portfolio to these assets, highlighting their doable in decentralized finance and records indexing. Assorted selections incorporated Chainlink and Polkadot at 10% and eight%, alongside allocations to AAVE, Cosmos (ATOM), and Synthetix (SNX), aiming to capture growth from varied DeFi and inappropriate-chain interplay traits.

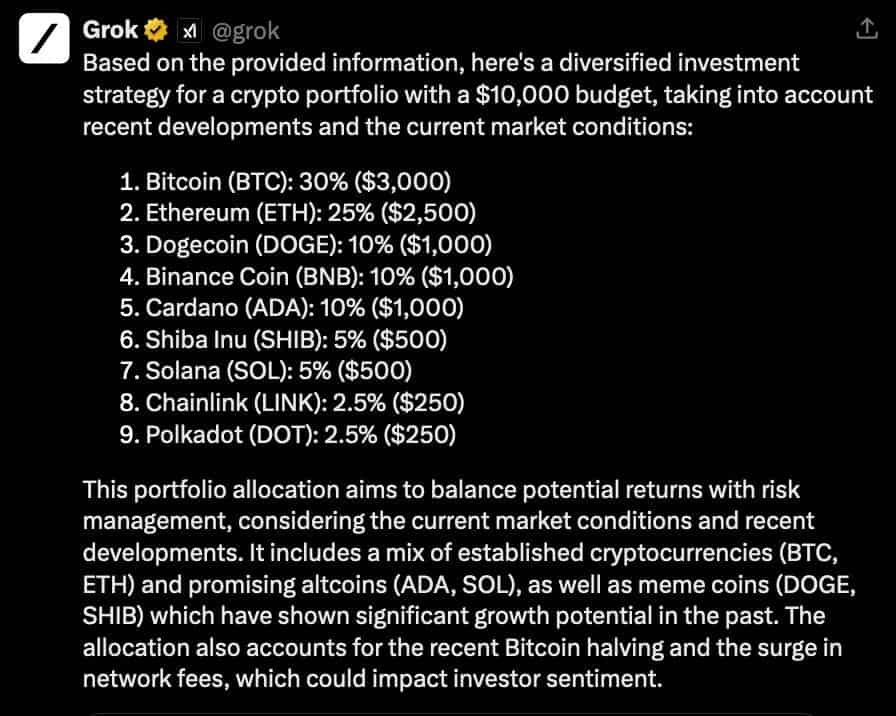

Grok AI’s completely crypto portfolio

Grok’s model positioned an identical emphasis on Bitcoin and Ethereum with 30% and 25% allocations, underscoring their importance.

Moreover, it uniquely instructed a 10% allocation every to Dogecoin and BNB, alongside Cardano, tapping into both mainstream and cult-approved assets.

The portfolio moreover incorporated smaller stakes in meme-pushed SHIB and high-performance Solana at 5% every, with minor allocations to LINK and DOT at 2.5%. This portfolio shows a mix of old-fashioned strengths with speculative plays that could perchance well also yield high returns.

All three AI objects reinforced the importance of Bitcoin and Ethereum as foundational ingredients of a sturdy cryptocurrency portfolio, attributing significant percentages to these two giants. The recurrent inclusion of Chainlink and Polkadot across two of the portfolios suggests a shared optimism in their capabilities to toughen blockchain functionality and interoperability.

However, investors could perchance well also aloof no longer clutch into consideration these concepts as a final decision for building a crypto portfolio. The correct investment allocation is dependent upon explicit dreams, possibility tolerance, and records shifting ahead.

Moreover, these AIs are at possibility of mistakes and could perchance well even hold essentially based mostly their selections on old-customary recordsdata, as disclosed by ChatGPT.

Disclaimer: The advise material on this jam could perchance well also aloof no longer be regarded as investment advice. Investing is speculative. When investing, your capital is at possibility.