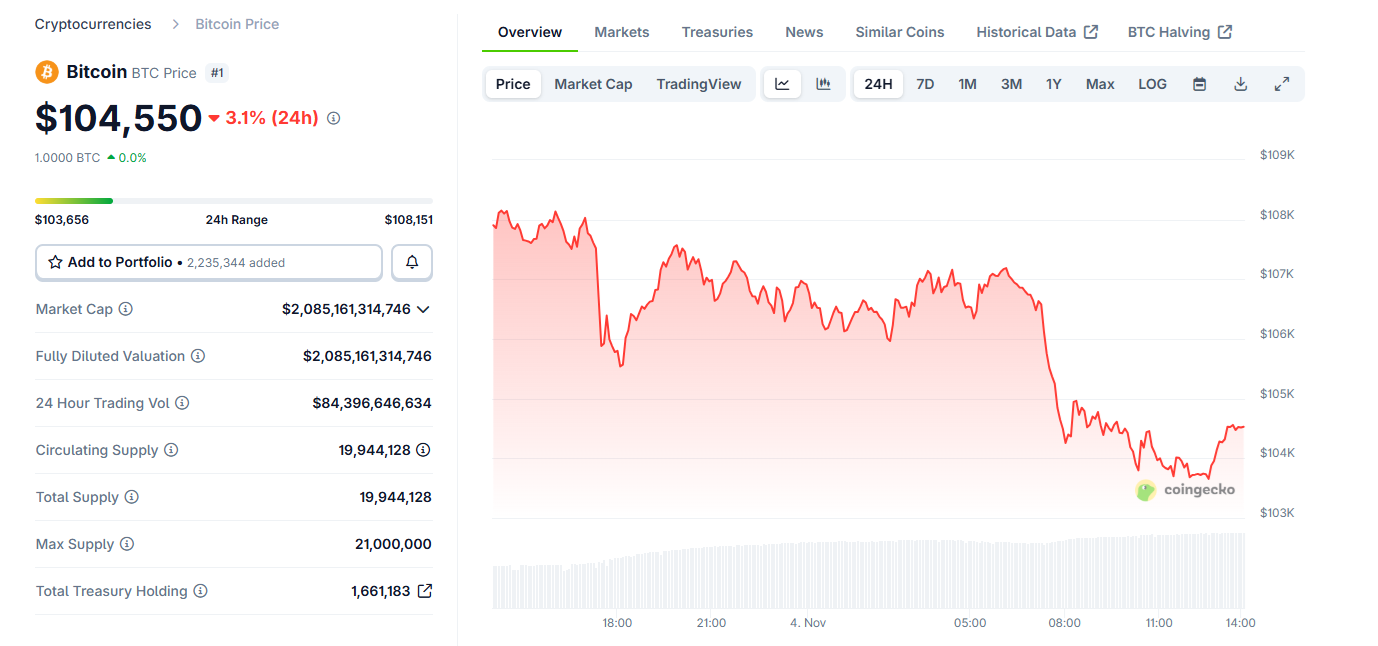

BTC dipped to the $103,000 range, extending the losses from Monday. The main coin lost about a of its newest payment foundation fortify stages, leaving the last fortify at $ninety 9,000.

BTC lost one other fortify level after dipping under $104,000 on Tuesday. The market showed rising fragility, pushing BTC down to $103,668.

In accordance with newest Glassnode knowledge, BTC lost the $109,000 payment foundation, where 85% of the provision became in income. The next level of fortify is at $ninety 9,000 and can delight in to soundless assist as a local market bottom or fortify.

The BTC selling and fearful shopping and selling continued on Tuesday, as both retail and whales bet against BTC. The main coin is now over $20,000 under its file valuation, sparking fears of a delight in market.

The contemporary BTC shopping and selling happens below stipulations of coarse difficulty, because the Crypto Misfortune and Greed Index dipped to 21 choices. Till recently, the index became at a impartial keep, soundless staring at for a recovery for BTC. Primarily the most newest designate moves show a shift to a doable delight in market.

All the plan in which thru primarily the newest downturn, income-taking continued. A whale that held for 14 years bought 10,000 BTC for over $1B, after acquiring the resources for splendid $1.54. About a of the whale selling became absorbed by contemporary wallets shopping the dip.

BTC prepares for return to $100,000

In accordance with Polymarket predictions, BTC has a excessive probability of returning to $100,000. Within yesterday, the possibility rose from 60% to over 70%.

Bitcoin has lost fortify on the 85th percentile payment foundation (~$109K) and is now hovering shut to $103.5K.

The next key level sits all the plan in which thru the seventy fifth percentile payment foundation (~$99K), which has historically equipped fortify all over pullbacks.📉https://t.co/2geS82B0iR pic.twitter.com/IPsYmBbxyl

— glassnode (@glassnode) November 4, 2025

BTC has moreover shown a skill to rebound quickly after selling, intelligent above $104,000 within minutes of primarily the newest dip.

To this level, the market has absorbed major selling from whales, moreover to retail traders, without inflicting a deep capitulation. BTC remains to be mostly held for the long length of time, though holders delight in been though-provoking to raise earnings.

Will BTC return with a speedy squeeze?

In accordance with the liquidation heatmap, a BTC speedy squeeze is no longer as doable. All the plan in which thru old intervals, BTC in most cases rallied to liquidate speedy positions. Nowadays, liquidity amassed all the plan in which thru the $112,000 and $115,000 stages, however those positions delight in been closed.

The contemporary liquidation heatmap reveals BTC speedy liquidity amassed all the plan in which thru the $108,000 level, though the positions delight in been smaller.

BTC launch curiosity moreover moved decrease to $32.6B. Since October 11, traders delight in no longer rushed to rebuild launch curiosity, as a exchange looking out forward to a directional transfer.

As of November, BTC is staring at for a soar whereas staring on the weekly shut stages. A shut below $103,000 for the week is seen as one other signal of a doable delight in market.

BTC is now repeating the price moves from early November in 2024, which later became a twelve months-cease rally. Within the long length of time, BTC remains to be seen as revisiting contemporary all-time peaks, though momentary market corrections are moreover inflicting wretchedness.