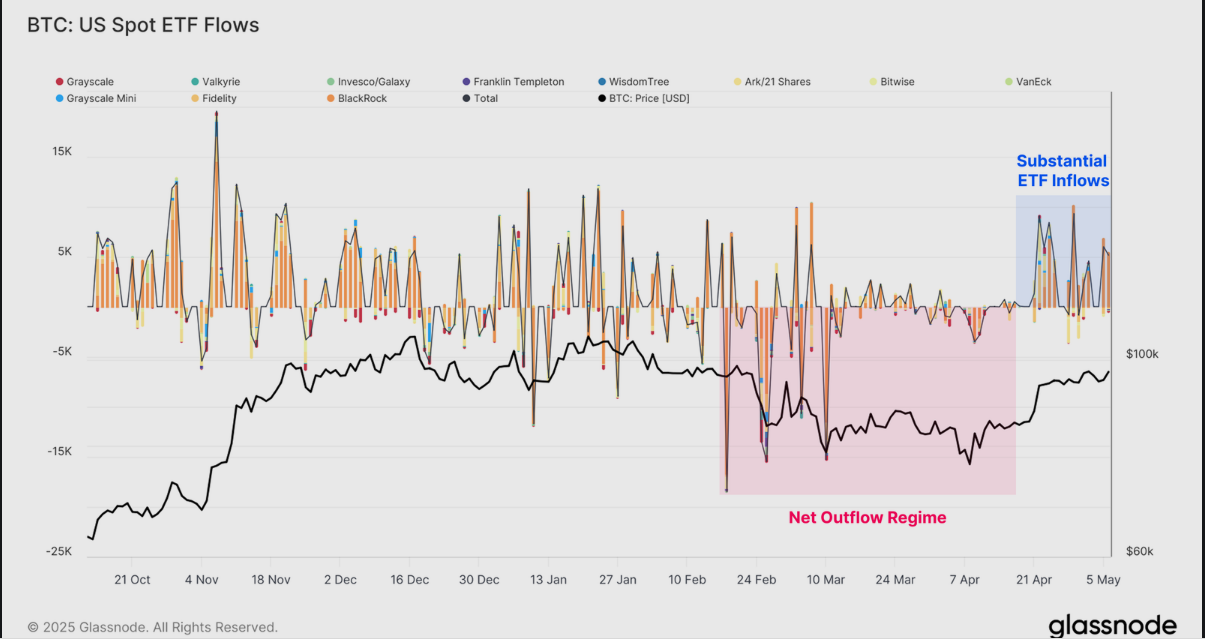

After months of bleeding, U.S. Bitcoin ETFs pulled in $4.6 billion over two weeks, the biggest two-week turnaround ever, per Would possibly perhaps well seventh The Week On-chain newsletter named “Gaining Ground.”

Situation Bitcoin ETFs noticed objective about $1.3 billion in obtain inflows over appropriate two trading days this previous week, signaling a though-provoking shift in institutional sentiment.

BlackRock’s IBIT alone drew $970.9 million in a single session—its 2d-largest every day influx since open—while opponents esteem Fidelity’s FBTC persevered to scramble.

After enduring the biggest sustained outflow slump on file in April, the ETF advanced is now reduction in boost mode.

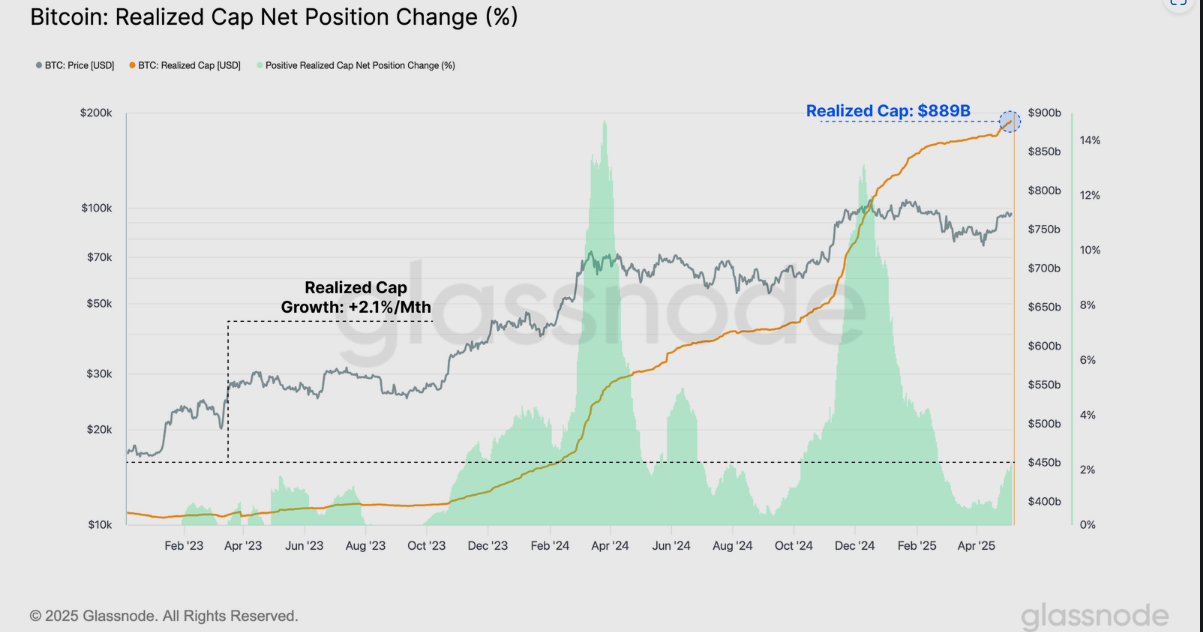

Bitcoin rate itself soared to $97,900 on April 27, 2025, from a $74,000 low, pushing the market’s realized cap to a file $889 billion, essentially essentially based on CoinMarketCap knowledge.

This rally introduced reduction to thousands and thousands of holders, however with costs teetering shut to a excessive threshold and volatility expectations oddly mute, is this the market bottom—or a setup for one more twist?

Account Bitcoin ETF Inflows and BTC “Gaining Ground”

Bitcoin ETFs were in a rut. From January to March 2025, they misplaced 70,000 BTC in obtain outflows—the longest sustained exit on file.

Then, all the pieces changed. Between April 13 and April 27, 2025, ETFs absorbed $4.6 billion, objective about wiping out prior losses.

Resources under administration hit 1.171 million BTC, appropriate 11,000 panicked of the 1.182 million BTC height. This surge, fueled by Bitcoin’s climb to $97,900, signals institutional quiz is reduction with a vengeance.

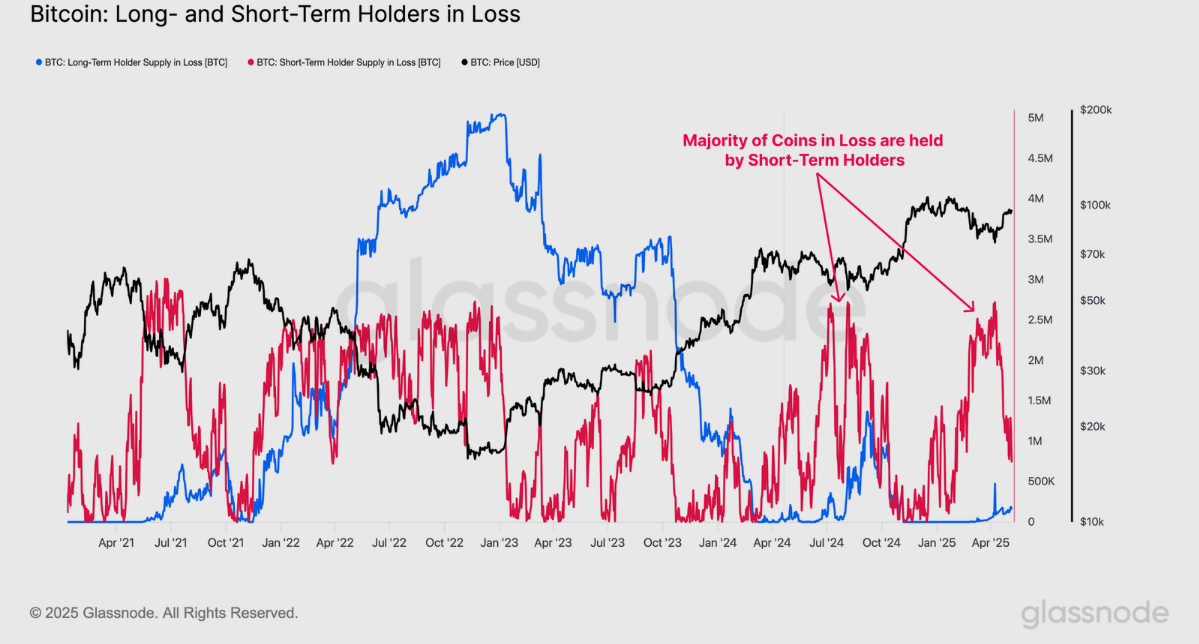

The Bitcoin rate soar from $74,000 to $97,900 wasn’t appropriate a chart blip—it used to be a lifeline. On the April low, over 5 million BTC were underwater.

By April 27, 2025, only 1.9 million remained in loss, with 3 million BTC flipping to be taught,essentially essentially based on the newsletter. Short-Timeframe Holders (STH), conserving 83% of underwater cash, led profit-taking.

Each day capital inflows reached $1 billion, with earnings dominating 98% of transactions. The realized cap grew 2.1% in a month to $889 billion, an all-time high, reflecting tough quiz.

Bitcoin rate is trading at $97,000, however it certainly’s on a tightrope. As per Glassnode’s diagnosis, the cost cleared the 111-day animated moderate and STH cost-basis, each and every shut to $94,000.

But, the Realized Supply Density metric spiked, exhibiting a dense cluster of cash with cost-bases around $95,000, gathered from December 2024 to February 2025. Microscopic rate moves would possibly presumably well also spark colossal reactions, elevating volatility risks.

Alternatives markets add intrigue. Implied volatility for 1-week and 1-month contracts hit lows no longer considered since July 2024. Three- and 6-month contracts also compressed, with March 2026 strategies at a 50% premium—a historically low stage.

Traditionally, such low volatility expectations precede though-provoking rate swings. Merchants would possibly presumably well be underestimating turbulence.

Backside or Bounce?

The rally reshaped investor actions. Combined profit and loss volumes hit $1 billion every day, with only 15% of trading days this cycle seeing more.

Losses made up appropriate 1-2% of transactions, exhibiting most holders above $96,000 are conserving firm. STH unrealized losses, which spiked at some stage within the August 2024 Yen-Elevate-Trade unwind and early 2025 downturn, dropped to just, easing financial stress.

Per the tale, a fall beneath $94,000 would possibly presumably well also derail the rally, per. For now, Bitcoin’s $97,000 rate and ETF rally keep a doable bottom—however it certainly’s no longer a carried out deal.

Merchants will survey whether or no longer ETF momentum holds and if on-chain strength interprets into rate gains. With web page online funds reduction in desire and fewer underwater holders, the market would possibly presumably well even maintain chanced on a floor—no longer no longer up to till the next volatility surge.