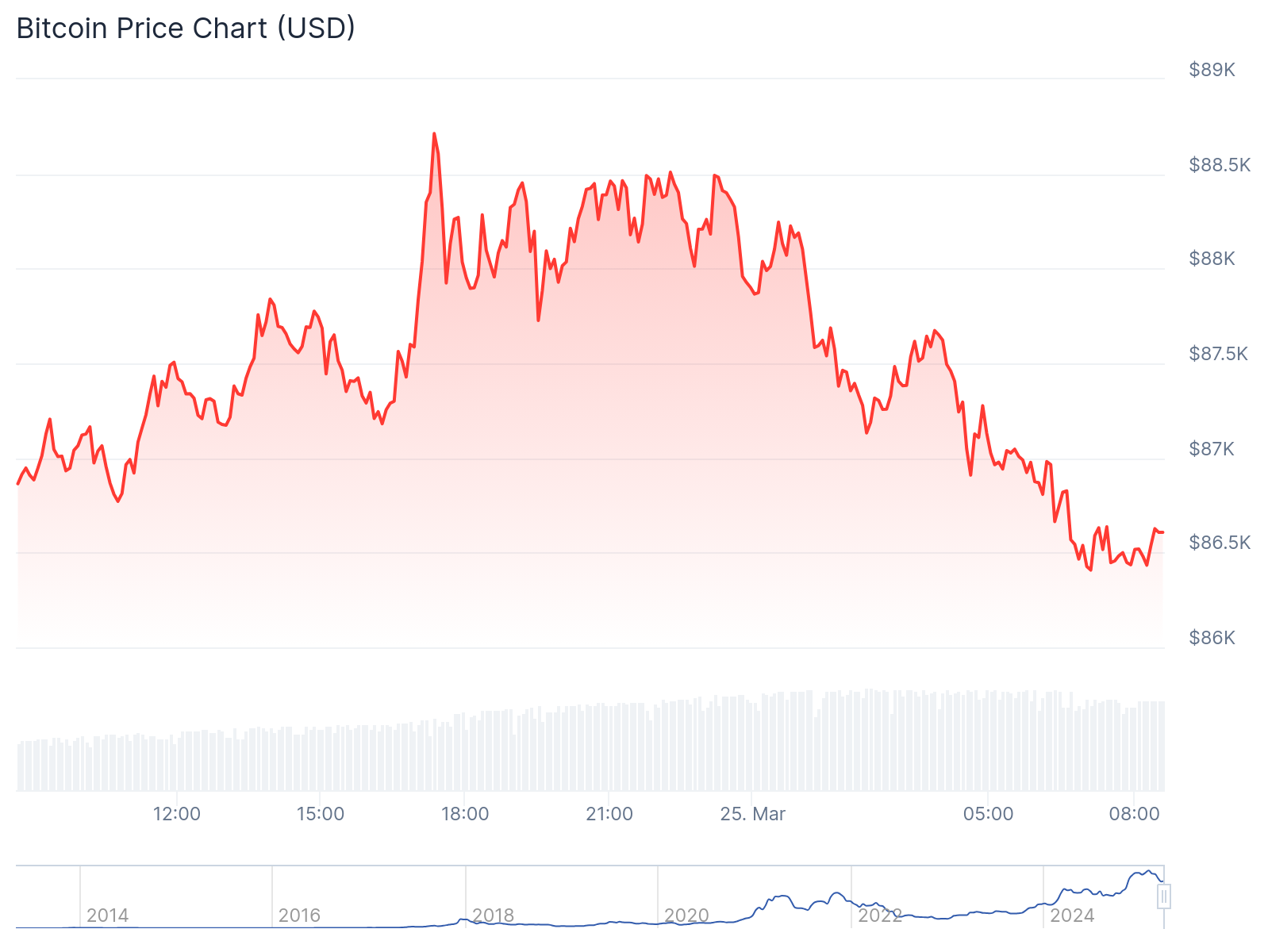

Bitcoin (BTC) mark prolonged its restoration Monday, hiking above $88,000, as a confluence of macroeconomic and institutional components boosted market sentiment.

BTC traded at $88,599 at press time, up 4.24% in 24 hours.

The rally adopted final week’s 4.25% rebound and got right here as delivery hobby surged and ETF inflows returned.

Per CryptoQuant, total delivery hobby crossed $32 Billion, whereas CoinGlass reported a $614.6 Million jump in BTC-USDT futures on Binance one day of early buying and selling.

CoinGlass famed in a tweet, “About 7,000 BTC delivery hobby used to be added on Binance futures,” suggesting increased trader exposure and forthcoming volatility.

Arthur Hayes Fashions BTC at $110K Goal—But Warns of Retrace

BitMEX co-founder Arthur Hayes predicted that Bitcoin could maybe well attain $110,000 sooner than retracing to $76,500.

In a put up on X, Hayes said macroeconomic tailwinds—specifically the Federal Reserve’s dovish tone and President Donald Trump’s flexible tariff stance—could maybe well push BTC to contemporary local highs.

“The Fed will shift from quantitative tightening to quantitative easing,” Hayes claimed, expecting liquidity to drive BTC quiz. He also downplayed the long-term impact of U.S. tariffs, calling them “non everlasting” disruptions to broader mark trends.

Hayes suggested that Bitcoin could maybe well also honest finally aim $250,000 however emphasized the likelihood of a pullback after the $110K stage.

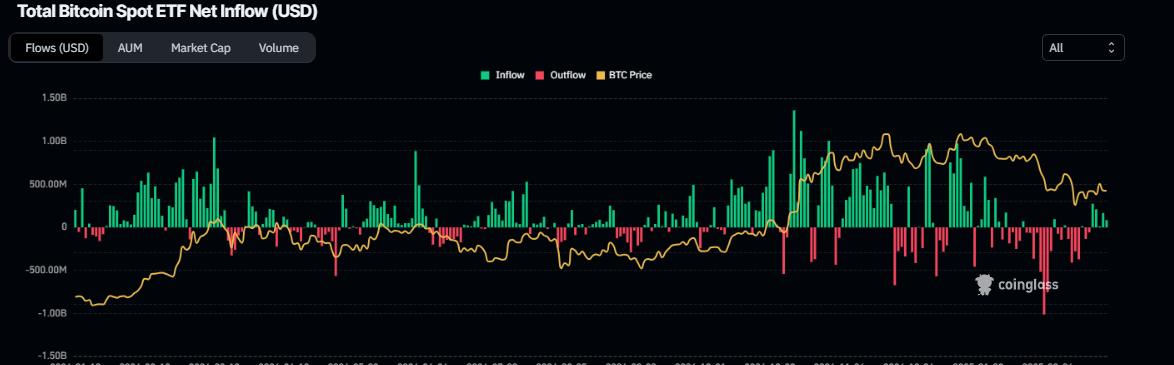

Bitcoin ETF Inflows Return as Technique Buys More BTC

Institutional flee for food showed indicators of restoration final week. Per CoinGlass, Bitcoin space ETFs recorded $744.30 Million in fetch inflows after posting $830.5 Million in outflows the earlier week.

Meanwhile, crypto firm Technique obtained $584 Million in BTC on March 24, raising its holdings to 506,137 BTC.

The company extinct proceeds from 1.97 million part sales and a broader $21 Billion stock issuance program.

Critics warn Technique’s aggressive accumulation could maybe well also honest be propping up BTC above $80,000. A funding shortfall or stock issuance discontinue could maybe well stress costs.

Peaceable, ETF inflows suggest broader investor hobby could maybe well also honest be returning.

BTC Mark Faces Resistance at $89K as Bulls Take a look at Key Ranges

No subject Monday’s upside, BTC mark continues to battle come severe resistance.

Per Ali Martinez, BTC faces a “key resistance cluster at $89,000,” where the 50-day spirited moderate meets a descending trendline.

Rekt Capital added that Bitcoin is checking out the 21-week EMA as abet. “Reclaim the 21-EMA as abet and Bitcoin will be in a local to breakout to ~$93,500,” the analyst posted on X.

Even even though BTC mark hit an intraday excessive of $88,804 Monday, it didn’t withhold above $88,000 one day of earlier classes. The March 3 day-to-day end at $92,000 remains a key stage for bulls.

Stablecoin Reserves Surge as Merchants Look Modern Liquidity

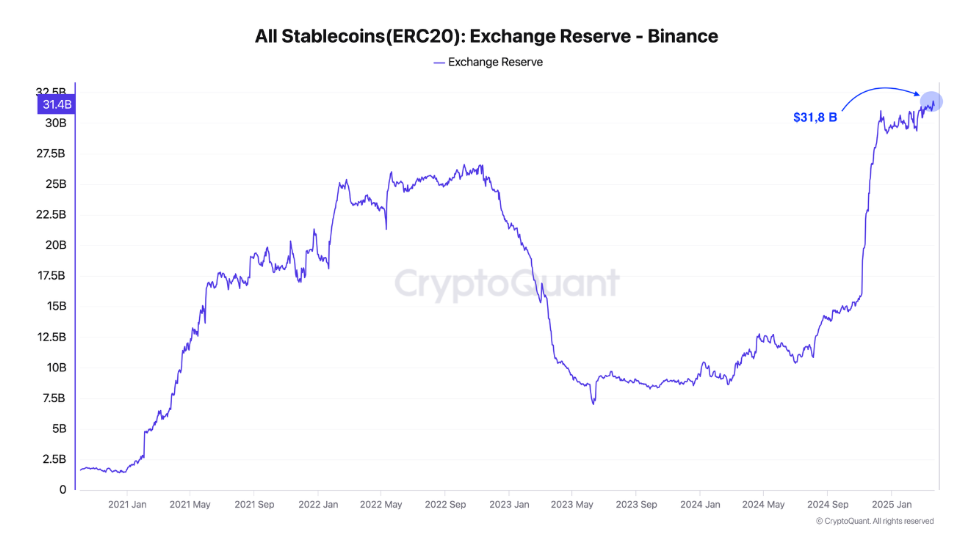

On-chain info also parts to bullish undercurrents. CryptoQuant reported that Binance’s ERC-20 stablecoin reserves hit an all-time excessive of $31 Billion.

Rising stablecoin balances on the final signal incoming buy stress as traders prepare to enter markets.

Coupled with rising delivery hobby, this ability liquidity could maybe well also honest abet additional upside—however also raises risks.

“Leverage-driven pumps magnify liquidation likelihood,” CryptoQuant warned. If the rally loses steam, overexposed positions could maybe well trigger cascading sell-offs.

Macro Factors Stay in Point of curiosity for BTC Mark

Economists inquire the core Deepest Consumption Expenditures (PCE) index, the Federal Reserve’s most well-appreciated inflation gauge, to rise by 2.7% in February.

If confirmed, this could well abet Fed Chair Jerome Powell’s contemporary statements on transitory inflation and enhance bets on price cuts in 2025.

Trump’s reported notion to soften some tariffs sooner than April 2 also lifted equities.

S&P 500 futures jumped 1.5% on March 24, additional easing fears of a beefy-scale economic slowdown.

BTC Mark Eyes $92K—But Momentum Remains Fragile

Whereas Bitcoin looks well-positioned to enviornment $92,000, its momentum remains fragile.

Issues about recession, excessive AI stock valuations, and U.S. federal spending cuts proceed to weigh on broader likelihood markets.

Bitcoin’s quick route hinges on ETF quiz, macro policy shifts, and leveraged trader behavior.

As liquidity builds and delivery hobby climbs, volatility could maybe well spike in either direction.