Bitcoin’s label is consolidating in a proper differ as market contributors are unsure regarding the future direction of the price.

Technical Prognosis

By TradingRage

The Daily Chart

On the on a typical foundation chart, the price has fair as of late rebounded from the $50K space, following the numerous tumble below the 200-day transferring moderate. Currently, the market is consolidating below the transferring moderate, which is found across the $63K imprint, failing to climb support above.

Meanwhile, the $56K make stronger stage at value holds the market, preventing the price from dropping extra. Ensuing from this fact, a breakout from both this stage or the 200-day transferring moderate might maybe per chance resolve the non permanent label breeze of BTC and the crypto market.

The 4-Hour Chart

Having a glance on the 4-hour timeframe, the price has created a bullish flag sample following the latest recovery from the $50K space.

Involved by the price breeze within the flag sample, it can per chance very most practical be a topic of time earlier than the market breaks it to the upside, which can per chance cease in a rally in opposition to the $64K resistance zone in the short term.

On the opposite hand, demonstrate that issues might maybe per chance win gruesome snappy if the flag will get broken to the plan back.

On-Chain Prognosis

By TradingRage

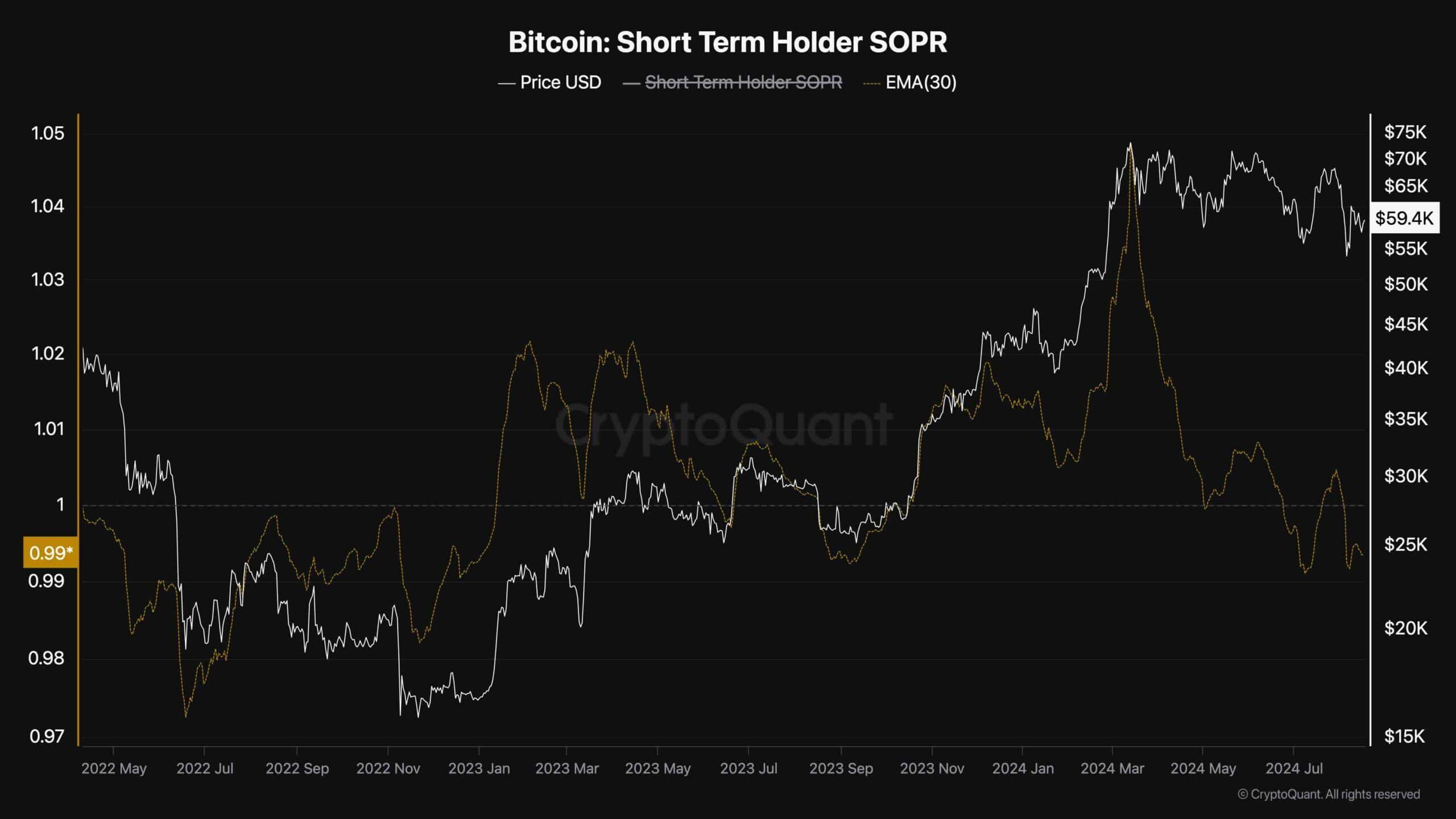

Bitcoin Short-Time length Holders SOPR

While Bitcoin’s label breeze has been barely uneven over the outdated few months, analyzing what the traders are going thru might maybe per chance additionally additionally be insightful.

This chart gifts the Bitcoin non permanent holder SOPR, which measures the combination ratio of profits (or losses) realized by non permanent traders. Values above one value aggregate profit realization, and values below one value losses being realized on aggregate.

Because the chart suggests, for the length of the outdated few months of consolidation, the profit margins for non permanent holders had been declining, and they also’ve even been realizing losses in the outdated few weeks. While melancholy, this shakeout might maybe per chance be a standard designate of a label backside in the heart of a long-term bull traipse. Yet, this is no longer assured, as a gargantuan preference of issues can have an effect on how the price will behave in the shut to future.