Bitcoin’s designate has been on an virtually vertical upward push in the closing few days, drawing attain its all-time excessive of $69K. But, the cryptocurrency could well perhaps now no longer agree with a brand new story correct away, as some warning alerts are pointing to a transient correction.

Technical Prognosis

By TradingRage

The Everyday Chart

On the each day timeframe, it’s evident that the cost has been rallying aggressively during the closing month, breaking past plenty of valuable resistance ranges. The market is currently one step faraway from making a brand new all-time excessive, as there are no valuable prolonged-term resistance ranges left rather then the $69K level itself.

But, the Relative Strength Index demonstrates a transparent overbought signal that would display a doable consolidation or pullback in the impending days.

The 4-Hour Chart

Wanting at the 4-hour timeframe, the cost has created a transient resistance level at the $64K tag. BTC has been consolidating between this level and the $60K strengthen level just these days.

Meanwhile, the Relative Strength Index is taking flight from the overbought zone with out the cost displaying a valuable tumble. This is also interpreted as a cooldown for momentum and hint at a doable continuation quickly after a breakout from the $64K level.

Sentiment Prognosis

By TradingRage

Bitcoin Funding Rates

While Bitcoin’s designate is readily drawing attain its all-time excessive, the market attracts many patrons and speculators. On the different hand, this crude optimism will be costly in the short term.

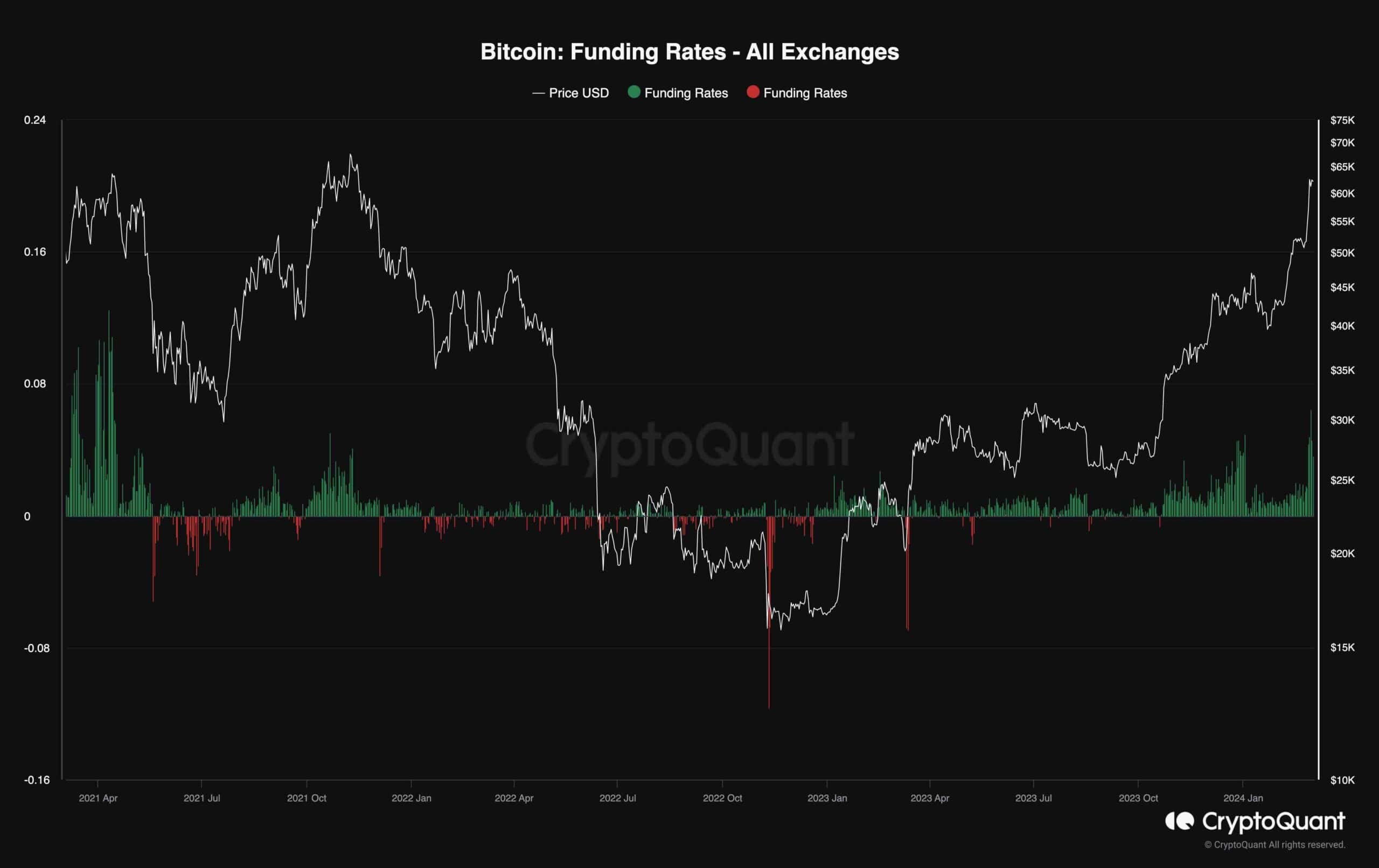

This chart demonstrates the Bitcoin funding charges, one in every of the most treasured metrics for future market sentiment overview. Values above zero are related to optimism, while unfavorable values display bearish sentiment.

For the time being, the funding charges are displaying excessive values, as they agree with got spiked vastly in the closing few days. This could well outcome in a prolonged liquidation cascade in the short term, which could well perhaps then lead to a short tumble. Therefore, a correction will be due quickly sooner than the bullish pattern continues.