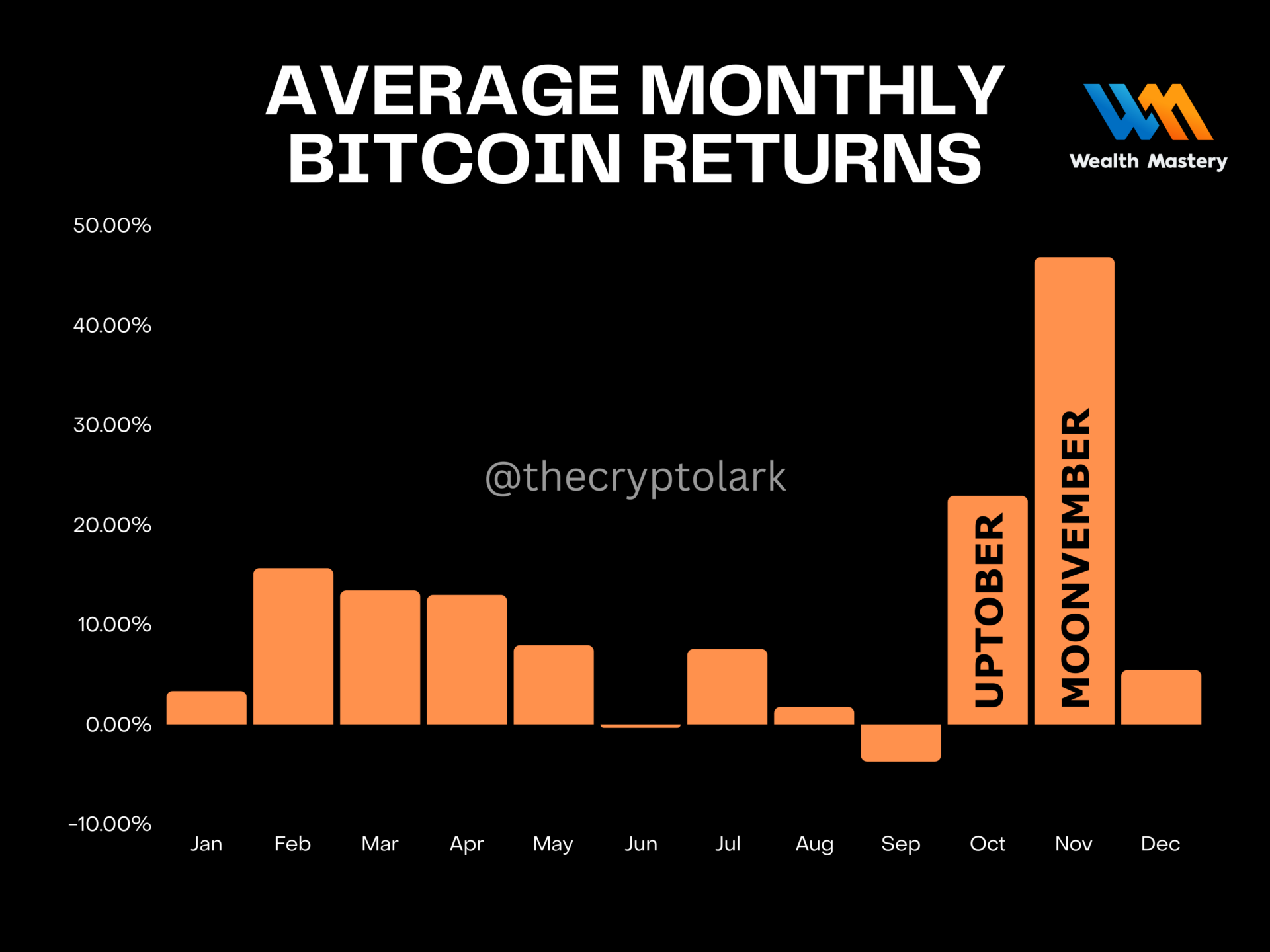

As we head into the fourth quarter of 2024, Bitcoin (BTC) options project is heating up, reflecting an increasingly extra possibility-on sentiment amongst traders. As October rolls around, the Bitcoin neighborhood is wrathful since this has been Bitcoin’s licensed time to shine within the past. In actual fact, the buzzword ‘Uptober’ is making a comeback.

Research means that Bitcoin’s ticket cycles generally open to diagram terminate off 170 days following a halving and peak 480 days later. On story of doubtlessly the most up-to-date halving took place approximately 170 days within the past, many contemplate that this may increasingly be the starting of a serious upward rise for Bitcoin.

Increased BTC options project indicators optimism amongst traders

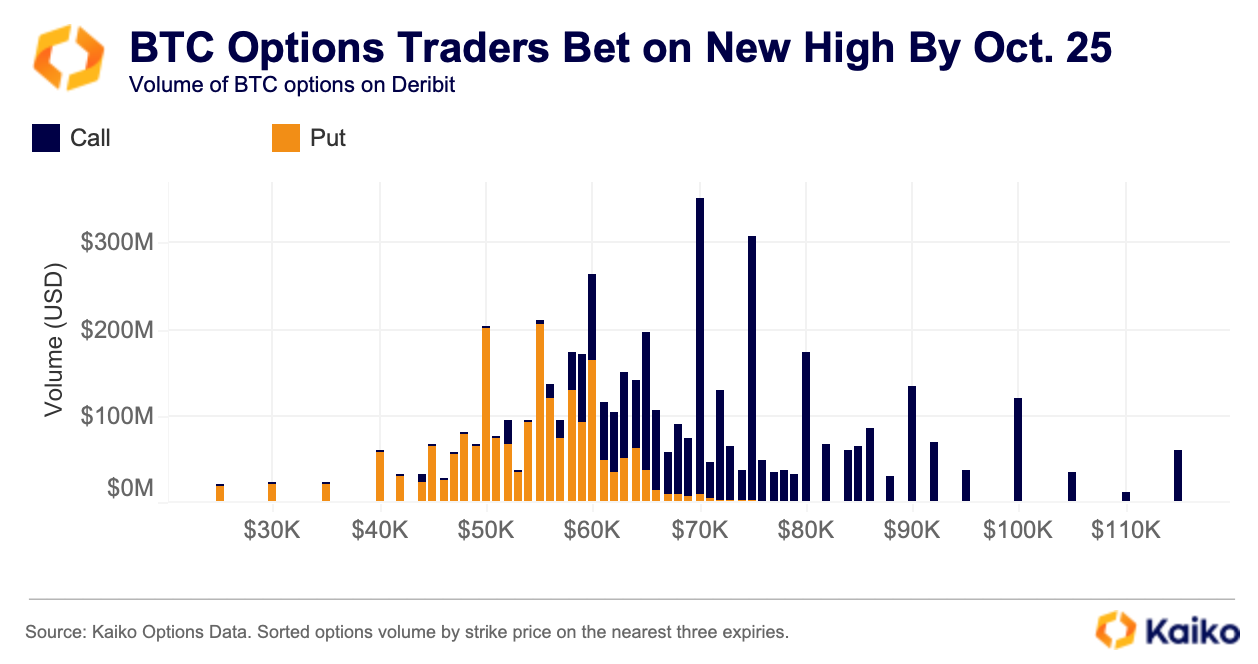

Lately, there has been an expand in options trading quantity, which implies that traders are strategically positioning themselves to profit from market fluctuations. One fascinating pattern is the surge in trading volumes for BTC options expiring on the stop of October.

The exchange in habits displays strategic adjustment by traders who are wanting ahead to ticket actions ahead. The surge in options project coincides with the U.S. Federal Reserve’s recent announcement of a payment-cutting cycle, which began this month. The initial 50 basis point lower has injected optimism into the market, leading traders to speculate on extra cuts before the yr ends. This has prompted elevated trading volumes on contracts with strike prices above $100,000, in particular for December 27 options.

The results of a weaker greenback and the Fed’s resolution to ease quantitative tightening measures haven’t fully confirmed up yet; on the opposite hand, market sentiment appears to be like to be bettering as traders alter their positions.

Political shifts ignite BTC discourse as Trump and Harris include cryptocurrency

The 2024 U.S. election urge is fueling BTC’s fire with both of the considerable contenders coming into the cryptocurrency discourse. Extinct President Donald Trump, as soon as a crypto skeptic, now helps digital assets. He began taking cryptocurrency donations for his marketing campaign earlier this yr in May perhaps perhaps moreover honest, which straight attracted the consideration of the cryptocurrency neighborhood. In June, Trump expressed his toughen for Bitcoin miners and expected that domestic mining would story for the leisure Bitcoin provide, extra solidifying his first payment-crypto attitude.

On the stop of July, Trump made headlines by attending the Bitcoin Convention in Nashville because the considerable customer, where he proposed creating a nationwide strategic reserve of BTC. To top it all off, Trump solidified his involvement within the cryptocurrency field on September 16 when he introduced “World Liberty Financial,” his gain decentralized finance initiative.

Conversely, Vice President Kamala Harris has been courting the cryptocurrency alternate to boot, albeit with elevated prudence. She had been quiet for a whereas, but now she is speaking up, indicating that she is becoming extra chuffed within the alternate. In actual fact, elegant honest recently, her team launched a policy doc that promised to “assist innovative applied sciences admire AI and digital assets. This switch signaled a nod toward the significance of cryptocurrencies admire Bitcoin.

Analysts forecast bullish traits no matter Bitcoin’s recent decline

Basically basically basically based on CoinMarketCap info, a “lengthy squeeze” within the perpetual futures market prompted the price of Bitcoin to descend by better than 3% on the old day. That resulted in $49 million in lengthy-plan liquidations.

CryptoQuant signifies the futures market has been overheated, with open hobby exceeding $19 billion. Basically basically basically based on Coinglass statistics, BTC values diminished at any time when that took place.

As Bitcoin enters October, many crypto consultants and macro analysts are weighing in on what also can unfold within the arriving days. Certainly one of the considerable themes analysts are focusing on is the surge in global liquidity, which is a key driver for Bitcoin. Julien Bittel, Head of Macro Research at Global Macro Investor, notes that global money provide (M2) has begun to rise all all over again, a traditionally certain signal for Bitcoin.

Julien means that BTC tends to react fast to such liquidity injections, and given the most up-to-date macro atmosphere, we may per chance well even be nearing what he calls a “remaining-likelihood saloon to head lengthy before The Banana Zone surely kicks in.” One other considerable crypto analyst, Michaël van de Poppe, has enlighten an extraordinarily bullish target for Bitcoin. He predicts that by the stop of 2024, Bitcoin also can alternate between $90,000 and $100,000.