Bitcoin miners had been actively reducing their holdings in most contemporary weeks because the coin’s imprint continues to hover under the extreme $100,000 achieve. At press time, the main coin trades at $98,535, noting a 1% decline from its all-time high of $ninety nine,860 recorded throughout Friday session.

Because the BTC market begins to construction sideways, its miners may well perhaps perhaps be caused to extra distribute their holdings for profit or to offset growing mining costs.

Bitcoin Miners Promote Their Holdings

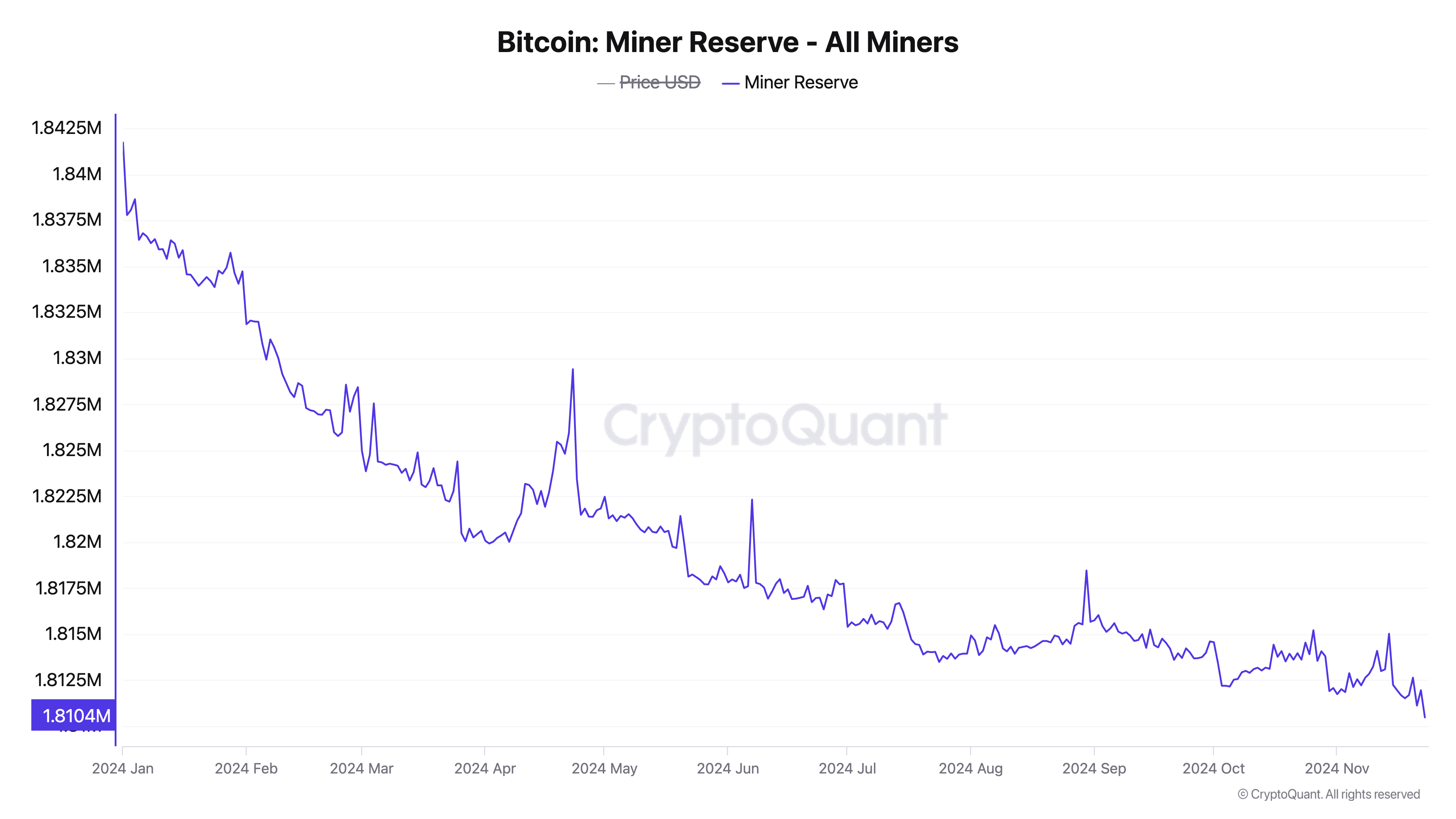

In accordance to CryptoQuant’s data, Bitcoin’s miner reserve has fallen to its lowest level since the muse of the 12 months. As of this writing, it sits at 1.81 million BTC.

This metric tracks the form of coins held in miners’ wallets. It represents the coin reserves miners accumulate yet to sell. A decline within the BTC miner reserve indicates that miners on the Bitcoin community are distributing their coins both to rob earnings or to duvet mining-associated costs.

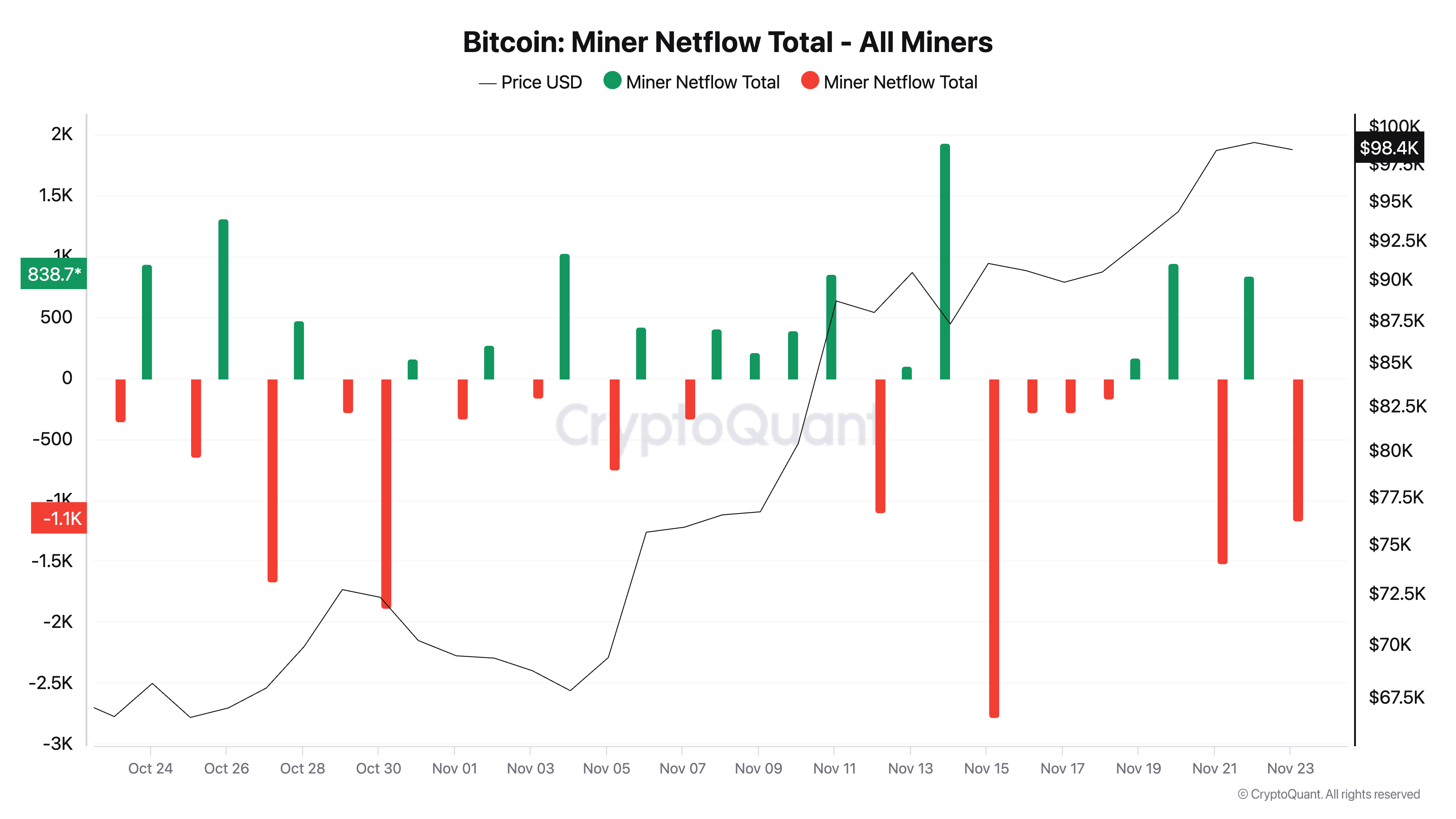

Moreover, readings from BTC’s miner netflow ascertain the day-to-day construction of coin sell-offs by the community’s miners. As of this writing, the metric’s imprint is unfavorable at -1,172 BTC.

Miner netflow refers to the rep quantity of Bitcoin that miners are attempting to acquire or promoting. It is calculated by subtracting the amount of Bitcoin miners are promoting from the amount they’re attempting to acquire. When it’s unfavorable, it indicates that miners are promoting more coins than they’re attempting to acquire. This is most continuously a bearish signal and a precursor to a non eternal downward construction within the coin’s imprint.

BTC Imprint Prediction: The Bulls Stay in Attach watch over

Whereas BTC miners accumulate added to the coin’s promoting force over the previous few weeks, the bullish bias toward the king coin remains considerable. This is mirrored within the positioning of the dots that design up its Parabolic Discontinue and Reverse (SAR) indicator. As of this writing, these dots leisure under BTC’s imprint.

The Parabolic SAR identifies an asset’s construction path and probably reversal factors. When its dots are positioned under the asset’s imprint, it suggests a bullish construction. Traders elaborate this as a signal to head long and exit short positions.

If this construction persists, BTC’s imprint will reclaim its all-time high of $ninety nine,860 and can rally previous the $100,000 psychological barrier. On the different hand, a spike in profit-taking snarl will invalidate this bullish outlook. If attempting to acquire force weakens, BTC’s imprint can also plunge to $88,986.