The originate passion of the well-liked Solana-based mostly meme coin E book of Meme (BOME) cratered to a four-month low of $39 million on July 7.

Witnessing a minute uptick since then, BOME’s originate passion has risen by 10% prior to now three days.

E book of Meme Sees Renewed Hobby

An asset’s originate passion measures the total series of its prominent alternatives or futures contracts that own now now not been settled. When it spikes, it system that more traders are stepping into unique positions.

The surge in BOME’s originate passion after plunging to a Three hundred and sixty five days-to-date low is on account of the growth in the meme coin’s mark that has since adopted. Exchanging hands at $0.0078 as of this writing, BOME’s mark has risen by 8% since July 7. With rising prices, the uptick in the token’s originate passion alerts an uptick in its derivatives market order.

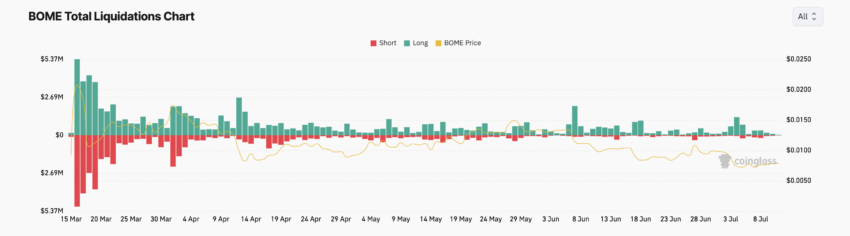

When an asset’s originate passion increases along with its mark, it usually confirms the strength and continuation of the uptrend. Curiously, no subject the growth in BOME’s mark prior to now three days, it has recorded more prolonged liquidations than quick ones.

Read More: BOOK OF MEME (BOME) Imprint Prediction 2024/2025/2030

Liquidations occur in an asset’s derivatives market when the asset’s cost strikes against the distance held by a trader. When this happens, the trader’s space is forcefully closed on account of inadequate funds to take care of up it.

Lengthy liquidations occur when traders who own taken prolonged positions are forced to sell their holdings at a lower cost to veil their losses because the associated price falls. It occurs when the associated price of an asset drops, and traders who own originate positions in opt of a mark rally are forced to exit their positions.

Therefore, BOME’s mark upward thrust, accompanied by a surge in prolonged liquidations, would possibly appear counterintuitive. On the other hand, it goes to be on account of margin calls.

When trading with leverage, traders must take care of a minimum story balance compared with the loan quantity. If the associated price dips momentarily, even accurate through a fundamental upward thrust, it goes to trigger a margin call, forcing them to sell a few of their holdings to meet the minimum balance requirement.

BOME Imprint Prediction: Will the Uptrend Continue?

An review of BOME’s Tantalizing Common Convergence Divergence (MACD) on a one-day chart reveals a ability bullish crossover.

The indicator measures an asset’s mark trends and momentums and identifies ability shopping and promoting opportunities.

A bullish crossover exists when the MACD line crosses above the signal line. This intersection means that the shorter transferring moderate is gaining on the longer one, signifying a shift in momentum in the direction of the upside.

In BOME’s case, this is set to occur. If the crossover is a success, it goes to push the meme coin’s mark to $0.0081.

On the other hand, if it is a false signal, the token’s mark would possibly tumble to $0.0077.