Regardless of its rapid upward push to a $1 billion market cap, Bogood enough of Meme (BOME) is now a shadow of its worn self. As of press time, the altcoin is buying and selling at $0.0070.

This payment indicates that the Solana-based meme coin is now 74.78% below its top from the principle quarter of this year. However, on-chain data suggests that whereas the token has declined, it is removed from done.

Market Doubts Book of Meme Doable Upswing

Regardless of BOME’s most in model downtrend, the cryptocurrency’s label has risen by 20% over the final 30 days. From a technical standpoint, the token would possibly presumably perceive extra beneficial properties, though they’ll be rapid-lived.

The day after day BOME/USD chart reveals the formation of a falling wedge. By definition, a falling wedge is a bullish pattern once quickly noticed when a cryptocurrency’s label experiences lower highs and lower lows following a previous increase.

This pattern moreover comprises a period of consolidation, after which a breakout happens. For BOME, the token is on the brink of one other rising vogue, as shown below.

Read more: What is Book of Meme (BOME) Crypto?

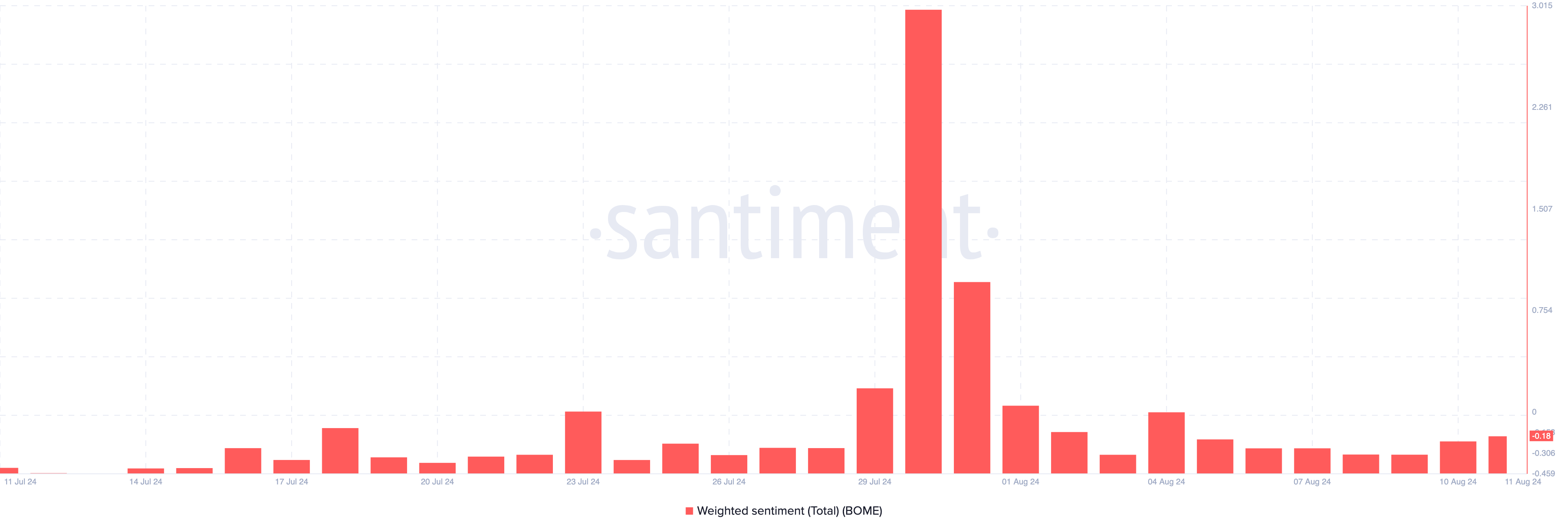

If nothing alters this pattern, then BOME’s label would possibly presumably device for the overhead resistance. However, consistent with Santiment, the Weighted Sentiment around BOME is detrimental.

Weighted Sentiment tracks on-line feedback a pair of cryptocurrency, with a definite rating indicating a bullish sentiment amongst market participants. Conversely, a detrimental rating suggests a bearish outlook.

If this detrimental sentiment persists, BOME’s most in model uptick can be rapid-lived, because it would also simply no longer be supported by elevated quiz of.

BOME Tag Prediction: Bullish Validation Stays Essential

Past the perception above, the Relative Energy Index (RSI) reveals that merchants strive to retain the stress. The Relative Energy Index (RSI) is a technical indicator used to measure momentum. Declining RSI readings level to weakening buyer strength, whereas an increase suggests rising bullish momentum.

At press time, the RSI is 42.76, a finding out greater than it became once days ago. Regardless of the upward thrust in momentum, the rating has but to surpass the honest line, suggesting that it would be engrossing to retain the expected uptrend.

A perceive on the Fibonacci retracement indicator offers insights into the aptitude increase and resistance level BOME can also simply attain. From the image below, BOME’s label can also simply hit $0.0075 in the rapid period of time. If shopping for stress will increase, the payment would possibly presumably upward push to $0.0093.

Read more: Book of Meme (BOME) Tag Prediction 2024/2025/2030

However, the meme coin risks a decline if sellers at final place administration of the momentum. In that case, BOME’s label would possibly presumably retrace to $0.0052.