BONK has surged 12% previously 24 hours, driven by renewed investor interest after REX Shares filed for an ETF software.

The news has sparked increased demand for BONK, suggesting the likely of a sustained trace rally.

BONK Climbs Following ETF Utility

On Tuesday, asset management company Rex Shares filed alternate-traded fund (ETF) capabilities for numerous meme coins, including TRUMP, DOGE, and BONK. This has since driven a resurgence in investor interest in BONK, whose charge has climbed 12% previously 24 hours.

An summary of the BONK/USD one-day chart exhibits that this double-digit rally has pushed the meme coin’s trace above its 20-day exponential animated common (EMA), which now varieties dynamic attend.

The 20-day EMA calculates an asset’s common trace over the past 20 days, prioritizing most stylish files. When the cost rises above the 20-day EMA, it signals bullish momentum, confirming merchants are gaining withhold watch over. Here is on the total seen as a explicit indicator, encouraging increased shopping for process and suggesting the likely of an ongoing upward trend.

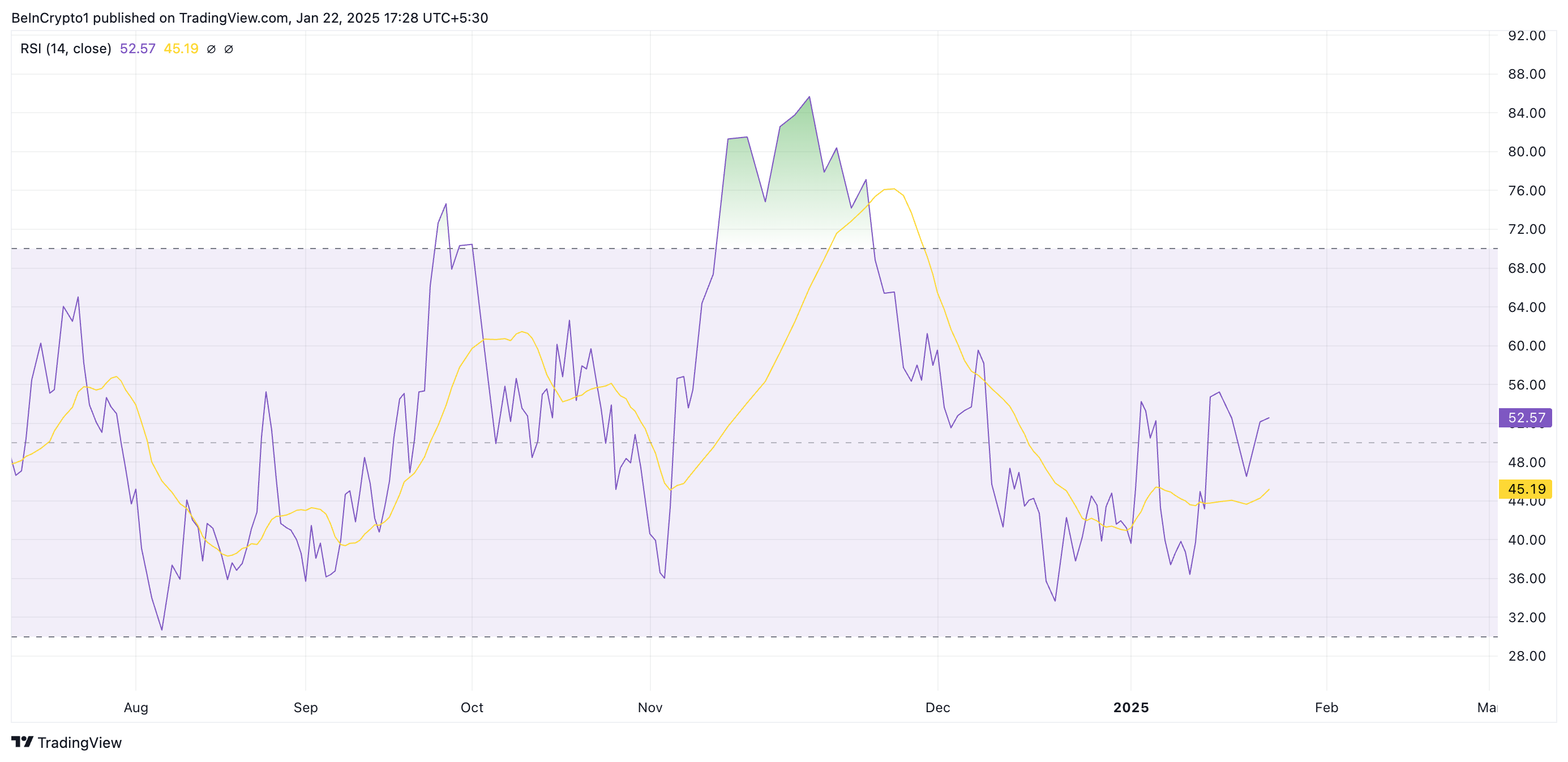

Furthermore, BONK’s surging Relative Strength Index (RSI) helps this bullish outlook. At press time, it’s a ways in an uptrend at 52.57.

This momentum indicator screens an asset’s overbought and oversold prerequisites. Configured this scheme, it highlights increasing bullish momentum, suggesting the asset is trending toward stronger shopping for prerequisites with out reaching an overbought sigh.

BONK Worth Prediction: Will the Rally Proceed?

If this shopping for stress is maintained, BONK’s trace could possibly possibly damage above its instantaneous resistance at $0.000033 and climb by 17% toward $0.000038.

Then again, if promoting process recommences, the meme coin could possibly possibly shed its most stylish positive aspects and drop to $0.000025.