The BONK designate narrative hints at a doubtless consolidation, as evidenced by a stable collection of merchants and a declining volume of trades. This observation is additional supported by its Relative Energy Index (RSI) for the time being positioned below the overbought stage, suggesting the market might per chance even be settling down following a serious designate surge at the onset of March.

Furthermore, the nearly converging Exponential Interesting Averages (EMA) lines indicate a looming bearish trend, which might per chance both precipitate a recent correction or, at least, lead to a market consolidation.

BONK RSI Is Below the Overbought Stage

The Relative Energy Index (RSI) for BONK, which serves as a needed gauge to detect whether or not an asset is in an overbought or oversold condition by inspecting the bustle and scale of its present designate adjustments, has considered a noteworthy decline from seventy 9 to 67 in the previous twenty days.

This indicator’s history with BONK shows that when it reaches an overbought teach, it in total precedes designate hikes; thus, the present fall to an RSI of 67 might per chance indicate an impending duration of market consolidation. The Relative Energy Index (RSI) is a broadly faded momentum oscillator in technical diagnosis that ranges from 0 to 100, geared in direction of identifying overbought or oversold cases of an asset.

Generally, an RSI above 70 indicates that an asset might per chance even be overbought and doubtlessly due for a pullback, whereas a discovering out below 30 suggests it could even be oversold and presumably ready for a rebound.

An RSI shut to 67 in total alerts stability, fending off the volatility of being overbought. It suggests BONK is in a ‘goldilocks zone’. It’s not too bullish or bearish. The market appears balanced and stable.

Traders might per chance also explore this as a trace of upcoming market steadiness. They mediate BONK might per chance initiate consolidating soon. This form its cost might per chance even be in fashion after a time of rapid development or correction.

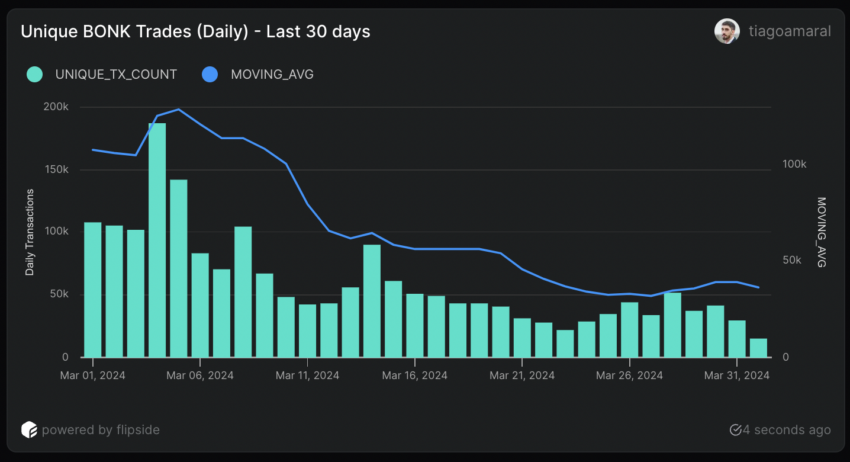

BONK Project Is Declining

On March 4, BONK reached a file excessive, with everyday trades peaking at 187,000. This excessive, nonetheless, became once rapid-lived. Rapidly after, it dropped to a 30-day low with most effective 22,200 trades by March 23. Furthermore, the 7-day enchanting average for BONK trades has been declining in the previous few days. Buying and selling exercise has begun to decline, reducing from 51,600 on March 28 to 29,300 by March 31.

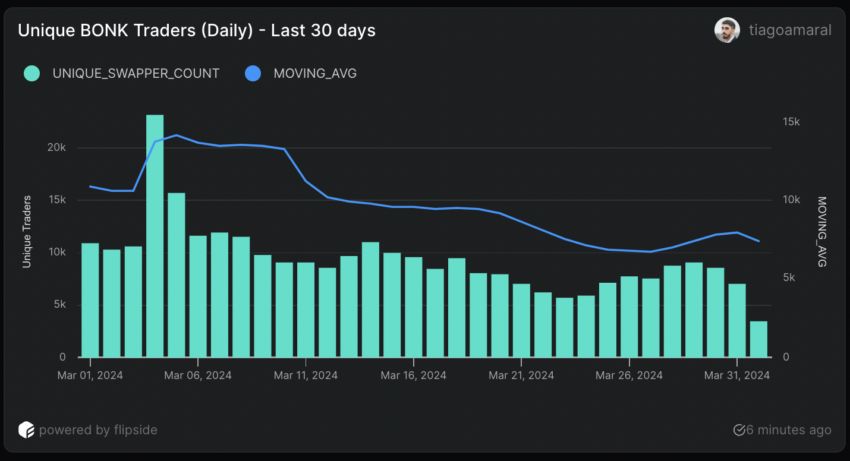

In a the same vogue, the stage of everyday seller engagement has carefully adopted this trend. After reaching a height with 23,200 abnormal merchants coinciding with the height trading volume on the similar day, there became once a serious downturn, ushering in a duration of market stabilization correct thru the center of March.

This section of relative peaceable, nonetheless, became once correct the precursor to a noticeable downtrend in seller exercise in the latter days of the month, with the gathering of filled with life merchants falling from 9,030 on March 29 to correct 7,050 by March 31.

Both 7-day enchanting averages started to fall on the final day notorious. This suggests investors might per chance even be shifting their center of attention from BONK to other contemporary memecoins. These cash might per chance promise elevated returns.

BONK Mark Prediction: Is The Occasion Over?

Now not too lengthy previously, indubitably one of BONK’s transient Exponential Interesting Practical (EMA) lines converged in direction of a lengthy-term EMA line, suggesting a switch in direction of market consolidation.

This condition, in total interpreted as a duration of stabilization after necessary designate movements, is required for confirming the asset’s present designate stage as sustainable sooner than any additional directional trend develops.

EMA lines prioritize present designate knowledge. This lets in them to offer rapid insights into doubtless market adjustments. For BONK, the EMA lines enchanting nearer collectively trace a balanced investor sentiment. It reveals a section with out certain bullish or bearish momentum. This suggests a doable designate equilibrium.

For the time being, BONK is encountering a pivotal enhance stage at $0.000024 and $0.000021. Keeping above this stage might per chance stabilize its designate, combating necessary declines.

However, should quiet BONK fail to preserve this enhance, it risks a downturn in direction of $0.0000195. On the different hand, if an uptrend appears, the BONK designate might per chance retest its resistance stages at $0.000035 and $0.000036.