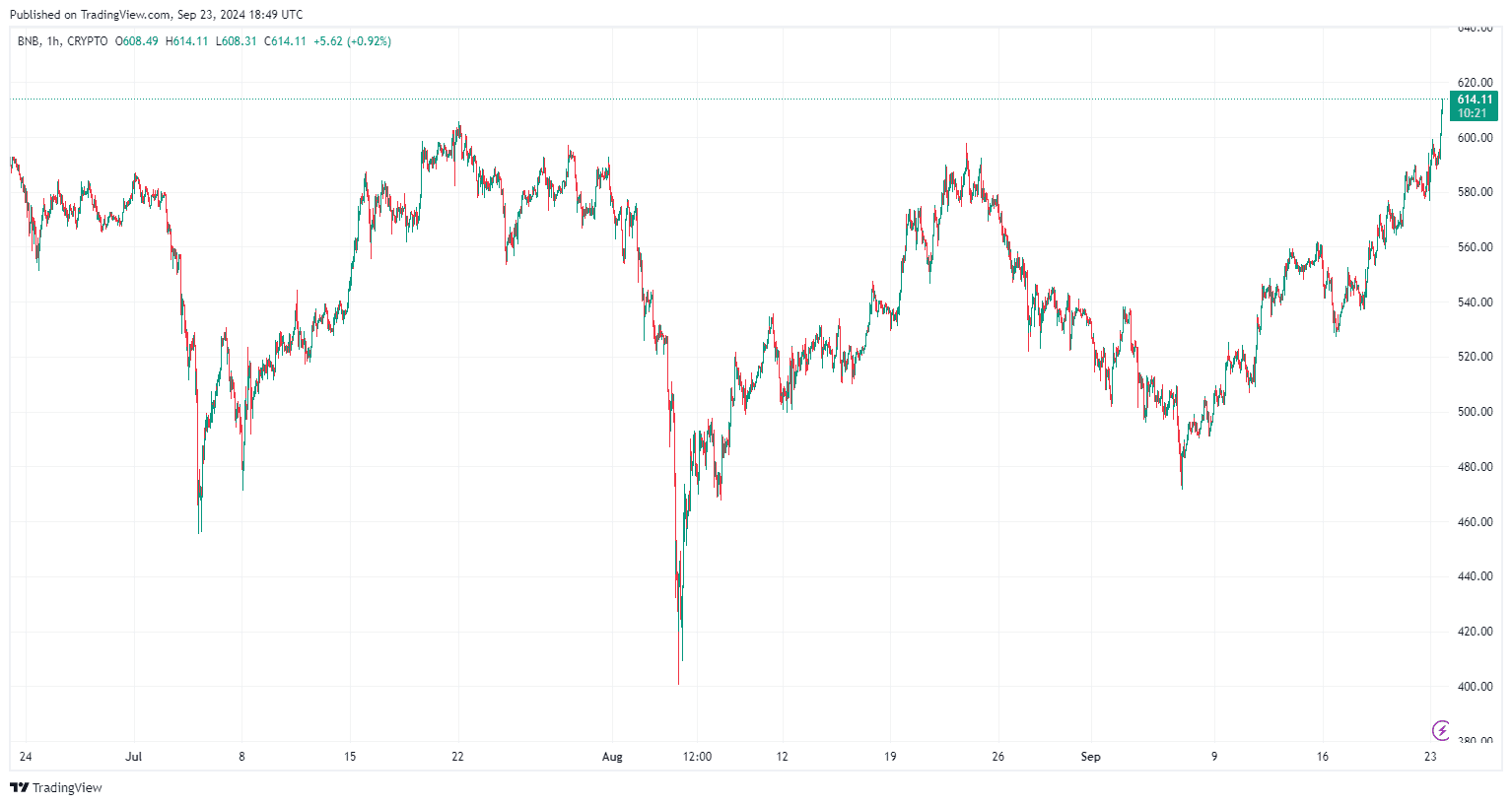

BNB stamp has been driving a wave of bullish momentum, breaking serious resistance ranges and showing indicators of extra gains. After surpassing the 100-day Straightforward Transferring Life like (SMA), the cryptocurrency is coming near the $650 resistance imprint. The market is buzzing with optimism as BNB positions itself for sustained development. But can this rally continue, or is a correction all through the corner? This text dives into most contemporary technical evaluation and market indicators to evaluate the functionality for persevered bullish circulate.

BNB Label Diagnosis As BNB Breaks the 100-Day SMA

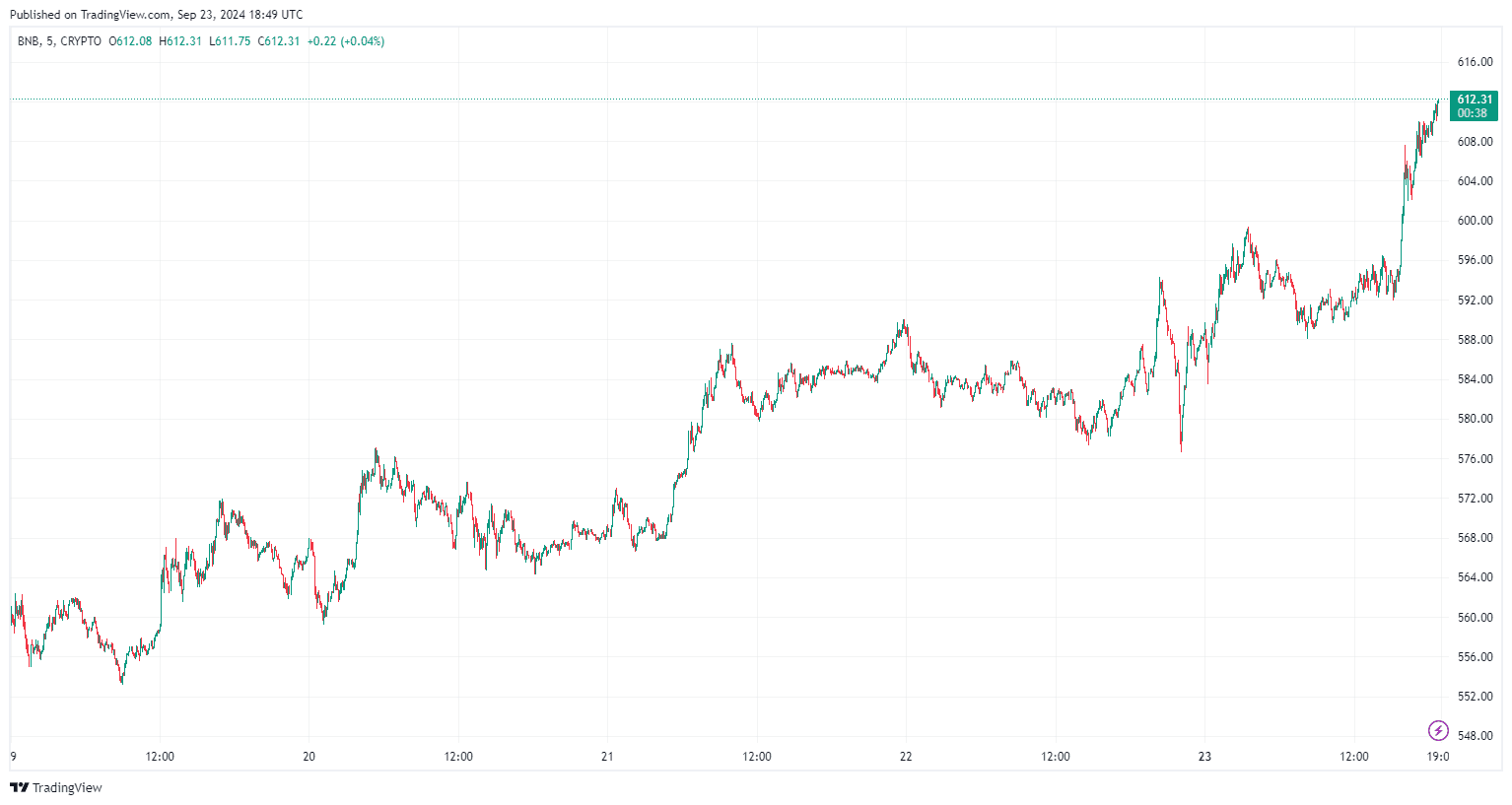

BNB’s most contemporary surge previous the 100-day SMA has sparked bullish sentiment amongst merchants. Breaking through this technical barrier is seen as a key indicator of upward momentum. On the 4-hour chart, BNB demonstrated solid purchasing for stress, with the Relative Strength Index (RSI) hiking above 76.37%, reflecting a bullish pattern that could maybe maybe furthermore power prices better toward the $650 resistance level.

The 100-day SMA is a widely-watched indicator in technical evaluation, and when a stamp moves above this moderate, it most incessantly alerts energy. In BNB’s case, this breakout has impressed optimism for persevered stamp appreciation.

BNB Label Eyeing the $650 Resistance Diploma

Essentially the major resistance level for BNB stamp lies at $650, a serious stamp level that merchants are closely monitoring. With the altcoin procuring and selling round $613 at the time of writing, an upward switch toward this level could maybe maybe furthermore delivery the doors to extra gains.

The $650 imprint is no longer any longer the supreme level of hobby. If BNB surpasses this resistance, the next key zones to discover consist of $670 and $690. These ranges are main for determining whether or no longer BNB’s rally could maybe maybe furthermore lengthen true into a better bull slither, doubtlessly aiming for the unique all-time excessive goal over $720.

BNB Label Faces Consolidation Part and Short-Term Fortify

While BNB stamp is showing energy, it has entered a consolidation portion near the $600 imprint, main some merchants to query whether or no longer the rally can continue with out a pullback. The worth is at expose hovering below $620 and facing on the spot resistance at $615, with predominant enhance ranges at $600 and $610.

A downside correction is that you just are going to be in a feature to take into consideration if BNB fails to certain the $620 resistance. In that case, BNB could maybe maybe furthermore tumble toward the $560 level. From now on losses could maybe maybe furthermore push the worth all of the most sensible likely blueprint down to the $550 zone. The presence of solid enhance at these lower ranges means that even supposing a correction happens, BNB could maybe maybe furthermore peaceful shield its bullish trajectory within the medium timeframe.

BNB Label Prediction: What Lies Forward for BNB?

The outlook for BNB stamp relies on its skill to shield above the predominant enhance ranges and spoil through the $650 resistance zone. If a hit, BNB could maybe maybe furthermore goal $680 and beyond. Then again, failure to shield above $600 could maybe maybe furthermore impress a bearish correction, bringing the worth all of the most sensible likely blueprint down to examine lower ranges.

For now, the technical indicators live bullish. The hourly MACD reveals a solid upward pattern, and the RSI is positioned favorably above the 50 level. The worth action within the upcoming lessons will resolve whether or no longer BNB can spoil better or if a transient correction is on the cards.

BNB has demonstrated impressive energy after breaking the 100-day SMA and is heading within the correct course to examine the serious $650 resistance level. With bullish momentum constructing and enhance holding firm, the cryptocurrency could maybe maybe furthermore peek extra gains within the near timeframe. Then again, merchants could maybe maybe furthermore peaceful help an peek on key enhance ranges, as a failure to certain $620 could maybe maybe furthermore lead to a downside correction.