A recent examine by Block Scholes and Bybit finds a resilient crypto derivatives market, despite latest market turbulence. The listing affords insights into futures, alternate choices, and perpetual contracts, emphasizing the field’s ability to withstand necessary market occasions.

Futures Market Balance Highlighted in Novel Document No topic Bitcoin Sell-Off

The joint listing from Block Scholes and Bybit highlights the balance of futures markets amidst a engaging promote-off that drove bitcoin (BTC) under $59,000. No topic this, launch passion in futures markets remained regular, suggesting that merchants had diminished their leveraged positions, thereby limiting the wretchedness of forced liquidations. The listing notes that this sample has been consistent within the course of the 300 and sixty five days, reflecting a cautious means by market participants at some stage in lessons of heightened volatility.

Additionally, the listing underscores the definite shift within the toncoin (TON) funding rate following necessary market occasions, further signaling renewed passion in leveraged positions. The listing additionally sheds light within the marketplace’s outlook regarding the upcoming U.S. presidential election. Per the prognosis, the volatility term structure indicates a stable bullish sentiment for out-of-the-money calls on post-election expirations.

The listing states:

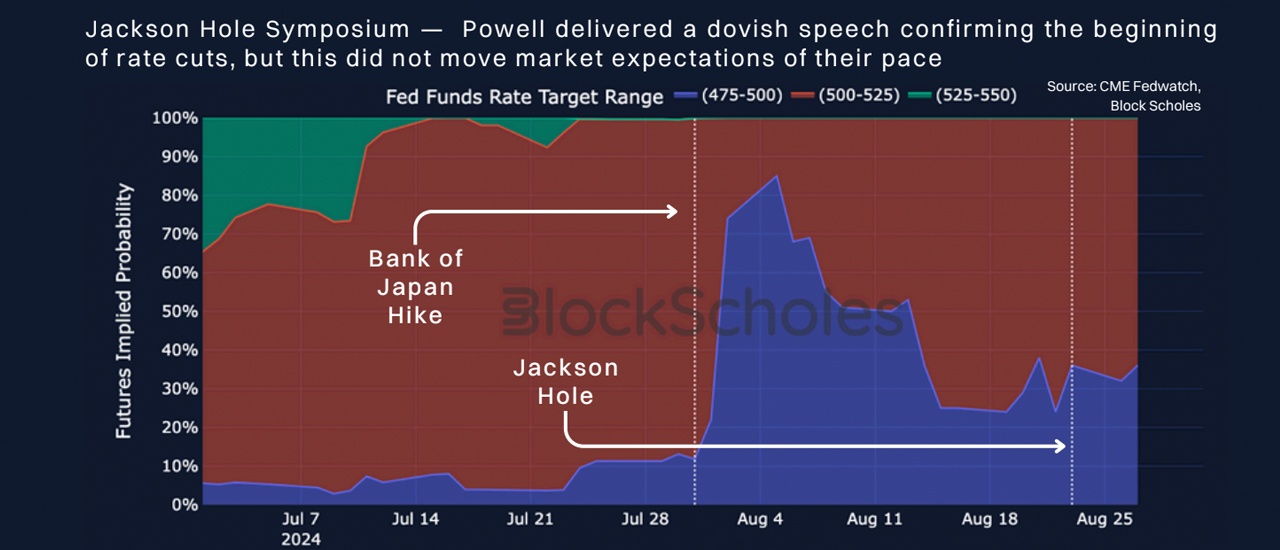

The term structure of volatility holds a truly identical form to sooner than Chair Powell’s Jackson Gap speech… Smiles for expiries after the election place an incredible stronger bullish skew in the direction of OTM calls, whereas short-dated smiles sing a seek files from for downside protection.

This insinuates that merchants count on a favorable atmosphere for crypto sources following the election. Additionally, the listing’s observation of continued seek files from for downside protection in short-dated expirations reflects cautious optimism available within the market. The findings from the Block Scholes and Bybit examine point out a maturing crypto derivatives market that adapts without warning to transferring dynamics. The consistent balance seen, even amid necessary occasions, facets to a rising self assurance among merchants.