Blast launched its optimistic rollup leisurely Thursday, pleasant a pledge to enable customers to withdraw funds locked in a crew multisig for over three months.

The price of consumer deposits crept as a lot as nearly $2.3 billion by open time. Now customers possess a replacement: withdraw or get something to realize with the funds on the newly launched layer-2.

Knowledge from DefiLlama early Friday showed that the balance of the Blast bridge contract had plummeted by about 70%, which CoinDesk reported as “$1.6 billion outflows.”

The staunch amount of withdrawals is no longer that sure-slice. Funds are interesting out of the deposit contract at a healthy clip, however the capital — largely Lido staked ether (stETH) — are entering into Blast’s ETH Yield Supervisor Proxy — no longer leaving the community as a results of consumer withdrawals.

Learn more: Blast from the previous: 3 years on from the open of ETH staking

Surely, some withdrawals are to be expected, on condition that ether (ETH) has bustle up about 70% since Blast invited customers to lock up their capital for over three months in alternate for a aspects IOU.

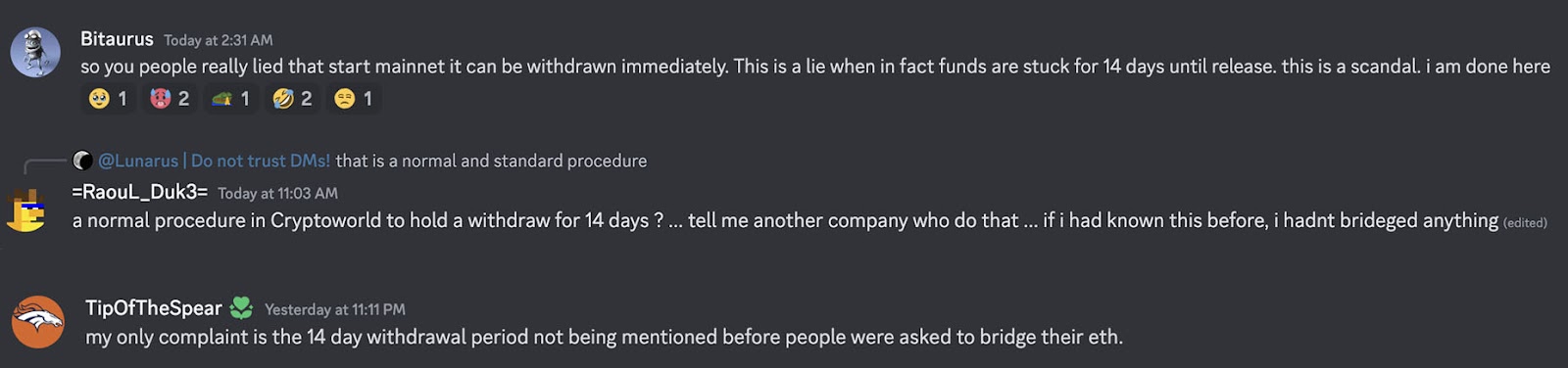

Many depositors seem to be jumping on the likelihood to reclaim their funds, in step with dozens of discussions in the Blast Discord channel. However, some teach they were unaware of the lengthen length required to make exhaust of Blast’s bridge wait on to Ethereum.

Complaints akin to those would possibly presumably moreover be found in the Blast Discord since open

Due to this of the particulars of Blast’s optimistic rollups assemble, depositors must wait 14 days and pay Ethereum gas costs to circulation their deposits wait on to mainnet. Optimistic rollups, love OP Mainnet, most frequently possess a seven-day withdrawal lengthen. Identified as the gap length, this lengthen enables for the submission of fraud proofs to make certain that that the integrity of transactions sooner than they’re finalized.

The Blast developer documentation says the prolonged length is a “security feature designed to succor right Blast.” Blockworks has reached out to Blast representatives for clarification.

Dedicated third-occasion bridge dapps would possibly presumably provide sooner transfers, however for a fee. For occasion, Orbiter costs 1.5% for the privilege.

Blast has been a marketing phenomenon to this level. Spearheaded by NFT dapp Blur founder Tieshun Roquerre, identified by his on-line moniker “Pacman,” it launched with elephantine fanfare last November.

Backed by excessive patrons and promoted by broadly followed influencers, all whereas any semblance of working venture used to be months away.

Learn more: Blast TVL hits $390 million, with out a product

Since then, it employed developers, forked the OP stack, and persevered to compose customers lured by the promise of Blast aspects besides ETH staking yield.

85,000 accounts possess derive entry to to the Blast Discord, and the crew incentivized rankings of self sustaining developers to originate on the platform via its Spacious Bang marketing campaign.

57,000 wallets possess interacted with the chain for the explanation that layer-2 when stay, recordsdata exhibits. About $40 million is now tracked in DeFi dapps by DefiLlama, largely borrowing and lending market ZeroLend, an Aave v3 fork.

However it has moreover been beset by rug-pulls. A minimal of six of the many meme money launched to this level had been scams that grew to change into nugatory, Dexscreener exhibits.

Learn more: Life like possible crypto rug pull makes $2,600 in income: Chainalysis

One, a playing venture aptly known as RiskOnBlast, absconded with 420 ether, price more than $1 million raised in a token sale sooner than the Blast open.

Assuming Blast retains on the least $1.88 billion of the deposits obtained, this is also the third-greatest layer-2 community on Ethereum, a excellent feat.

Can Blast cut out its have enviornment of interest in an more and more crowded Ethereum rollup market?