The day prior to this, Dec. 10, BlackRock’s Ethereum ETF (ETHA) made a immense splash, touchdown within the tip four ETF launches of 2024, per Nate Geraci, President of the ETF Store. With a day-to-day catch influx of around $81.6574 million, ETHA has viewed consistent boost over the final 12 days, making it a key participant within the extremely competitive cryptocurrency landscape.

The day prior to this’s files confirmed that full catch inflows for say Ethereum ETFs reached about $305.74 million. Of this, BlackRock’s ETHA accounted for a immense chunk of swap – $81.65 million – whereas Constancy’s ETF (FETH) led the pack with $202 million.

Produce that 8 straight days of inflows into iShares Ethereum ETF…

Over $1bil full.

Top 4 ETF originate of 2024 (out of approx 675 ETFs). https://t.co/5LKWrDdfjw

— Nate Geraci (@NateGeraci) December 11, 2024

As BlackRock’s ETHA continues to design floor, its success shows broader traits within the cryptocurrency funding say. Ethereum-centered funding products saw story-breaking inflows this week, reaching a full of $1.2 billion and exceeding earlier highs self-discipline in July.

Will BlackRock originate Solana (SOL) ETF, though?

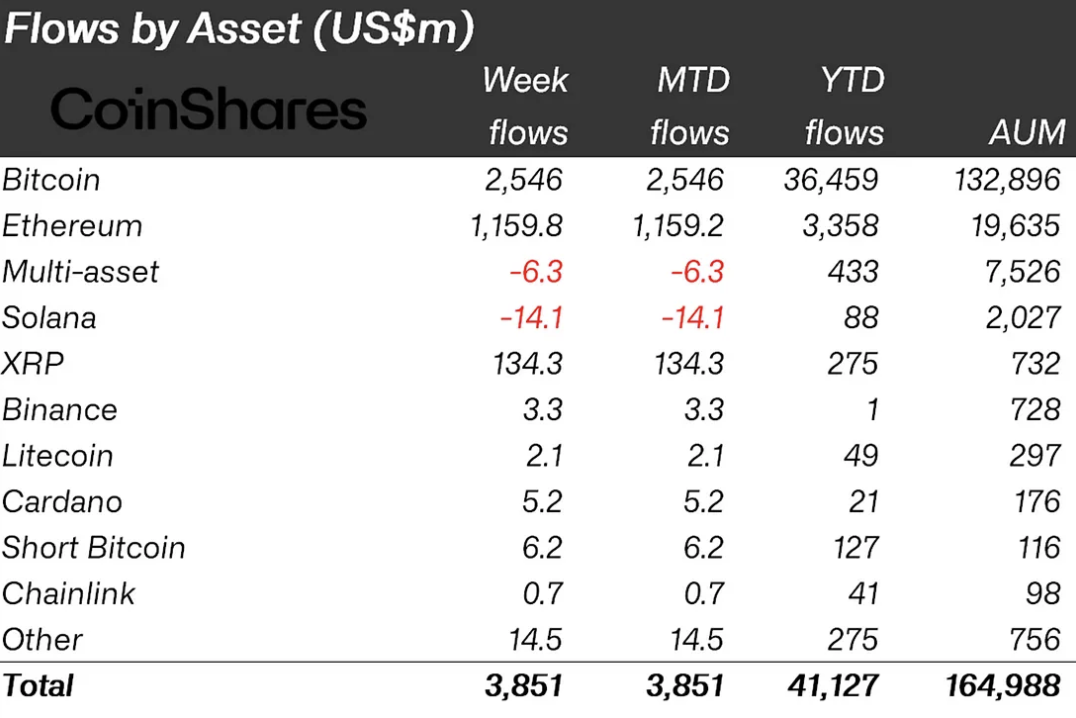

This has resulted in a fall in Solana, which has viewed $14 million in outflows for two weeks running, per CoinShares analyst James Butterfill.

BlackRock’s overall performance has additionally been pretty spectacular. Its Bitcoin ETF, IBIT, is now equal to the blended dimension of 50 European-based ETFs, which shows that its impact extends past just correct Ethereum investments.

Meanwhile, ETHA is within the tip four for ETF launches, just correct on the abet of leaders love IBIT and FBTC. It has derive momentum and will shut the outlet before the tip of the year and advance in third among all ETFs.

BlackRock’s Ethereum ETF has carved out a sure say in a competitive market, giving investors a capability to design publicity to Ethereum’s boost. With its smartly-liked inflows and rising visibility, ETHA is shaping up to be a derive contender within the landscape of digital asset investing.