BlackRock’s Ethereum ETF, ETHA, faced heavy selling stress this week, coinciding with a period of heightened volatility in the asset.

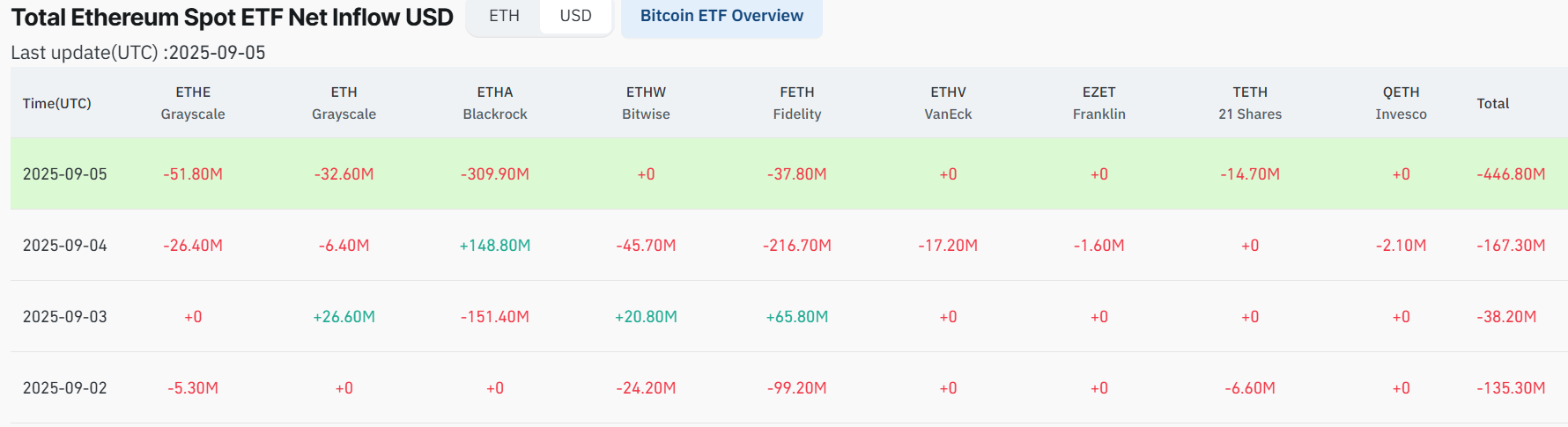

Info means that the ETF recorded catch outflows of $312.5 million. The handiest certain session came on September 4, when $148.8 million flowed into the fund.

This be successful in became straight offset by three consecutive redemption days, including $151.4 million on September 3, $309.9 million on September 5, and smaller drawdowns on assorted days, ensuing in a deeply detrimental week.

The outflows approach as U.S. keep of residing Ethereum ETFs, which saw powerful inflows in August, are now below mountainous stress. By incompatibility, Bitcoin ETFs, including BlackRock’s IBIT, recorded catch inflows, suggesting institutions are rotating in direction of the more established asset.

Whereas huge redemptions from keep of residing ETFs signal waning institutional search data from, retail and offshore buyers hold helped cushion ETH from steeper losses. Even so, the 2d-largest cryptocurrency is now testing the $4,000 make stronger.

ETH mark prognosis

At press time, Ethereum (ETH) became procuring and selling at $4,281, up 0.11% one day of the last 24 hours but down 4% on the week.

On the technical front, prognosis by Ali Martinez highlighted that ETH is drawing approach a decisive stage approach $4,260, which has consistently acted as a key pivot in newest sessions. Failure to withhold this threshold may well perchance also keep of residing off a sharper decline in direction of the $4,000 psychological discover.

Critically, ETH has struggled to construct momentum above the $4,380 and $4,500 resistance zone, with repeated rejections underscoring power selling stress. On the downside, $4,260 remains the excessive barrier between relative steadiness and a deeper retracement.

With volatility elevated and upcoming macro events keep of residing to handbook menace property, Ethereum’s reaction one day of the $4,260 stage will doubtless resolve its subsequent most necessary directional mosey.

Featured image through Shutterstock