BlackRock, the sector’s finest asset supervisor, drastically elevated its Bitcoin (BTC) holdings on Friday, December 6. This constructing came quick after one other asset supervisor, Grayscale, equipped BTC value $150 million.

The fearless acquisition signifies BlackRock’s rising self belief within the flagship cryptocurrency. With institutional avid gamers continuously shopping after Bitcoin’s $100,000 milestone, right here is what would possibly perchance well also very neatly be subsequent for the coin.

Bitcoin Continues to Net BlackRock’s Backing

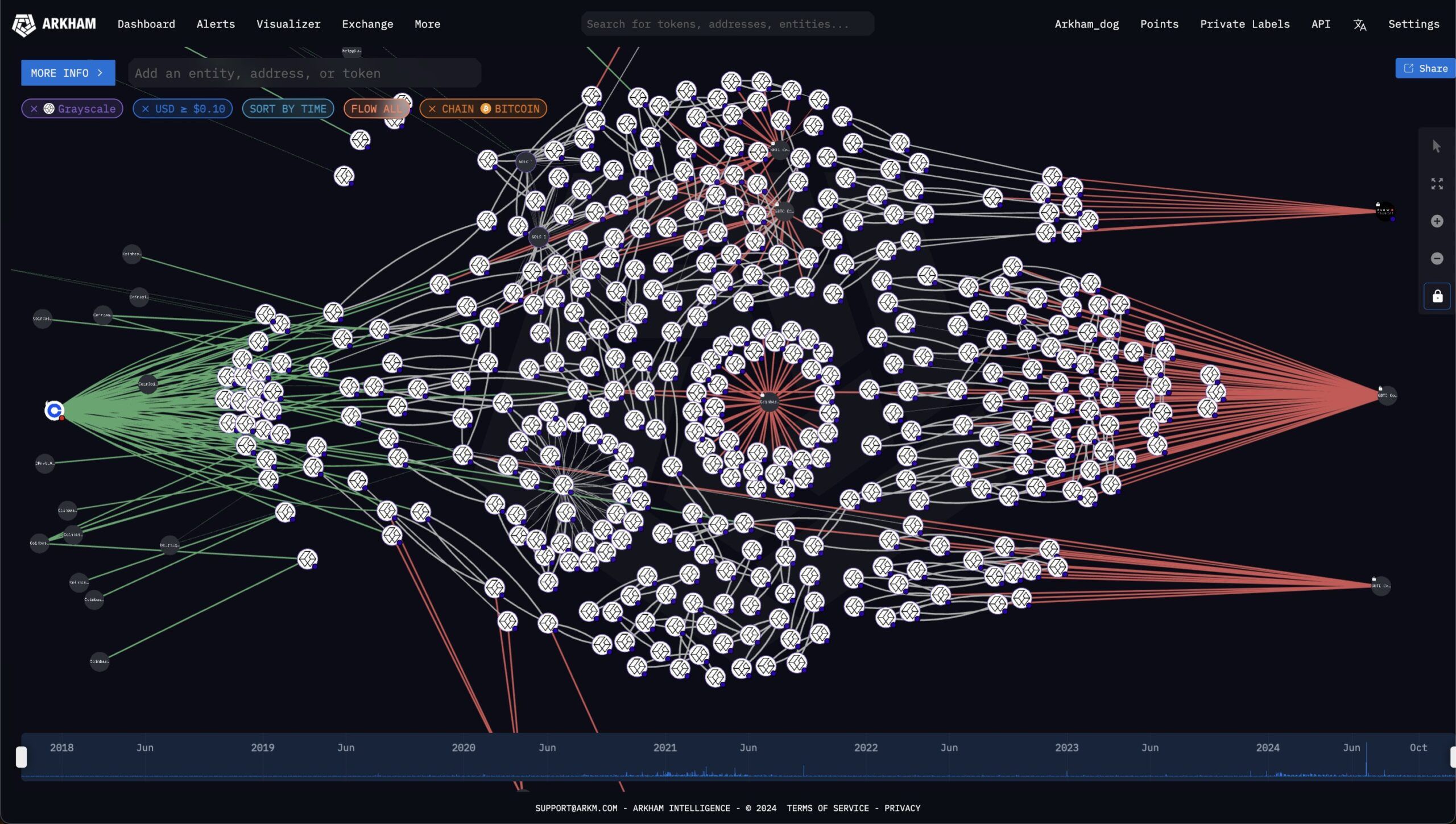

Bitcoin’s label surged to $100,000 for the main time on Thursday, December 5. Arkham Intelligence reported that the milestone precipitated Grayscale, a Bitcoin commerce-traded fund (ETF) issuer, to promote $150 million value of BTC.

In stark inequity, BlackRock, which is talked about to preserve 500,000 BTC, took a distinct potential. The investment broad added $750 million to its Bitcoin holdings in some unspecified time in the future later, signifying self belief within the asset’s prolonged-length of time prospects no matter recent label swings.

Based entirely totally on BeInCrypto’s findings, this broad upward thrust in BlackRock’s Bitcoin retaining used to be very crucial in serving to the cryptocurrency to retest $100,000 after it quick dropped to $97,000. But the build a question to now is: Will BTC proceed to upward thrust?

One potential to know if Bitcoin’s label will proceed to leap is to stare on the SOPR. The SOPR stands for Spent Output Profits Ratio. It is calculated by dividing the profits held by Prolonged-Length of time Holders (LTH) by the ones held by Quick-Length of time Holders (STH).

When the ratio is excessive, it potential LTHs enjoy elevated spent profits than STHs. On this event, it potential that the price is shut to the local or market top. However, in step with CryptoQuant, Bitcoin SOPR has dropped to 1.Forty five, indicating that STHs enjoy the upper hand, and the price is closer to the underside than the tip.

If this vogue continues, then Bitcoin’s label would possibly perchance well also commerce elevated than $100,000 inner the arriving weeks.

BTC Model Prediction: $100,000 Would possibly Correct Be the Start?

From a technical level of view, Bitcoin’s label is shopping and selling inner a symmetrical triangle on the 4-hour timeframe. A symmetrical triangle sample signals a length of consolidation, where the price tightens between converging trendlines earlier than a breakout or breakdown happens.

A breakdown under the lower trendline in overall signifies the starting attach of a bearish vogue, whereas a breakout above the upper trendline in most cases marks the starting up up of a bullish vogue.

Furthermore, the Chaikin Money Circulation (CMF) is within the actual space, indicating principal shopping tension. Would possibly simply aloof this remain the same and BlackRock Bitcoin holdings expand, BTC label would possibly perchance well climb to $103,649.

In a extremely bullish scenario, Bitcoin’s price would possibly perchance well upward thrust to $110,000. However, if institutions love Grayscale proceed to promote in broad volumes, this can also not happen. In its attach, Bitcoin’s label would possibly perchance well decline to $93,378.