Paul Taylor, a project companion at BlackRock, has joined the advisory board of PairedWorld. This switch coincides with PairedWorld’s successful closure of a $1.5 million funding round.

PairedWorld is renowned for its blueprint to bettering loyal-world social interactions through blockchain expertise.

BlackRock Handbook Specializes in True World Interactions Initiative

PairedWorld has earned recognition for its mannequin that rewards physical social engagement. This methodology objectives to contend with digital habit and loneliness, furthermore offering fresh files avenues for client brands through True World Interactions (RWIs).

“We’ve created basically the most delightful and rewarding instrument for folk to join in the remark world for the reason that disco period ignited a worldwide circulate of track and dance that brought communities collectively, celebrating lifestyles and custom en masse,” PairedWorld co-founder Raluca Cherciu acknowledged.

Read extra: What Is Damus: The Decentralized Nostr-Powered Social Media

Paul Taylor’s inclusion in PairedWorld’s board is anticipated to take the protocol’s constructing tremendously. His wide expertise in fintech and blockchain aligns with PairedWorld’s mission.

Meanwhile, under CEO Larry Fink’s leadership, BlackRock is expanding its horizon. The asset administration agency has shifted from vulnerable atmosphere, social, and governance (ESG) labels to extra remark investment categories.

These encompass climate, inexperienced, and transition funds. This strategic pivot is share of BlackRock’s effort to manual in the global market amidst a politicized atmosphere surrounding ESG investing. The firm’s climate transition funds personal proven noteworthy growth, drawing $13.9 billion in salvage flows final one year.

BlackRock has certainly maintained a proactive blueprint in emerging sectors. Right here’s highlighted by its foray into the tokenization of loyal-world assets.

“We personal the expertise to tokenize this present day. If you would possibly personal a tokenized safety and identity, the moment you aquire or sell an instrument on a identical old ledger, that’s all created collectively. You favor to must focus on components around money laundering. This eliminates all corruption by having a tokenized system,” Fink outlined.

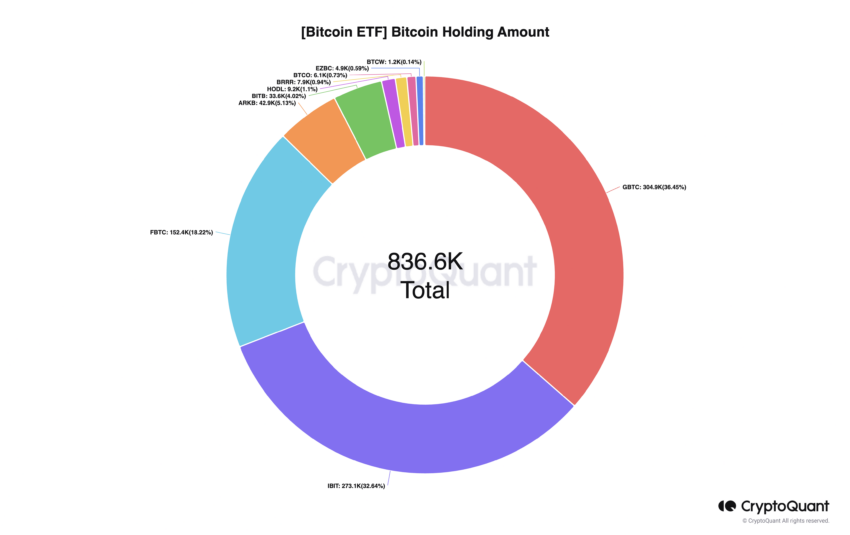

Moreover, BlackRock’s iShares Bitcoin Belief has been the fastest-rising location Bitcoin ETF, amassing over $15 billion in inflows within three months of its originate.

Read extra: What is The Affect of True World Asset (RWA) Tokenization?

As properly as to its blockchain ventures, BlackRock is extending its influence into fresh markets, including Saudi Arabia. Recently, BlackRock opened its first location of enterprise in Riyadh, signaling a deep dedication to the Center Eastern market. This expansion permits BlackRock to faucet into the state-owned Public Investment Fund (PIF), which controls approximately $925 billion.