Because the extremely anticipated open date of situation Ethereum ETFs approaches, Matt Hougan, Chief Investment Officer of crypto asset supervisor Bitwise, has wired the likely of these ETF inflows to drive the Ethereum designate to file highs.

In a most contemporary client show mask, Hougan highlighted the important affect that ETF flows would possibly maybe bear on the Ethereum designate, surpassing even the outcomes witnessed in the location Bitcoin ETF market in the US.

Ethereum ETFs Poised To Surpass Bitcoin’s Impact?

Hougan confidently predicts that introducing situation Ethereum ETFs will result in a surge in ETH’s designate, presumably reaching all-time highs above $5,000. On the opposite hand, he cautions that the main few weeks after the ETF open will likely be unstable, as funds would possibly maybe well waft out of the present $11 billion Grayscale Ethereum Belief (ETHE) after it is converted to an ETF.

This will likely be the same to the case of the Grayscale Bitcoin Belief (GBTC), which saw important outflows of over $17 billion after the Bitcoin ETF market modified into once licensed in January, with the main inflows recorded 5 months later on Might maybe perchance 3.

Composed, Hougan expects the market to stabilize in the very lengthy time frame, pushing Ethereum to file prices by the quit of the one year after the preliminary outflows subside, drawing a comparability with Bitcoin in key metrics to enjoy this thesis.

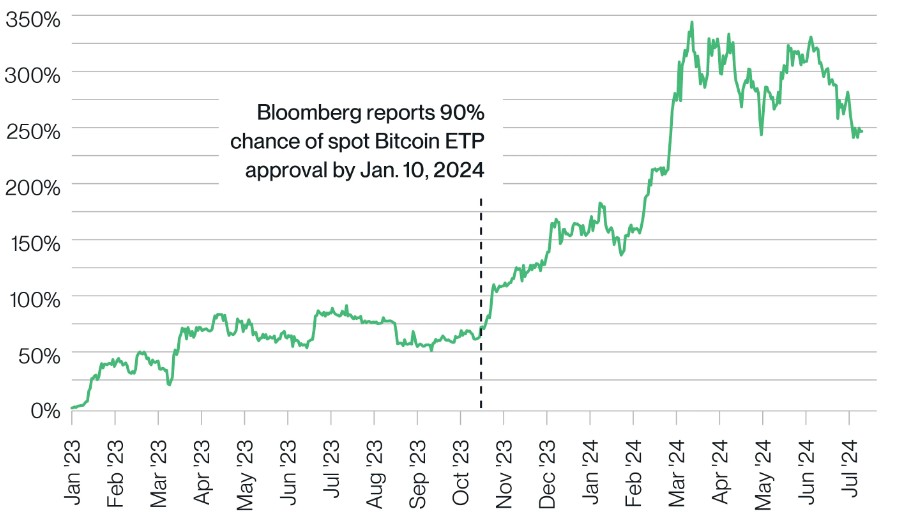

As an instance, Bitcoin ETFs bear purchased more than twice the amount of Bitcoin in comparison to what miners bear produced over the identical duration, contributing to a 25% magnify in Bitcoin’s designate since the ETF open and a 110% magnify since the market began pricing in the open in October 2023.

That talked about, Hougan believes the affect on Ethereum will likely be mighty more important, and identifies three structural the causes why Ethereum’s ETF inflows would possibly maybe bear a better affect than Bitcoin’s.

Lower Inflation, Staking Advantage, And Shortage

The first motive Bitwise’s CIO highlights is Ethereum’s lower transient inflation rate. While Bitcoin’s inflation rate modified into once 1.7% when Bitcoin ETFs launched, Ethereum’s inflation rate over the last one year has been 0%.

The second motive lies in the variation between Bitcoin miners and Ethereum stakers. As a result of expenses related to mining, Bitcoin miners generally promote mighty of the Bitcoin they develop to quilt operational expenses.

In distinction, Ethereum relies on a proof-of-stake (PoS) device, the put customers stake ETH as collateral to path of transactions precisely. ETH stakers, not harassed with excessive inform expenses, are not compelled to promote the ETH they assemble. As a result, Hougan suggests that Ethereum’s on each day foundation compelled promoting tension is lower than that of Bitcoin.

The third motive stems from the truth that an infinite piece of ETH is staked and, therefore, unavailable on the market. Currently, 28% of all ETH is staked, while 13% is locked in attention-grabbing contracts, effectively removing it from the market.

This finally ends up in roughly 40% of all ETH being unavailable for immediate sale, increasing a worthy shortage and in a roundabout contrivance favoring a attainable magnify in designate for the second most attention-grabbing cryptocurrency on the market, reckoning on the outflows and inflows recorded. Hougan concluded:

As I discussed above, I seek data from the recent Ethereum ETPs to be a success, gathering $15 billion in recent sources over their first 18 months on the market… If the ETPs are as successful as I seek data from—and given the dynamics above—it’s hard to think ETH not keen its former file.