The bullish spell solid by the scepter of bulls in Bittensor (TAO) by July Seventh, 2024, has ended by July Twenty sixth. The wall at $358 and the coinciding 200-day EMA band stopped bullish acceleration by limiting the positive aspects up to 75% only from the most fundamental $200 enhance.

The encountered wall of $358 has pushed the value downwards this week by almost 20%, in direction of the important enhance of $200. The fall accelerated when it breached the $300 previous swing low and the coinciding 50-day EMA dynamic enhance band. Likewise, varied indicators confirmed a bearish crossover, and the RSI turned into at 43.82.

Bittensor (TAO) space volume inflow had elevated 15.12% for the unique model at $56.428 Million, and the market cap has fallen 2% on intraday valued at $2.054 Billion. The short decline in the forty fourth very most engaging crypto by market cap appears imminent.

The liquidity ratio turned into worn in TAO at 3%, which on the overall is a level of be troubled. The low liquid in property most ceaselessly makes buying and selling complicated, so merchants are cautious of this level (DYOR). On top of that, to this point, 34.10% of the present floated available in the market, exactly 7.1 Million TAOs out of the max present of $21 Million.

Bittensor (TAO) Derivatives Insights Illustrations

Bittensor’s (TAO) open hobby turned into at $forty eight.41 Million. As per CoinGlass, it fell by 2.42% in the previous session. It signified a decrease in open contracts from the final day.

When writing, its derivatives and perpetual volume inflow elevated 13.03% for the short plot back model, the build the volume turned into $64.05 Million.

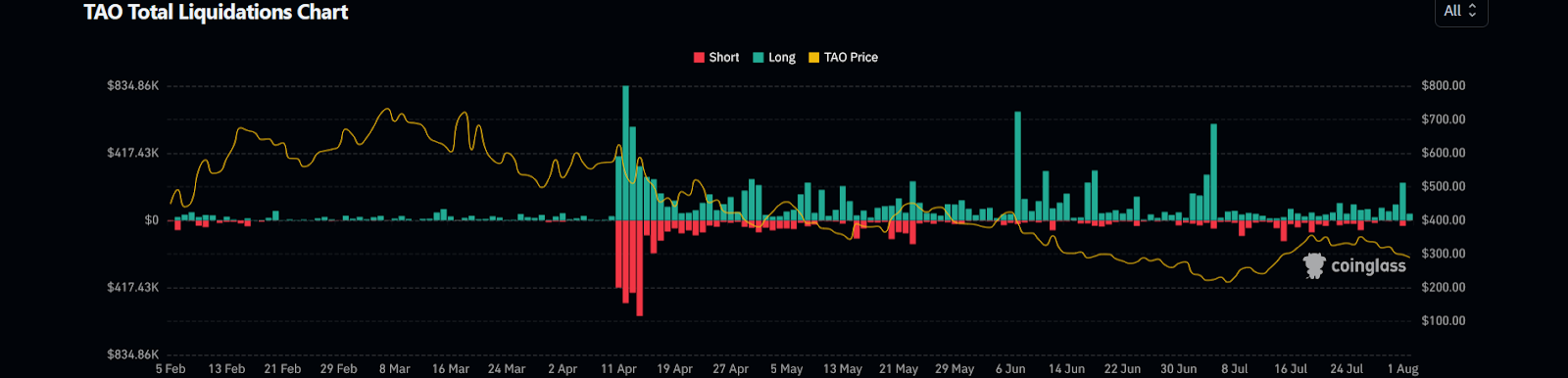

The lengthy versus short ratio for 24 hours turned into 0.8636, which signified that longs absorb been greater than shorts aspect liquidation. The greater lengthy liquidation confirmed elevated undergo hobby, signifying the chance of extra downward acceleration. The short liquidation quantity turned into $198.64K versus $34.44K for the lengthy liquidation.

Unwrapping TAO Each day Chart Insights

Bittensor (TAO) has given humongous returns to its merchants, which exceeds over 1600%, peaking at $755.01 (ATH) from October 2023 to March 2024. However, it encountered a present zone and did now not harness extra positive aspects above $755.01.

It turned into adopted by profit booking in TAO, which loosened extra than 70% of its beforehand completed positive aspects.

After failing to surpass $755.01, the value entered a spree of decrease lows, returning to the contemporary ask level in the following 4 months by July Fifth.

Thereon, the value rose temporarily and breached the upper border of the falling wedge. However, the TAO impress met the $358 level, which dusted it downwards, slipping the swing low of the beforehand constructed at $300.

The unique be troubled depicts a short lived decline and the failure of the falling wedge. Therefore, the bears also can recognize enhance ranges of $260 and $240, respectively. On the contrary, if any unexpected enhance spikes the value, the resistance will almost definitely be at $330 and $358, respectively.