TAO’s mark has surged tremendously one day of the final month, pushed by rising curiosity in synthetic intelligence money. With a fresh lengthen of over 60%, several indicators and metrics offer valuable insights into the coin’s probably future performance.

While the most fresh EMA setup signals robust bullish momentum, the distribution tension on TAO stays a ache that can well per chance per chance also impact its skill to withhold the uptrend.

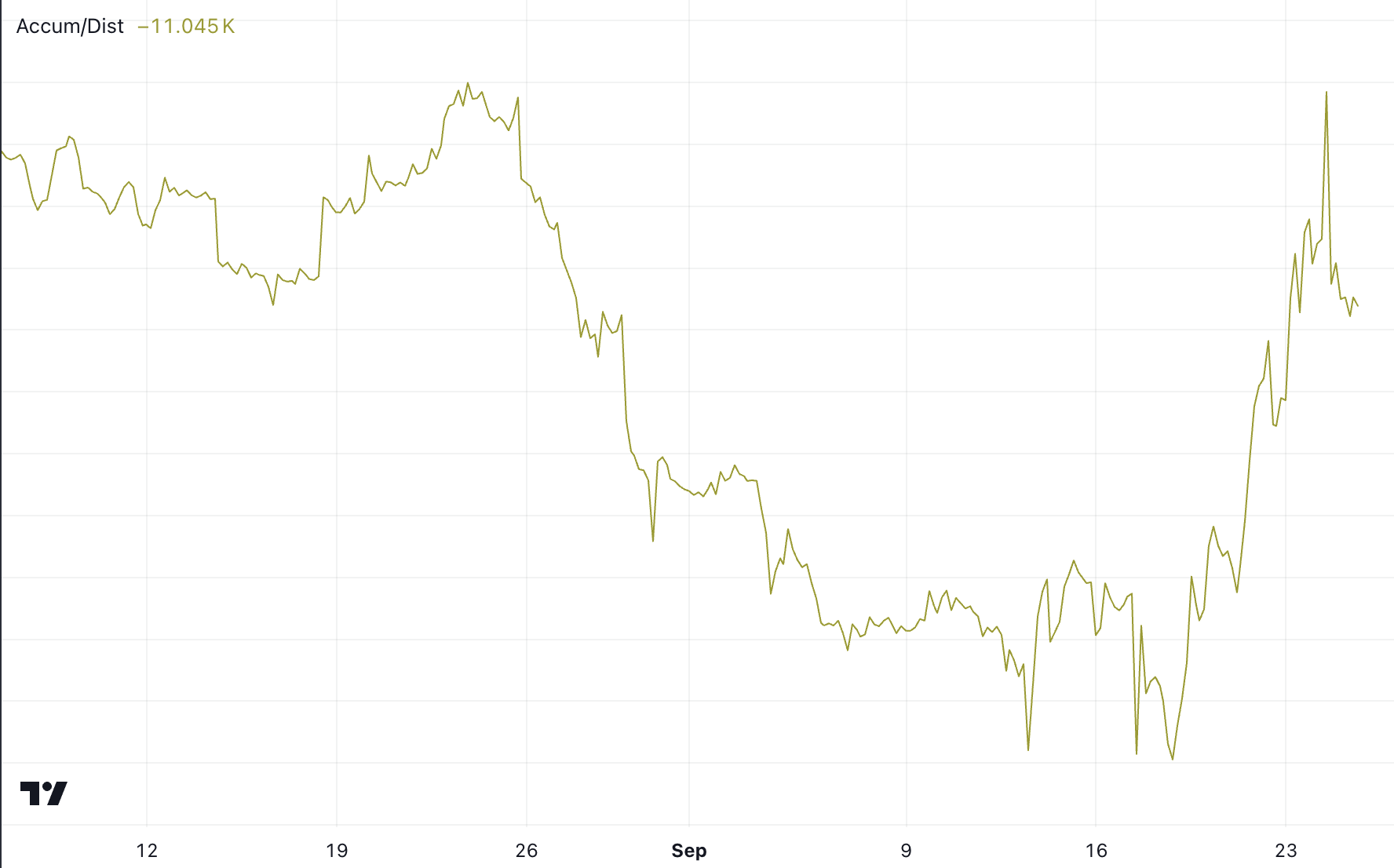

TAO Accumulation/Distribution Is Now Adverse, But That’s Now no longer as Deplorable as It Appears to be like to be

The Accumulation/Distribution payment for Bittensor (TAO) is roughly -11,045, which clearly signifies heavy promoting tension over the fresh duration. This unfavourable payment means that extra traders were offloading TAO somewhat than accumulating it. This would well per chance also lead to a bearish outlook for TAO mark within the conclude to duration of time.

The Accumulation/Distribution (A/D) metric is necessary in figuring out this market habits. It combines every mark circulate and trading volume to give a clearer record of whether an asset is being accrued (extra procuring for) or allotted (extra promoting).

With this robust distribution, the payment is more likely to face resistance in establishing a sustainable upward vogue except a shift in sentiment occurs.

Be taught extra: Top 9 Artificial Intelligence (AI) Cryptocurrencies in 2024

If the A/D line begins to stabilize or shift upward, it could in point of fact well per chance per chance also existing renewed curiosity and accumulation, potentially reversing the downward momentum. Since TAO grew extra than 60% within the final month, that can well per chance per chance also lead to robust promoting tension within the short duration of time.

Nonetheless, the Accumulation/Distribution metric at -11000 may perhaps well per chance per chance also no longer be robust ample to spark a bearish vogue on TAO. It’s valuable to care for an watch on this metric. If it continues to toddle down, it could in point of fact well per chance per chance also change the sentiment about the coin.

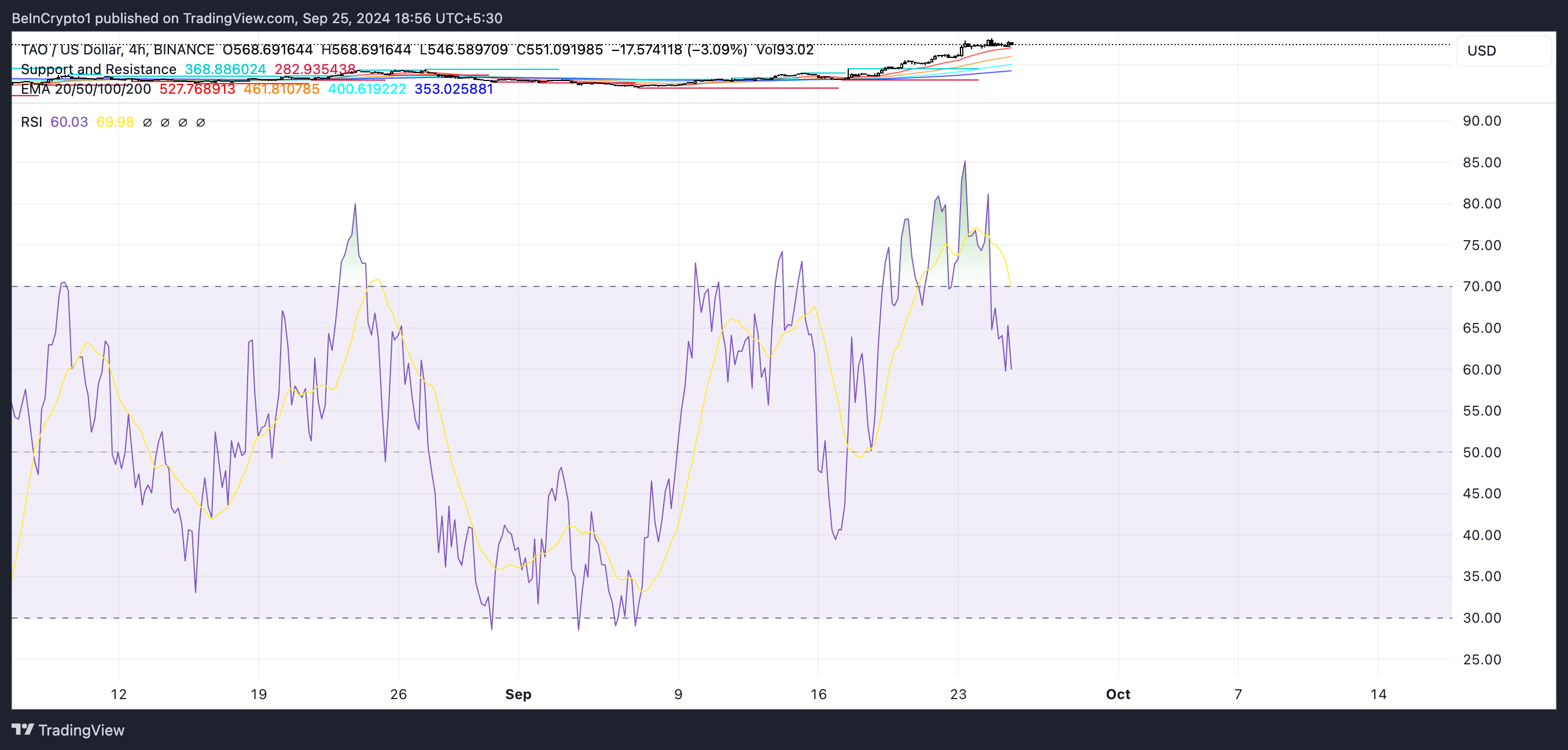

TAO RSI Is Quiet Wholesome for Extra Explain

Bittensor’s Relative Strength Index (RSI) for the time being sits at 60. Here’s necessary on story of it shows a valuable shift in momentum since September 16, when the RSI was at 39. This rise means that procuring for curiosity has elevated over this era, indicating stronger bullish sentiment for TAO.

An RSI in this differ choices to a market that is gaining energy but is rarely any longer but overbought, making it a probably indicator of extra mark appreciation within the conclude to duration of time if the momentum continues.

The RSI is a fashioned momentum oscillator ancient to measure the velocity and alter of mark actions. It ranges from 0 to 100, with thresholds customarily situation at 30 and 70. An RSI under 30 signifies that the asset is potentially oversold, signaling a procuring for different, whereas an RSI above 70 suggests the asset may perhaps be overbought, indicating a that it is probably you’ll well per chance also imagine correction or pullback.

With TAO’s RSI for the time being at 60, the token is in impartial to somewhat bullish territory. This would well per chance also counsel that TAO soundless has room for growth sooner than hitting overbought ranges.

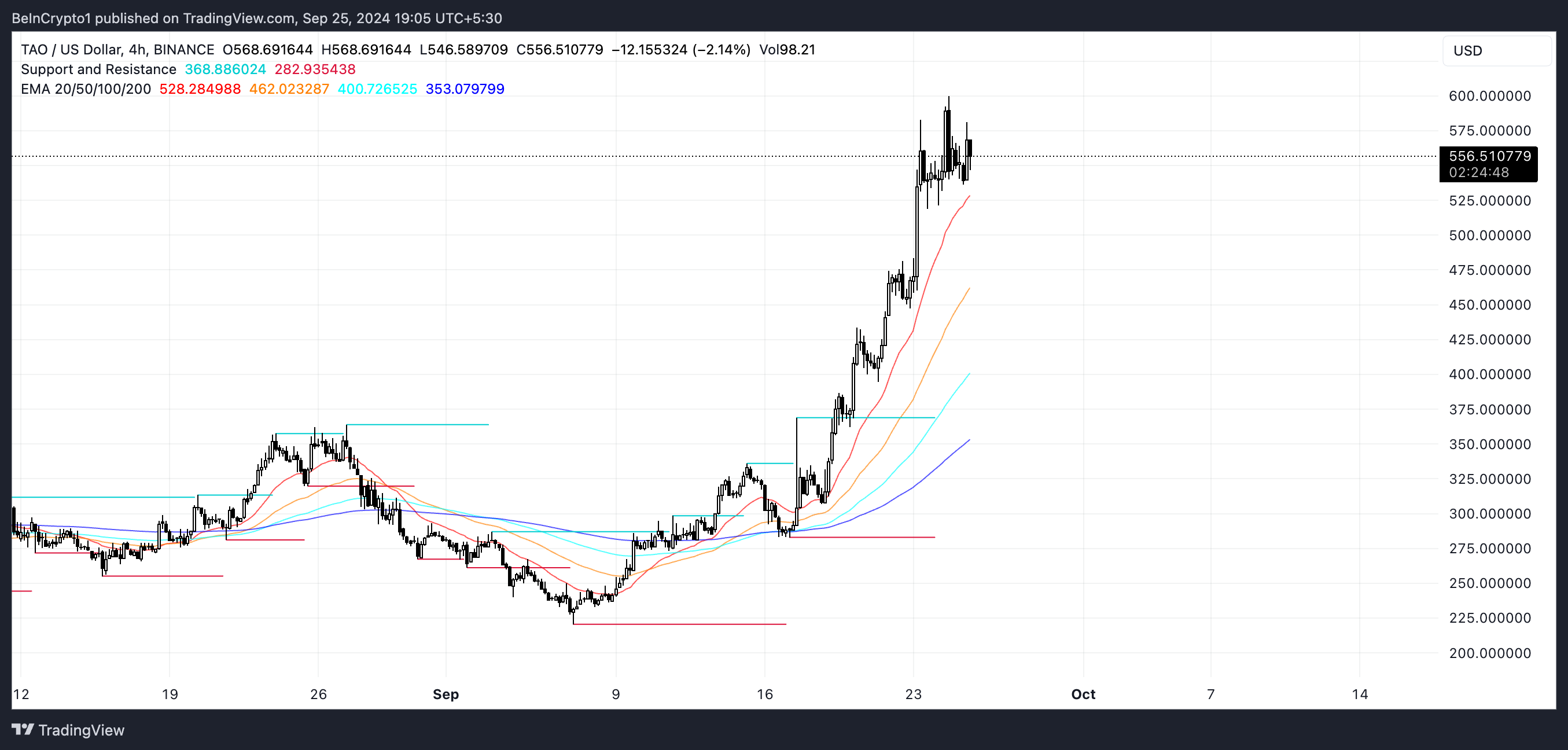

TAO Mark Prediction: Is It That it is probably you’ll well per chance also imagine to Reach $700 By October?

TAO is for the time being showing an extremely bullish setup, as its Exponential Piquant Common (EMA) lines are broadly unfold. This unfold signifies that the shorter-duration of time EMAs are tremendously greater than the longer-duration of time ones, signaling a sturdy uptrend. The widening gap between these EMAs shows consistent mark increases and rising upward momentum.

EMA lines are technical indicators that give extra weight to fresh costs, making them attentive to market process. When the payment stays above the EMAs, and shorter-duration of time EMAs are positioned above longer-duration of time ones, it confirms a solid uptrend.

Be taught extra: How To Invest in Artificial Intelligence (AI) Cryptocurrencies?

If TAO can care for this momentum, supported by the rising curiosity in AI money, it has the functionality to surpass $600 for the first time since April 2024. Breaking by diagram of the vital resistance level of $625 may perhaps well per chance per chance also push the payment extra, potentially reaching $700 — a 26.81% lengthen from its latest payment.

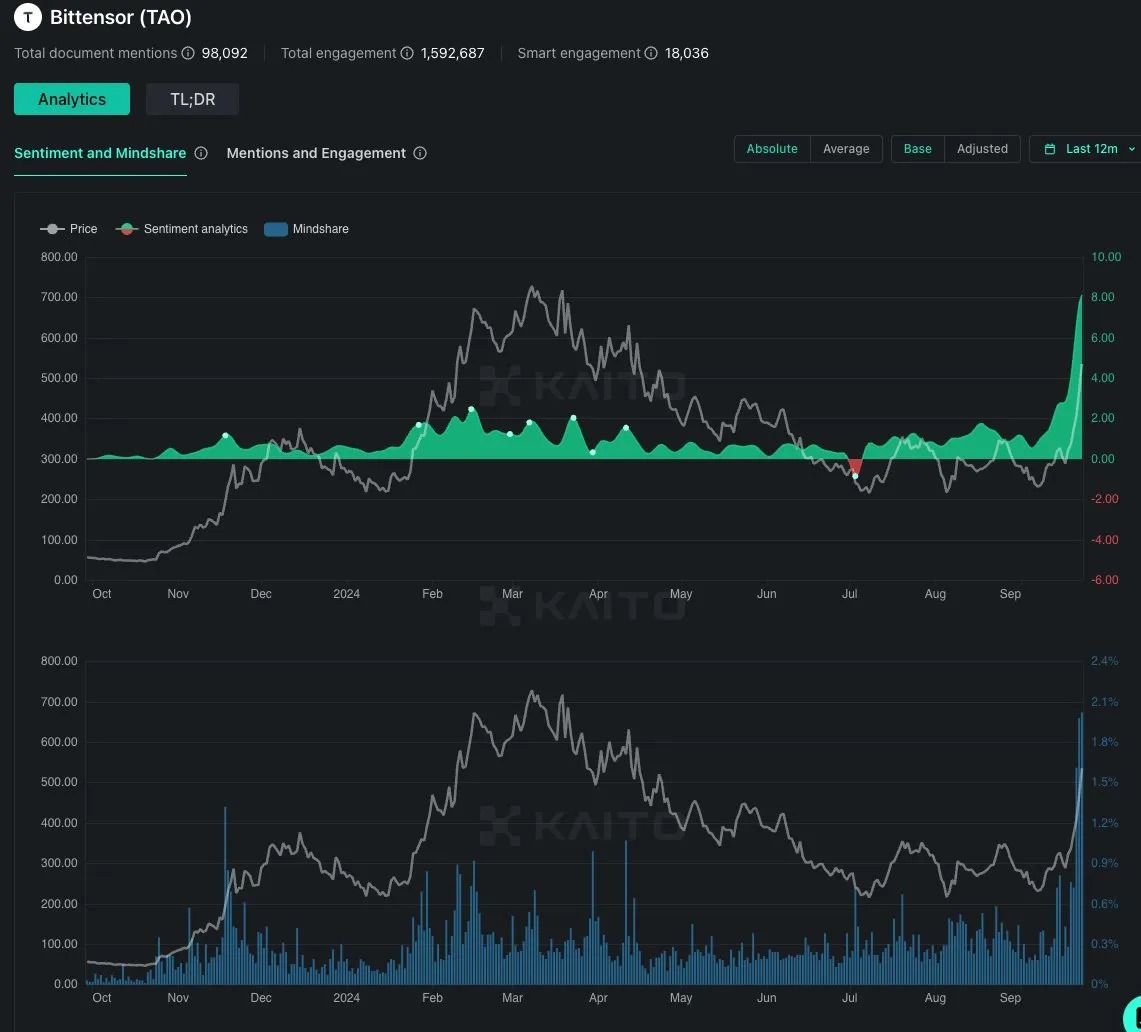

In diversified locations, Bittensor mindshare and sentiment lately hit current all-time highs, which may perhaps also make a contribution to a brand current mark rally.

Nonetheless, if TAO is unable to withhold this upward momentum, there are risks to take note. If the Accumulation/Distribution payment turns an increasing number of unfavourable, suggesting extra promoting tension, and if the RSI moves into overbought territory (above 70), the payment may perhaps well per chance per chance also watch a first-rate pullback. If so, TAO mark may perhaps well per chance per chance also drop as cramped as $284 over the upcoming weeks.