BitMine chairman Tom Lee has confirmed the firm went on an Ether purchasing for spree after the crypto market saw one in all its significant deleveraging events earlier this month.

“Launch interest for ETH sits on the identical stages as seen on June thirtieth of this yr, ETH used to be $2,500, given the expected Supercycle for Ethereum, this label dislocation represents an handsome possibility/reward,” he mentioned in a assertion on Monday.

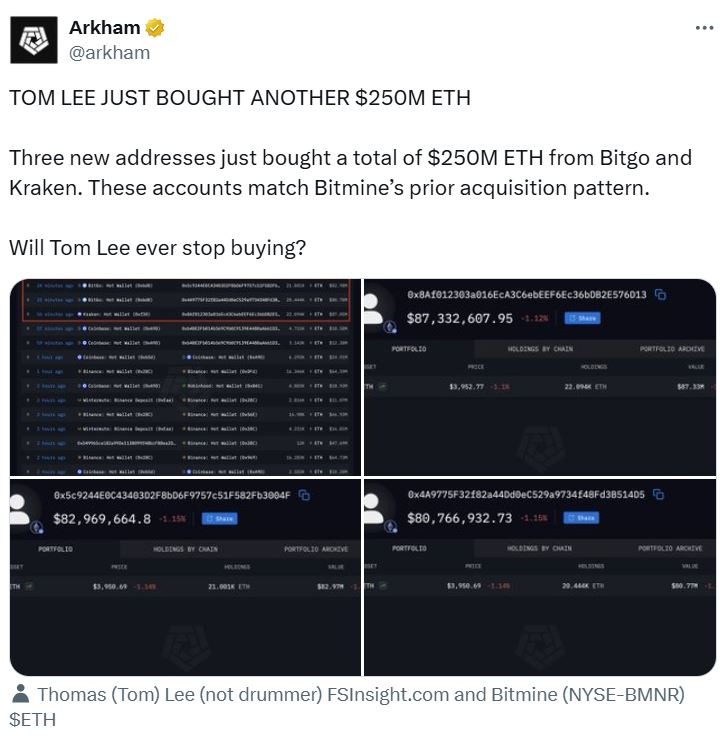

BitMine sold up one more $250 million Ether (ETH) on Monday from crypto exchanges Bitgo and Kraken, in accordance to blockchain analytics platform Arkham Intelligence.

This now brings BitMine more than halfway to its unbiased of maintaining 5% of Ether’s entire token provide, with entire Ether holdings now at over 3.3 million tokens value over $13 billion, and representing 2.74% of the total provide.

Lee made loads of bullish statements about Ether at some stage in the firm’s purchasing for spree closing week.

At some stage in an episode of the Bankless podcast closing Wednesday, Lee held agency on his prediction for Ether to hit $10,000 this yr, regardless of glorious over two months final on the clock. To reach Lee’s target, it would want to rise 150% from its label of $3,986 on Monday.

BitMine stock on the upward push

BitMine’s stock (BMNR) shot up 7.92% to commerce at $fifty three.80 on Monday. Within the closing six month’s the firm’s stock has acquired over 691%.

“BitMine continues to attract institutional investor capital as our high liquidity is appealing. The blended procuring and selling quantity a part of BitMine and MSTR is now 88% of all worldwide DAT procuring and selling quantity,” Lee mentioned.

BitMine reigns as basically the significant Ether firm

BitMine is by some distance basically the significant Ether treasury firm, with the next closest publicly listed stash held by SharpLink Gaming, totalling 840,012 tokens, in accordance to StrategicETHReserves.

Related: BitMine’s Lee calls ETH a ‘bargain to the future,’ Bit Digital eyes $100M

Institutions were gradually procuring Ether for the length of 2025, with the total at some stage in treasury corporations sitting at over 5.74 million tokens, representing 4.75% of the provide.

Journal: Sharplink exec shy by degree of BTC and ETH ETF hodling: Joseph Chalom