BitMine Immersion Applied sciences has bought one more 23,773 Ether all the draw in which thru the last three days amid the present market scurry, as its chairman pushed assist his prediction on Bitcoin’s all-time high.

In accordance with an X submit by the crypto records analytics platform Lookonchain, Bitmine bought 7,080 Ether (ETH) for roughly $19.8 million on Monday.

The identical wallet additionally bought 16,693 ETH for roughly $50.1 million on Saturday, bringing the total to merely about $70 million all the draw in which thru the last three days.

The moves continue the momentum from last week, which saw Bitwise bought 96,800 ETH for spherical $273.2 million.

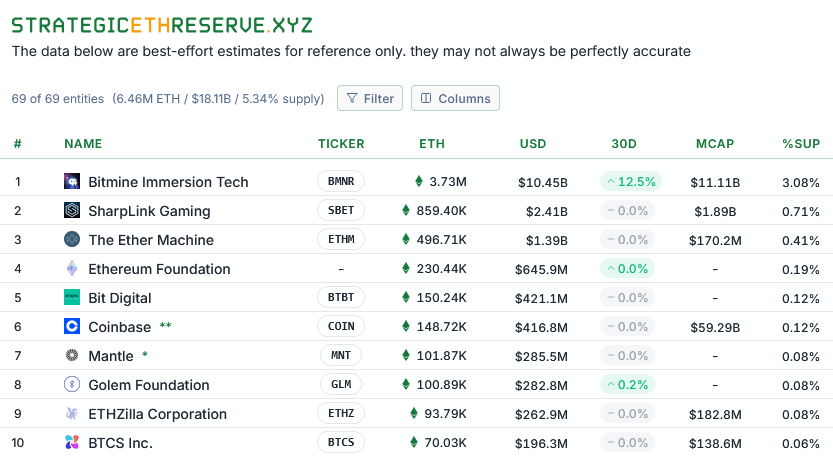

Bitmine is the finest ETH digital asset treasury firm (DAT) on the market by a huge margin, in step with strategicethreserve.xyz.

Bitmine’s aim is now 62% of the potential to its aim of preserving 5% of the Ether supply. On the opposite hand, the firm is within the red at current costs, because it posted on Sunday that it has 3.7 million ETH at a median buying stamp of $3,008 per token.

Tom Lee shifts Bitcoin call because the market scratches head over crypto scurry

Bitmine’s chairman, Tom Lee, has been adjusting his prediction for Bitcoin because the crypto market has stumbled in opposition to the discontinue of 2025.

Until October this year, Lee had been tipping Bitcoin (BTC) to hit a brand current ATH of $250,000 by the discontinue of 2025. On the opposite hand, he walked assist the likelihood last week, speculating Bitcoin would per chance perchance perchance additionally “perchance” secure its all-time high at the discontinue of this year.

Lee has shifted all over again at some level of an interview with CNBC on Sunday, now speculating that Bitcoin will hit a brand current all-time high in January.

“I quit mediate Bitcoin can form an all-time high by the discontinue of January,” he acknowledged, adding that “loads of its gonna count on equities improving, which we search files from it to.”

In other places, Jeff Dorman, the manager funding officer of digital asset funding firm Arca, acknowledged there will not be any concrete the reason why the crypto market has been struggling.

In an X submit on Monday, Dorman pointed to bullish fundamentals all over more than one markets.

“Wall Avenue is seeing all of the identical bullish indicators that I’m seeing — equity, credit and gold/silver markets are launching to ATHs every month since the Fed is slicing charges, QT is ending, user spending is solid, file earnings, AI query composed extremely solid, and many others.,” he acknowledged, adding:

“Meanwhile, all of the ‘supposed reasons’ for crypto selling off are with out complications debunked, or non-public reversed — MSTR is never always no doubt selling, Tether is never always no doubt bancrupt, DATs don’t appear to be selling, NVDA is never always no doubt blowing up, the Fed is never always no doubt turning hawkish, the tariff wars don’t appear to be restarting, and many others.”

Dorman argued that fraction of the relate will most doubtless be due to liquidity complications, as he pointed to doable difficulties on-ramping for extensive establishments such as Forefront and Snarl Avenue.

“So whereas it’s extensive that Forefront, Snarl Avenue, BNY, JPM, MS, GS, and many others are all COMING, they aren’t here at the present time. And except it’s easy to aquire via their existing mandates and methods, they neutral correct gained’t quit it,” he wrote.